Question: please complete the charts with infomation given Prepare journal entries to record the following merchandising transactions of Lee's, which uses the perpetual inventory system and

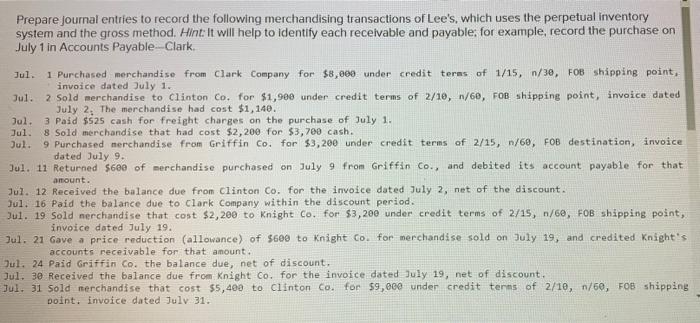

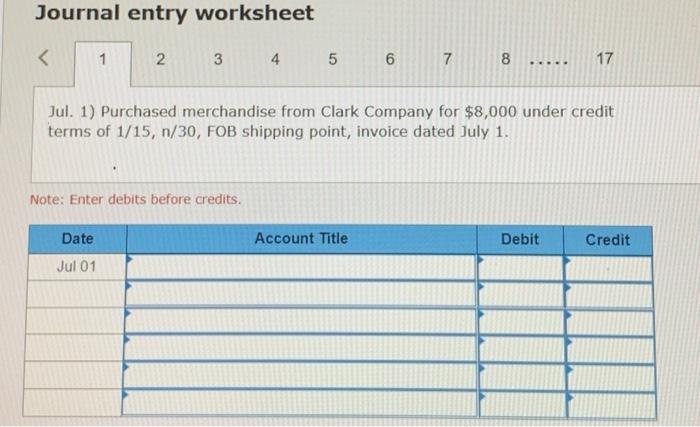

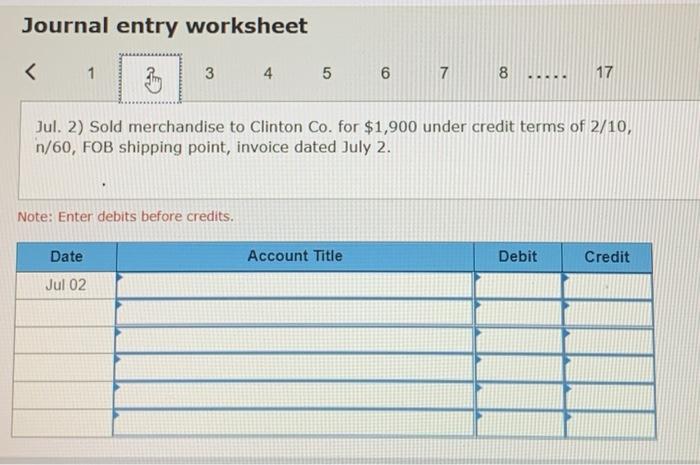

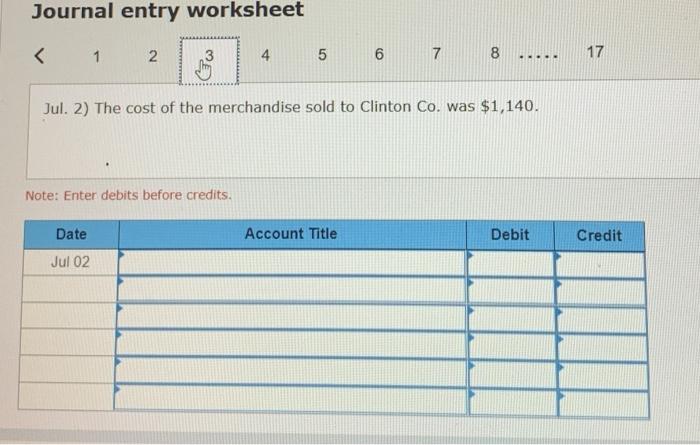

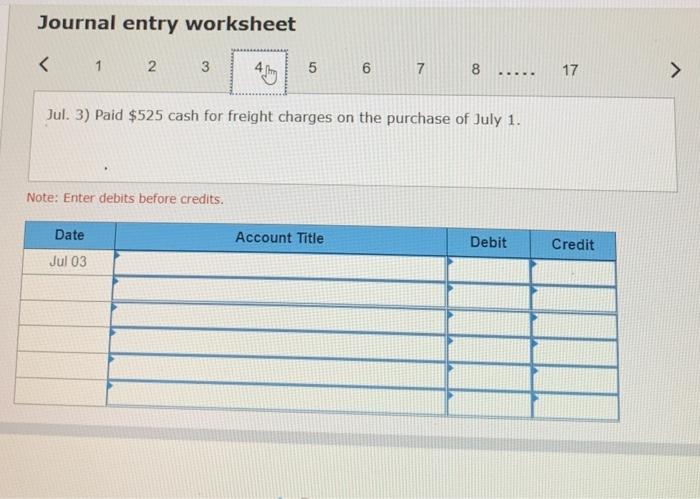

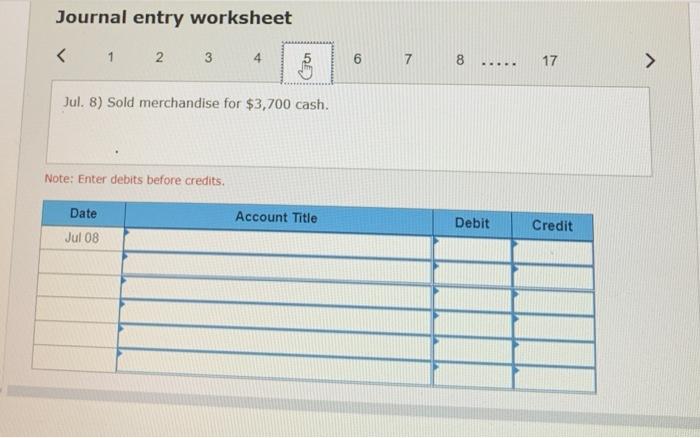

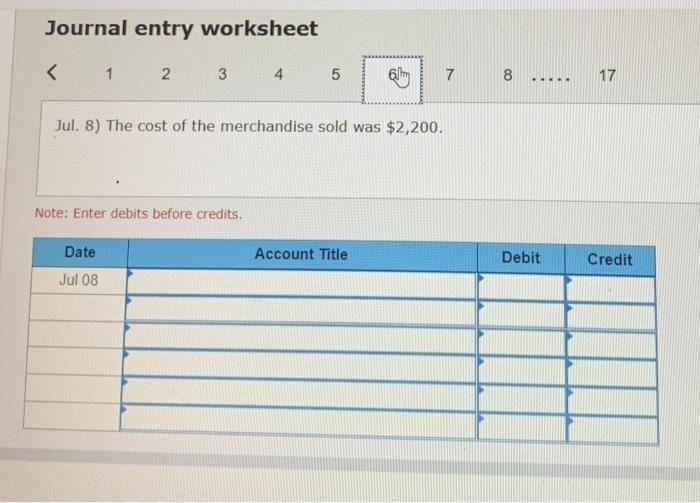

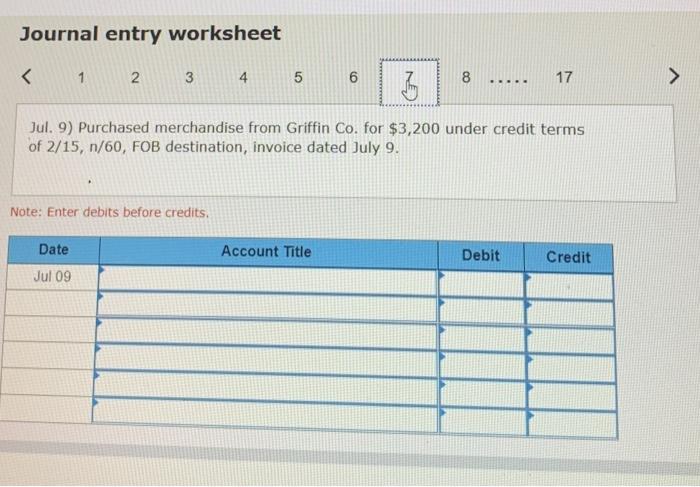

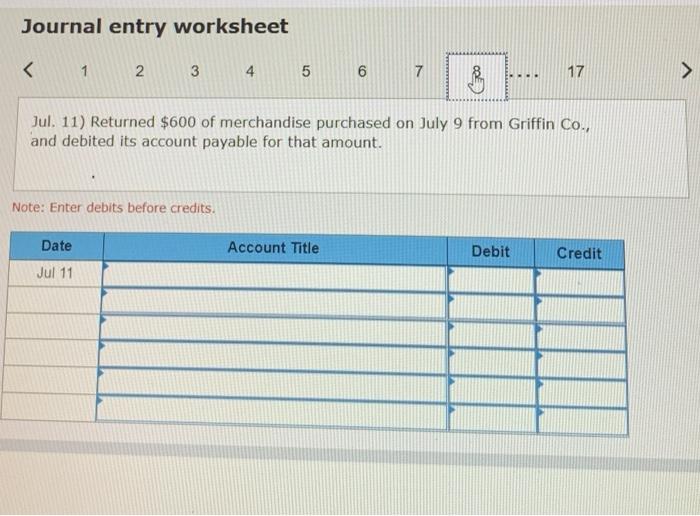

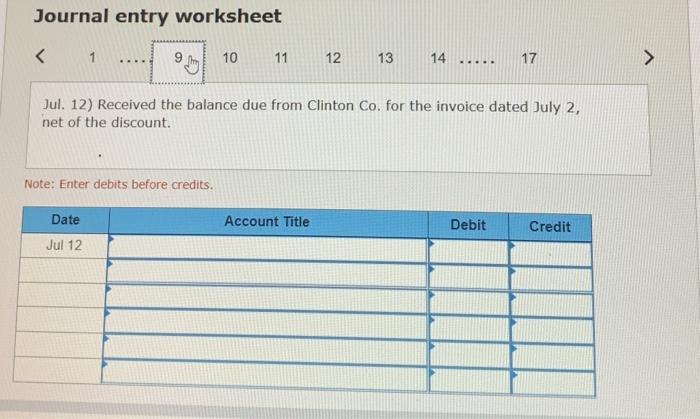

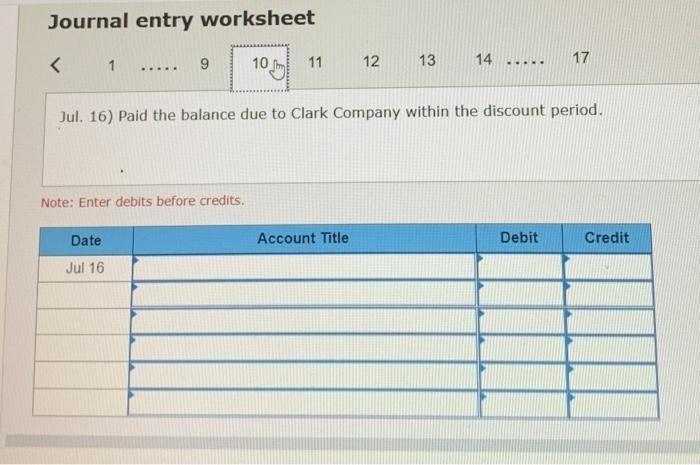

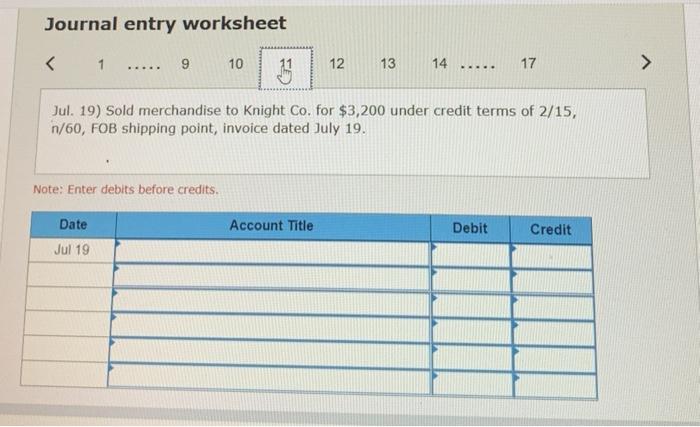

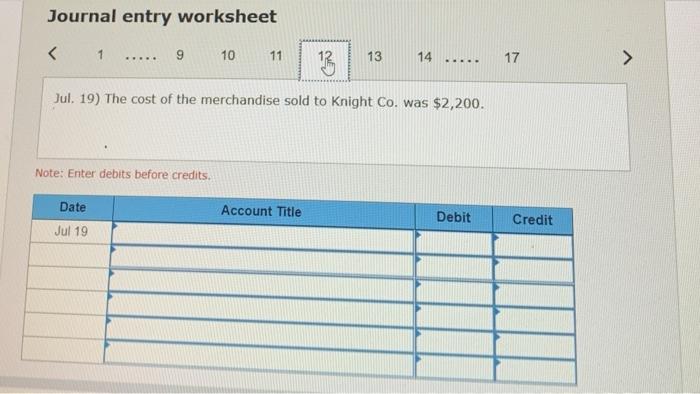

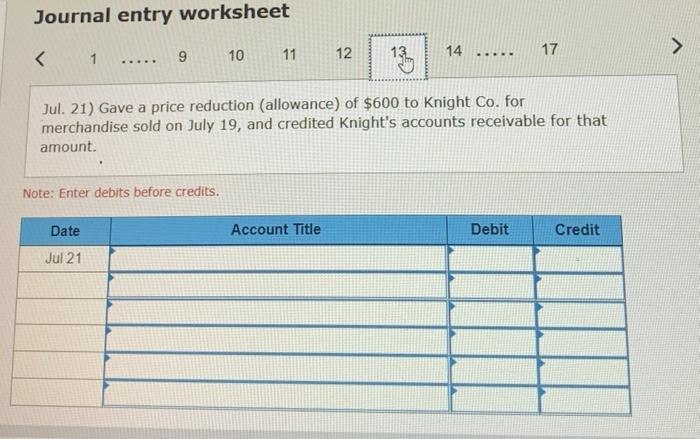

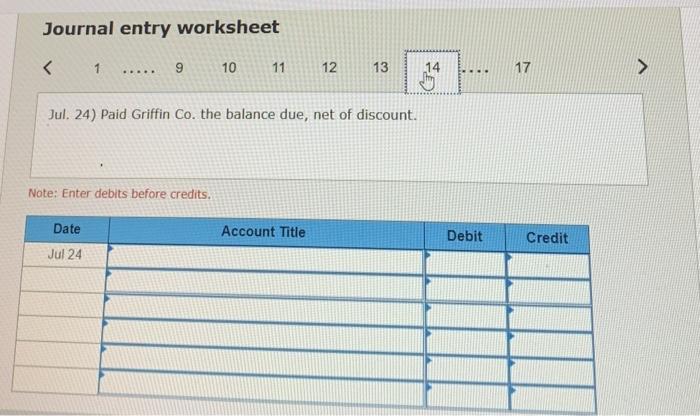

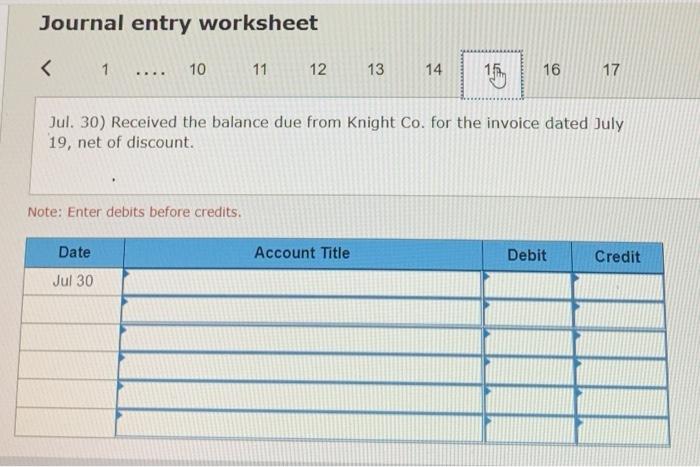

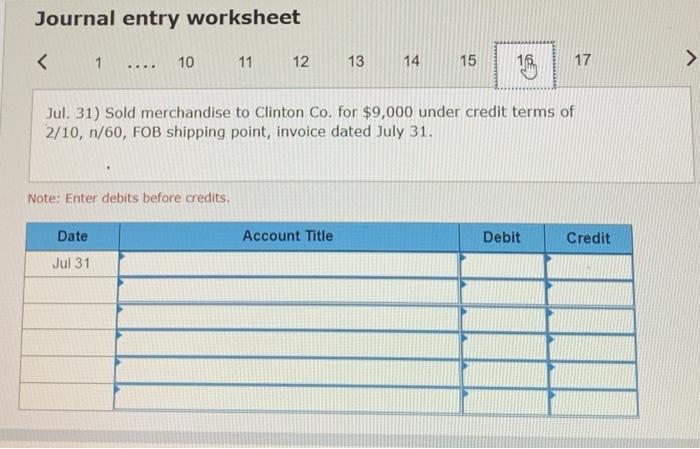

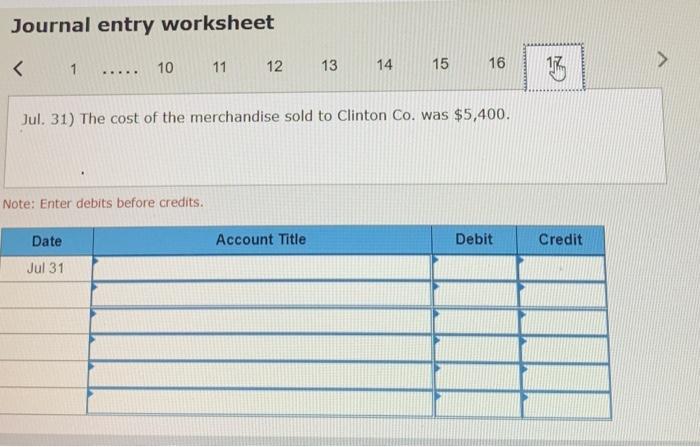

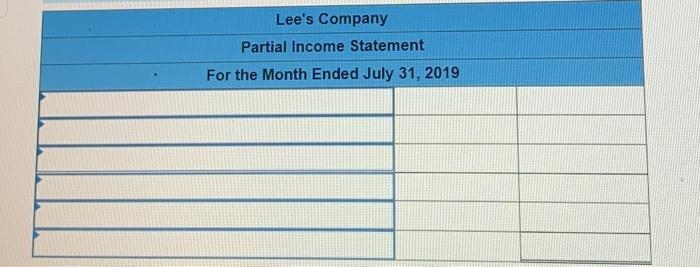

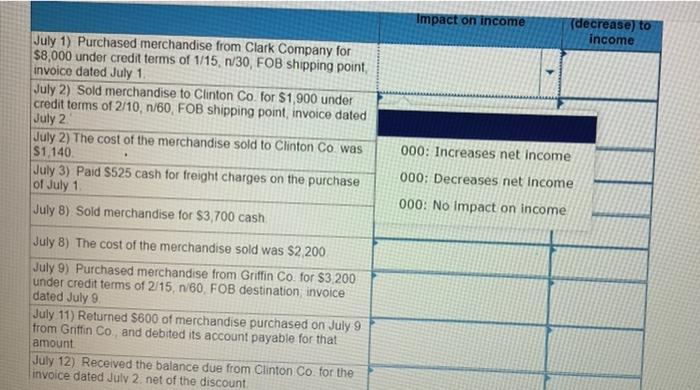

Prepare journal entries to record the following merchandising transactions of Lee's, which uses the perpetual inventory system and the gross method. Hint: It will help to identify each receivable and payable, for example, record the purchase on July 1 in Accounts Payable ---Clark. Jul. Jul. 1 Purchased merchandise from Clark Company for $8,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. Jul. 2 Sold merchandise to Clinton Co. for $1,900 under credit terms of 2/10, 1/60, FOB shipping point, invoice dated July 2: The merchandise had cost $1,140. Jul. 3 Paid $S25 cash for freight charges on the purchase of July 1. 8 Sold merchandise that had cost $2,200 for $3,700 cash. Jul. 9 Purchased merchandise from Griffin Co. for $3,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. Jul. 11 Returned $600 of merchandise purchased on July 9 from Griffin Co., and debited its account payable for that amount. Jul 12 Received the balance due from Clinton Co. for the invoice dated July 2, net of the discount. Jul. 16 Paid the balance due to Clark Company within the discount period. Jul. 19 Sold nerchandise that cost $2,200 to Knight Co. for $3,200 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. Jul. 21 Gave a price reduction (allowance) of $600 to Knight Co. for merchandise sold on July 19, and credited Knight's accounts receivable for that amount. Jul. 24 Paid Griffin Co. the balance due, net of discount. Jul. 30 Received the balance due from Knight Co. for the invoice dated July 19, net of discount. Jul. 31 Sold merchandise that cost $5,400 to Clinton Co. for 59,000 under credit terms of 2/10, 1/60, FOB shipping point. invoice dated July 31. Journal entry worksheet ..... . Jul. 19) Sold merchandise to Knight Co. for $3,200 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. Note: Enter debits before credits. Account Title Debit Credit Date Jul 19 Journal entry worksheet 1 9 10 11 13 14 ... 17 .... > Jul. 19) The cost of the merchandise sold to Knight Co. was $2,200. Note: Enter debits before credits. Account Title Date Jul 19 Debit Credit Journal entry worksheet Jul. 31) Sold merchandise to Clinton Co. for $9,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. Note: Enter debits before credits. Date Account Title Debit Credit Jul 31 Journal entry worksheet 1 12 13 14 15 16 Jul. 31) The cost of the merchandise sold to Clinton Co. was $5,400. Note: Enter debits before credits. Date Account Title Debit Credit Jul 31 Lee's Company Partial Income Statement For the Month Ended July 31, 2019 Impact on income (decrease) to income July 1) Purchased merchandise from Clark Company for $8,000 under credit terms of 1/15, n/30, FOB shipping point invoice dated July 1 July 2) Sold merchandise to Clinton Co. for $1,900 under credit terms of 2/10, 1/60, FOB shipping point invoice dated July 2 July 2) The cost of the merchandise sold to Clinton Co was $1,140 July 3) Paid $525 cash for freight charges on the purchase of July 1 July 8) Sold merchandise for $3,700 cash 000: Increases net income 000: Decreases net income 000: No Impact on income July 8) The cost of the merchandise sold was $2 200 July 9) Purchased merchandise from Griffin Co. for $3,200 under credit terms of 2/15, 1/60, FOB destination invoice dated July 9 July 11) Returned $600 of merchandise purchased on July 9 from Griffin Co. and debited its account payable for that amount July 12) Received the balance due from Clinton Co. for the invoice dated July 2. net of the discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts