Question: please complete the charts given, thumbs up guarenteed. Deb Kelley opened a web consulting business called Smart Deals and recorded the following transactions in its

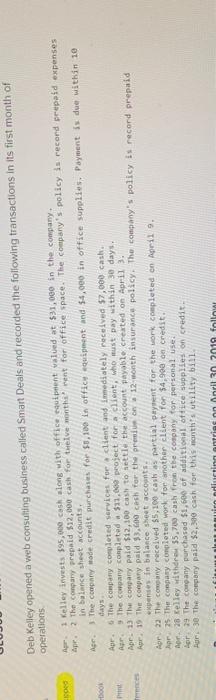

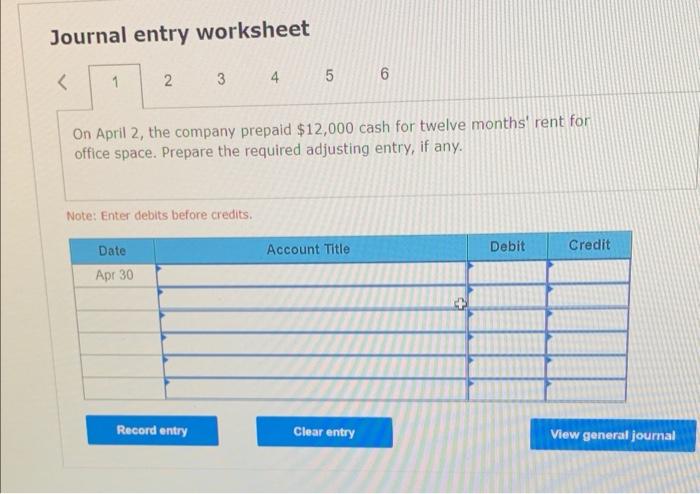

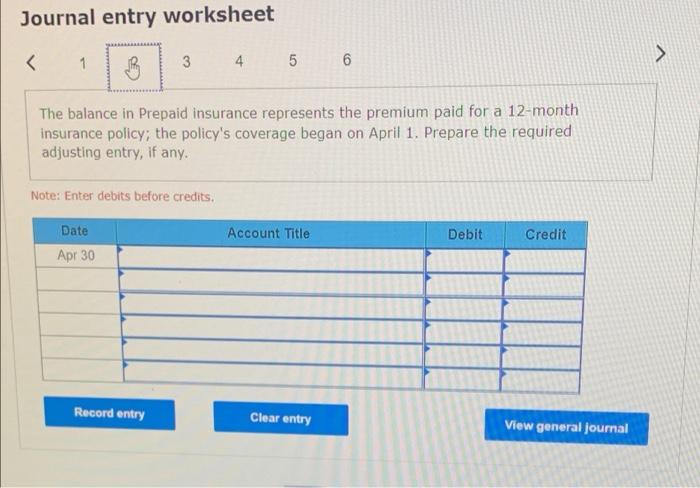

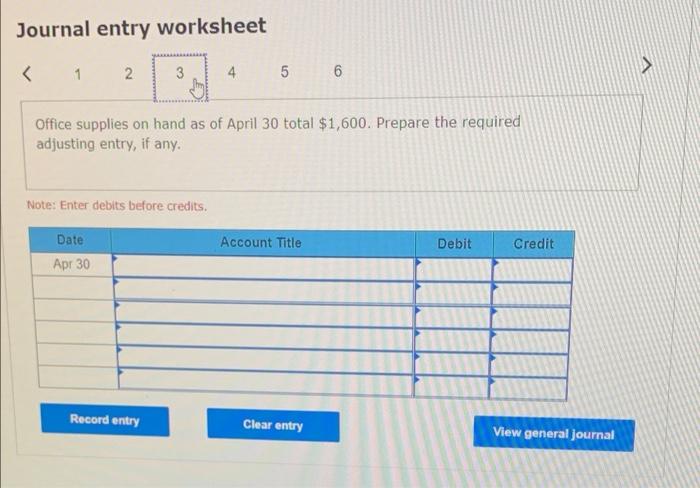

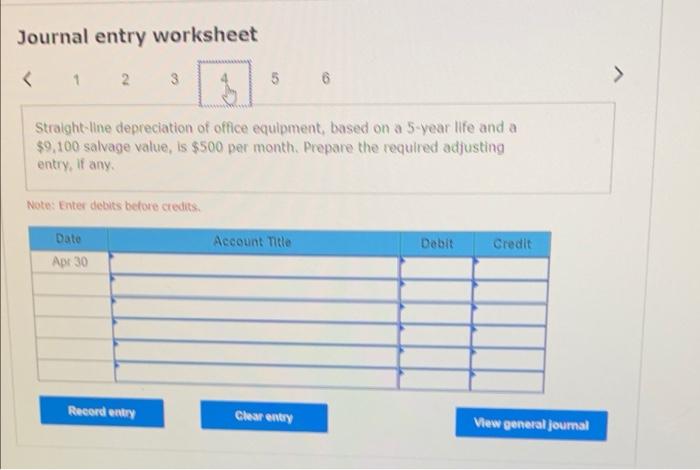

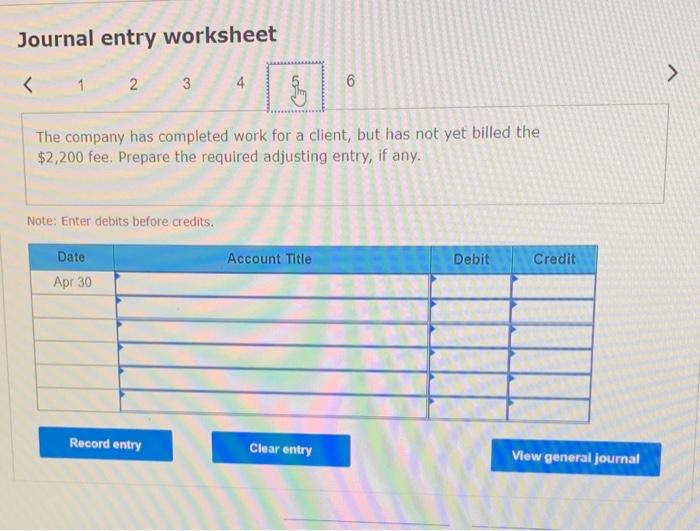

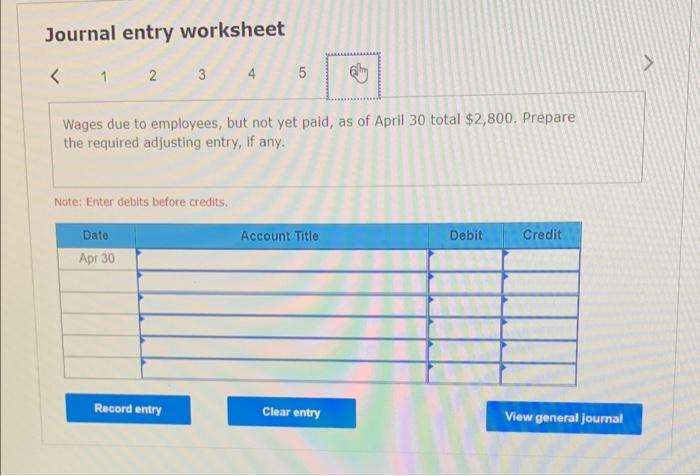

Deb Kelley opened a web consulting business called Smart Deals and recorded the following transactions in its first month of operations DOOR Print 1 Kelley invests 595,000 cash along with office equipment valued at $31,000 in the company. Apr. 2 The company prepaid $12,000 cash for twelve month rent for office space. The company's policy is record prepaid expenses in balance sheet accounts: Age. The company wade credit purchases for $3,100 in office equipment and 54,000 in office supplies. Payment is due within 10 days Apr 6. The company completed services for client and immediately received $7,000 cash Ar The company completed $1.000 project for a client, who must pay within 30 days. Apr. 13 The company pald $12,100 Cash to settle the account payable created on April 3. kor. 19 The company paid $3.600 cash for the presion 12 month insurance policy. The company's policy is record prepaid penses in balance sheet accounts. Apr 22 The company received 55,100 cash partial payment for the work completed on April 9. Apr 25 The company completed work for another client for 54,900 90 credit. Ar 28 Kelley with 55,700 cash from the company for personal use. Apr 29 The company purchased $1,609 of addition office supplies on credit Aur 30 The company paid $2,300 cash for this month's utility bl. diurtinn antries in Anril 30 2019 follow Journal entry worksheet 2 1 3 B 3 4 5 6 The balance in Prepaid insurance represents the premium paid for a 12-month insurance policy; the policy's coverage began on April 1. Prepare the required adjusting entry, if any. Note: Enter debits before credits. Account Title Debit Credit Date Apr 30 Record entry Clear entry View general journal Journal entry worksheet Office supplies on hand as of April 30 total $1,600. Prepare the required adjusting entry, if any. Note: Enter debits before credits. Date Account Title Debit Credit Apr 30 Record entry Clear entry View general journal Journal entry worksheet Straight line depreciation of office equipment based on a 5-year life and a $9,100 salvage value, is $500 per month. Prepare the required adjusting entry, if any. Note: Enter debits before credits Account Title Debit Dato Apr 30 Credit Record entry Clear entry View general joumal Journal entry worksheet 1 2 3 4 6 Go The company has completed work for a client, but has not yet billed the $2,200 fee. Prepare the required adjusting entry, if any. Note: Enter debits before credits. Account Title Debit Credit Date Apr 30 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts