Question: Please complete the calculation below. Jan. 2 7 18 19 20 Completed a consulting engagement and received cash of $5,700. Prepaid three months office rent,

Please complete the calculation below.

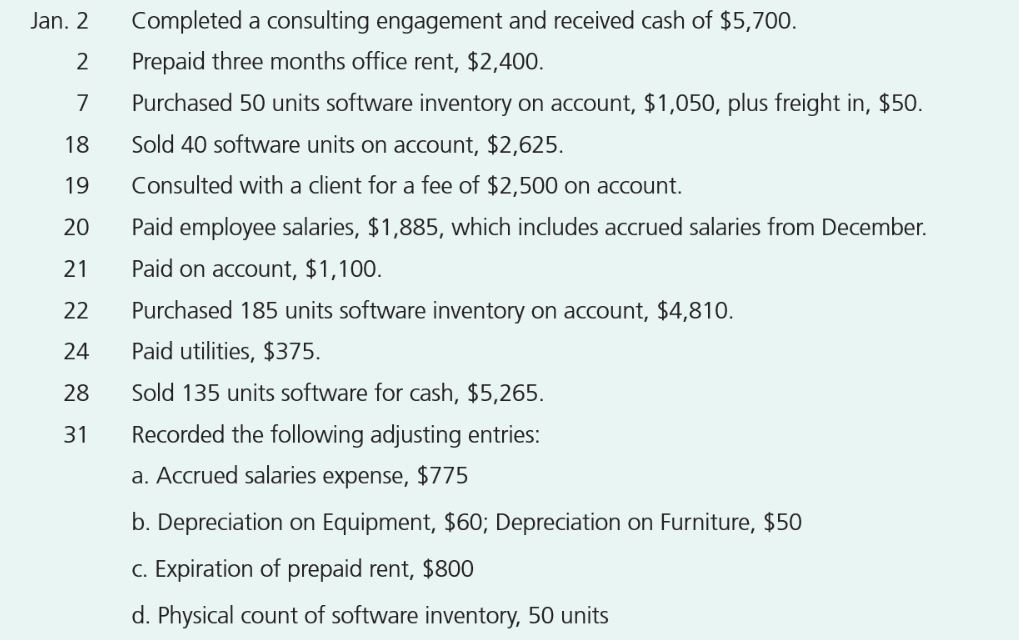

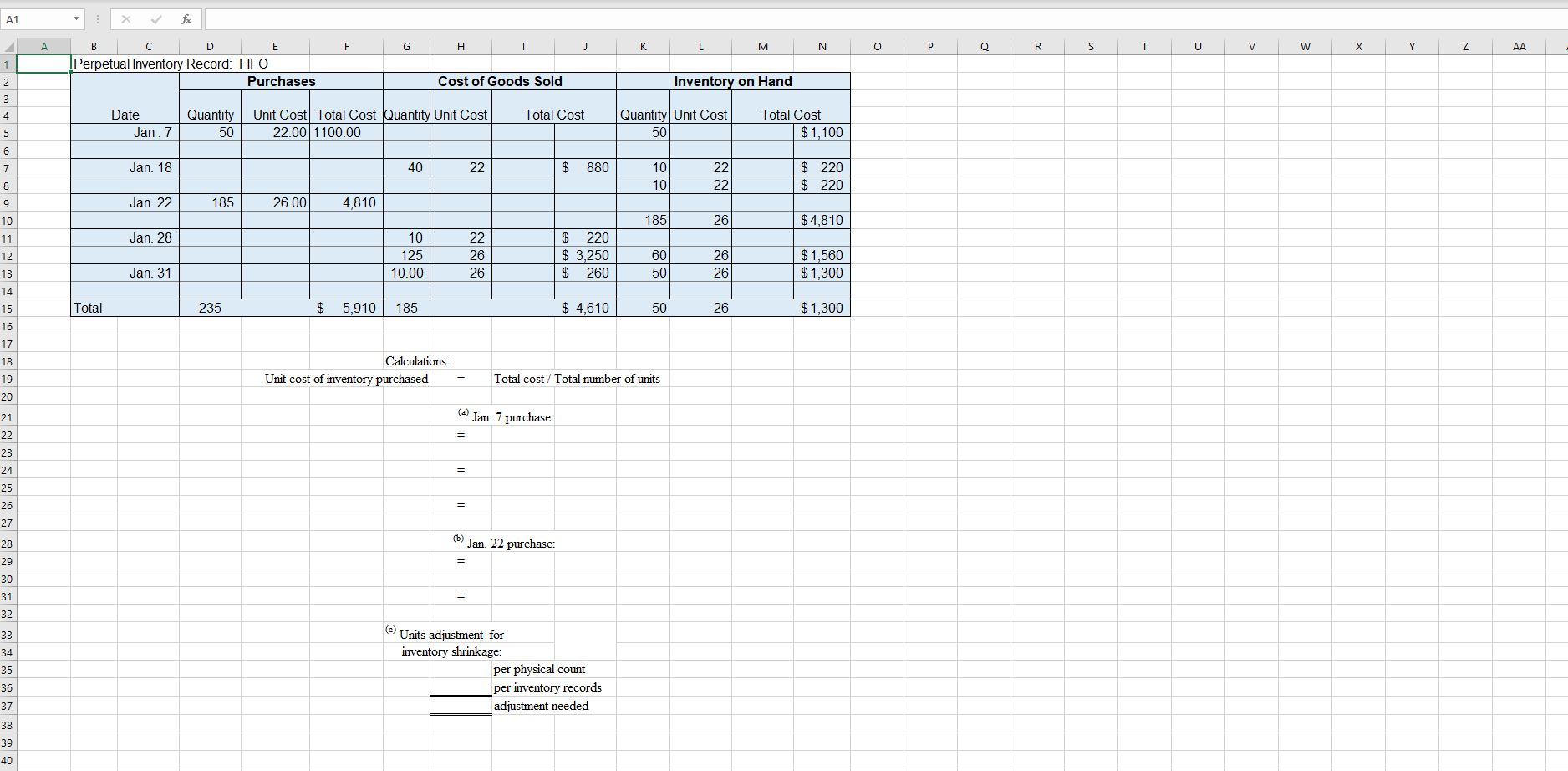

Jan. 2 7 18 19 20 Completed a consulting engagement and received cash of $5,700. Prepaid three months office rent, $2,400. Purchased 50 units software inventory on account, $1,050, plus freight in, $50. Sold 40 software units on account, $2,625. Consulted with a client for a fee of $2,500 on account. Paid employee salaries, $1,885, which includes accrued salaries from December. Paid on account, $1,100. Purchased 185 units software inventory on account, $4,810. Paid utilities, $375. Sold 135 units software for cash, $5,265. Recorded the following adjusting entries: a. Accrued salaries expense, $775 21 22 24 28 b. Depreciation on Equipment, $60; Depreciation on Furniture, $50 c. Expiration of prepaid rent, $800 d. Physical count of software inventory, 50 units A1 - : fe H J K L M o I PI e R I s T . u . V . W . X . r . z I AA Perpetual Inventory Record: FIFO Purchases Cost of Goods Sold Inventory on Hand Date Total Cost Quantity 50 Unit Cost Total Cost Quantity Unit Cost 22.00 1100.00 Quantity Unit Cost 50 Total Cost $1,100 Jan.7 10 Jan. 18 40 22 $ 880 $ 220 $ 220 Jan. 22 185 26.00 4,810 $4,810 Jan. 28 22 10 125 10.00 26 $ 220 $ 3,250 $ 260 $ 1,560 $1,300 Jan. 31 26 Total 235 $ 5,910 185 $ 4,610 $1,300 Calculations: Unit cost of inventory purchased Total cost / Total number of units (2) Jan 7 purchase (6) Jan. 22 purchase: Units adjustment for inventory shrinkage: per physical count per inventory records adjustment needed Jan. 2 7 18 19 20 Completed a consulting engagement and received cash of $5,700. Prepaid three months office rent, $2,400. Purchased 50 units software inventory on account, $1,050, plus freight in, $50. Sold 40 software units on account, $2,625. Consulted with a client for a fee of $2,500 on account. Paid employee salaries, $1,885, which includes accrued salaries from December. Paid on account, $1,100. Purchased 185 units software inventory on account, $4,810. Paid utilities, $375. Sold 135 units software for cash, $5,265. Recorded the following adjusting entries: a. Accrued salaries expense, $775 21 22 24 28 b. Depreciation on Equipment, $60; Depreciation on Furniture, $50 c. Expiration of prepaid rent, $800 d. Physical count of software inventory, 50 units A1 - : fe H J K L M o I PI e R I s T . u . V . W . X . r . z I AA Perpetual Inventory Record: FIFO Purchases Cost of Goods Sold Inventory on Hand Date Total Cost Quantity 50 Unit Cost Total Cost Quantity Unit Cost 22.00 1100.00 Quantity Unit Cost 50 Total Cost $1,100 Jan.7 10 Jan. 18 40 22 $ 880 $ 220 $ 220 Jan. 22 185 26.00 4,810 $4,810 Jan. 28 22 10 125 10.00 26 $ 220 $ 3,250 $ 260 $ 1,560 $1,300 Jan. 31 26 Total 235 $ 5,910 185 $ 4,610 $1,300 Calculations: Unit cost of inventory purchased Total cost / Total number of units (2) Jan 7 purchase (6) Jan. 22 purchase: Units adjustment for inventory shrinkage: per physical count per inventory records adjustment needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts