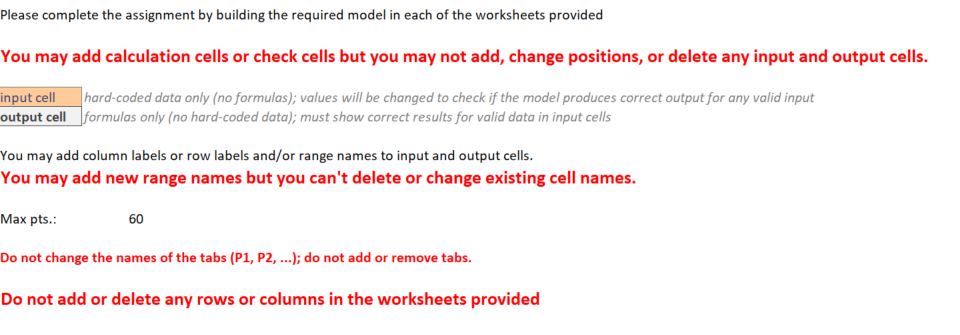

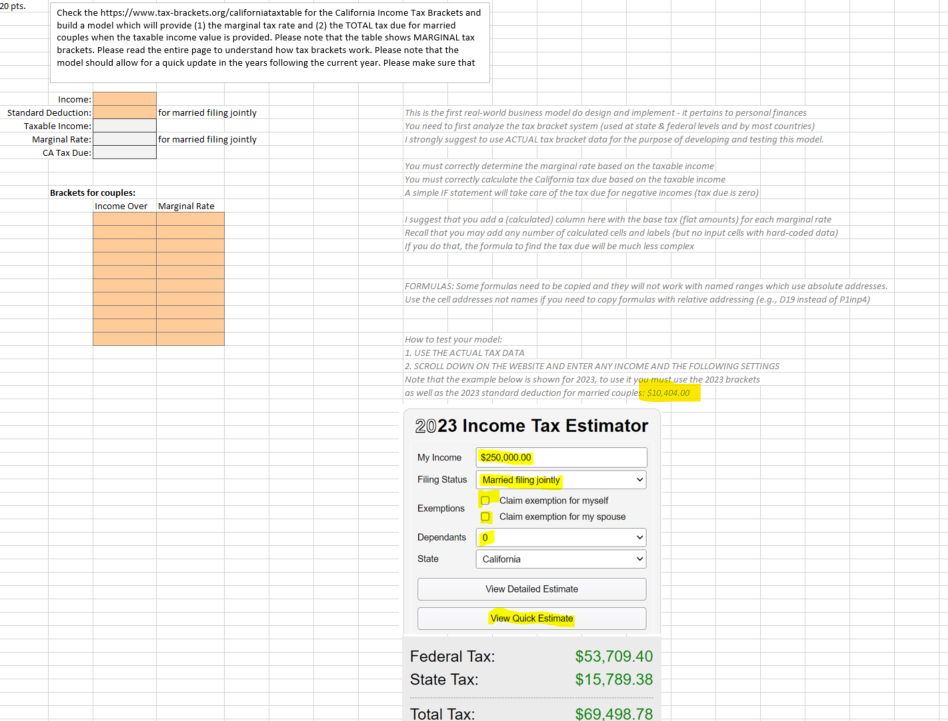

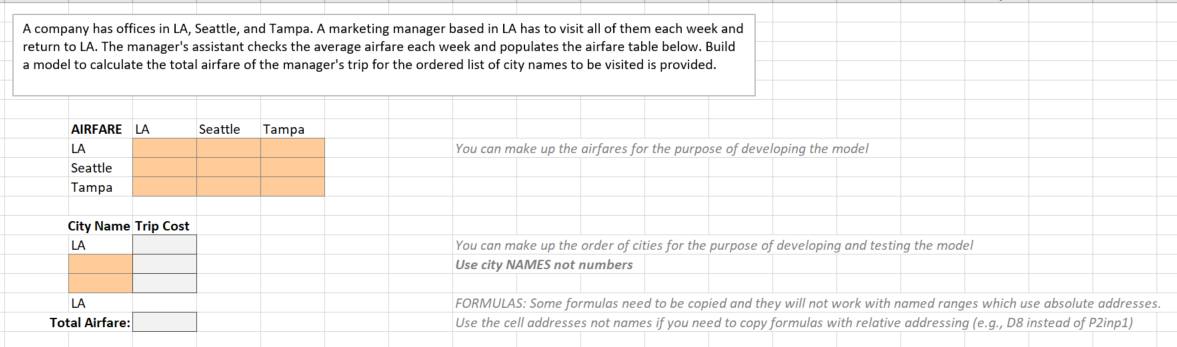

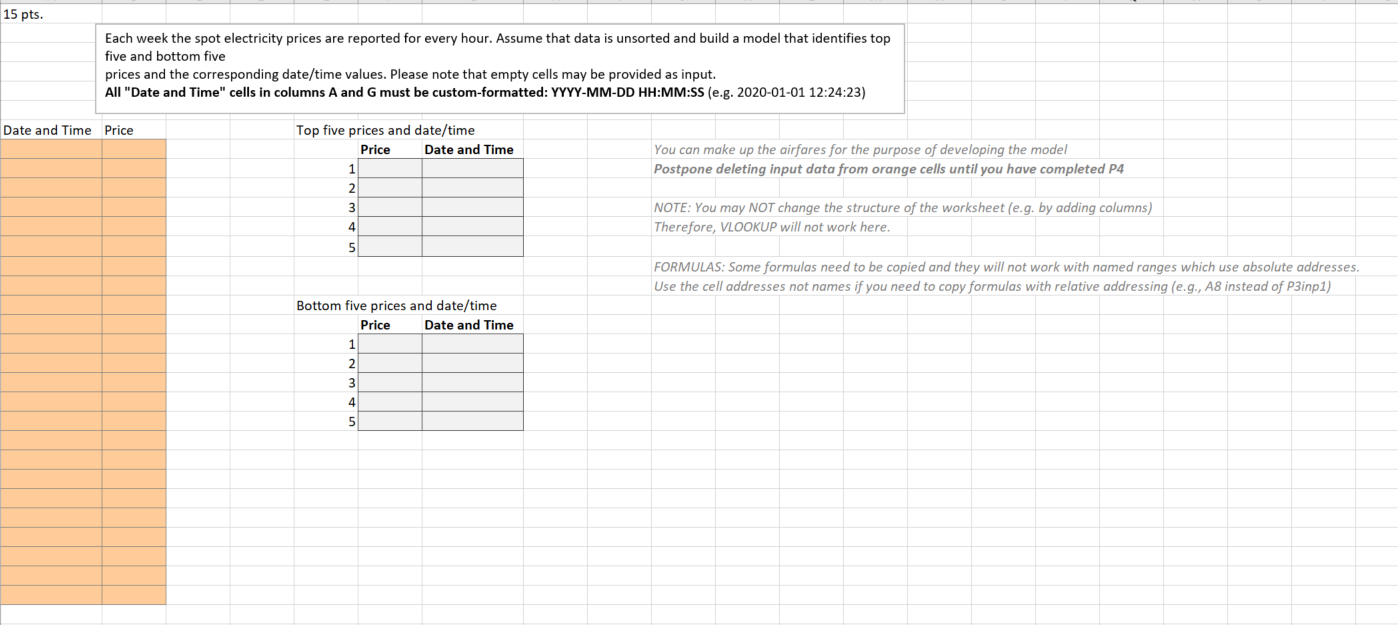

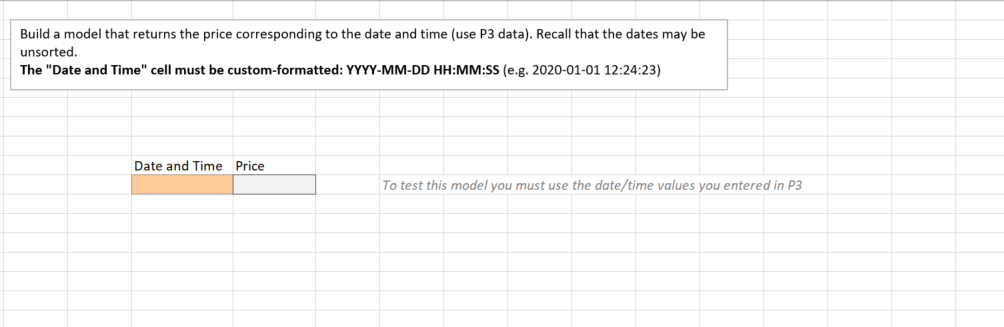

Question: Please complete the assignment by building the required model in each of the worksheets provided You may add calculation cells or check cells but you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock