Question: Please complete the closing journal entries for both the enterprise fund for 9-15. Chapter 7 Recording Transactions Affecting the Enterprise Fund and Business-Type Activities The

Please complete the closing journal entries for both the enterprise fund for 9-15.

Please complete the closing journal entries for both the enterprise fund for 9-15.

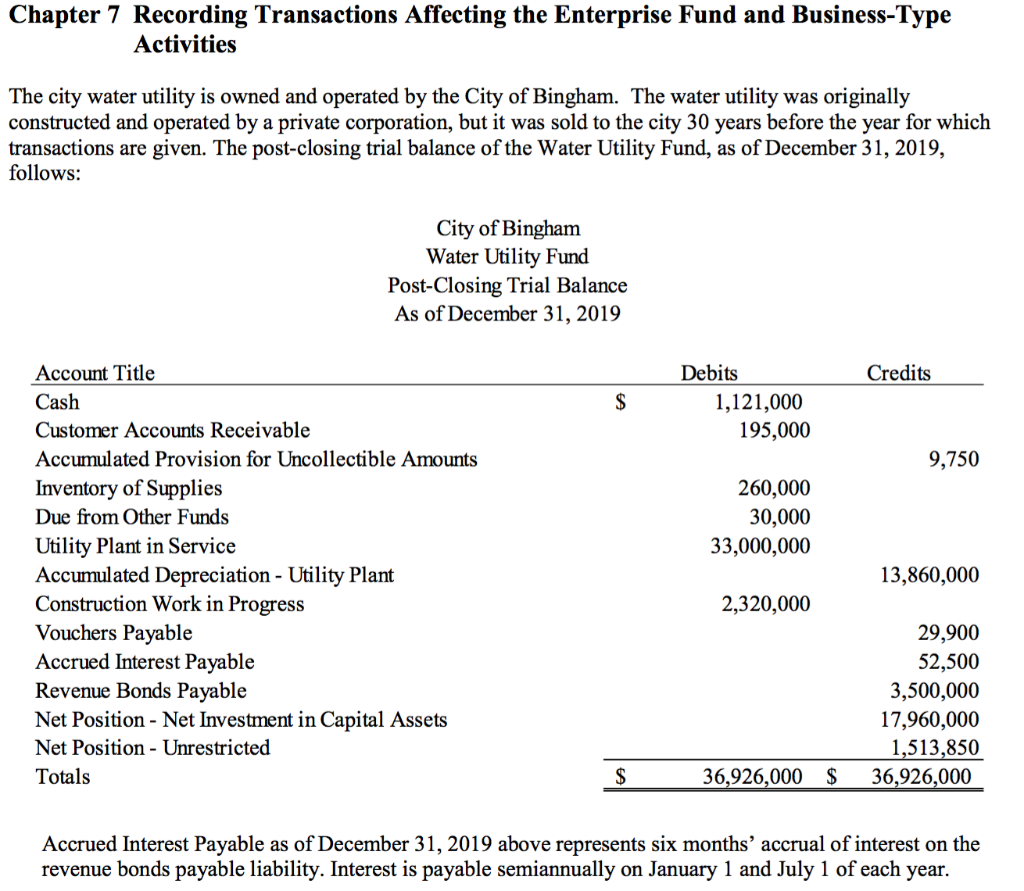

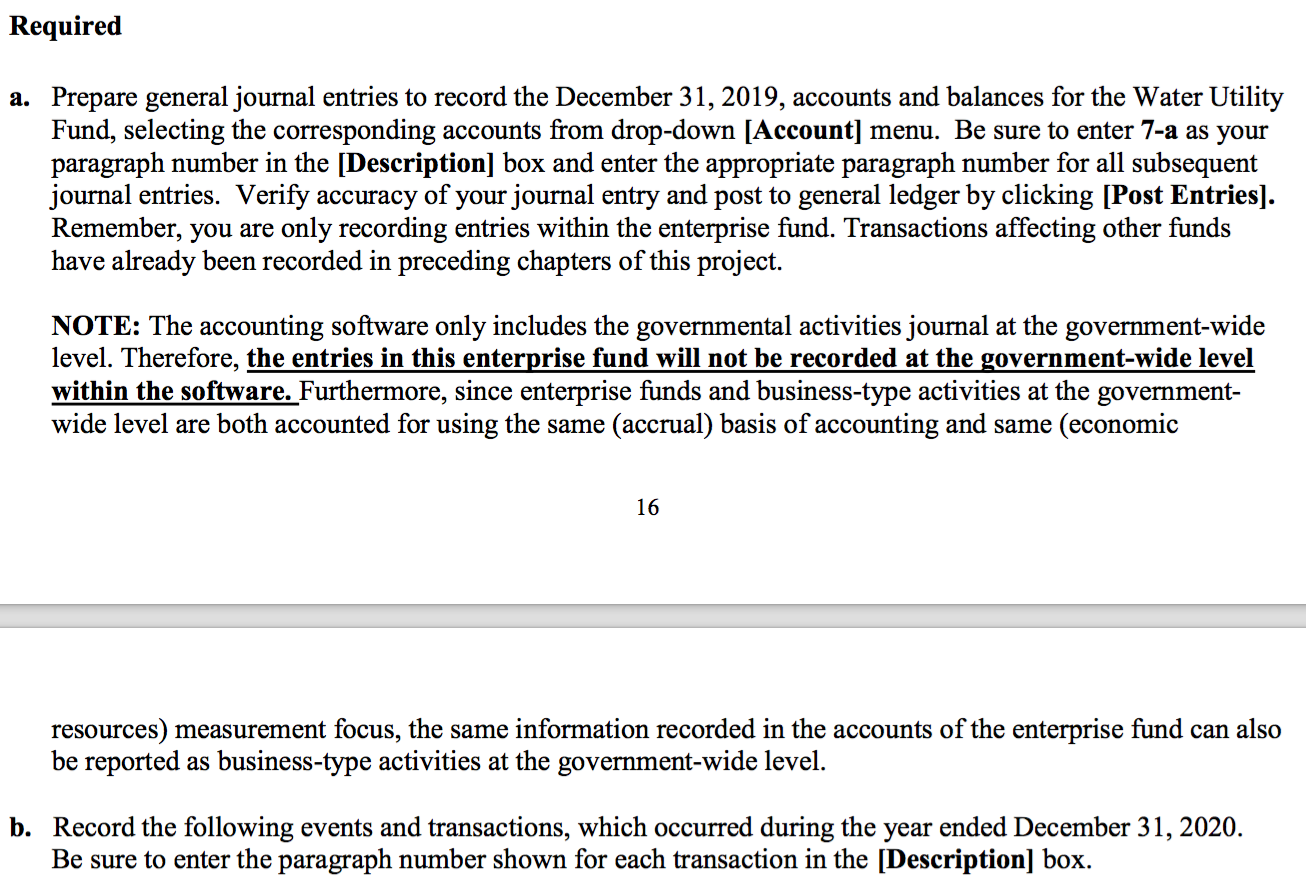

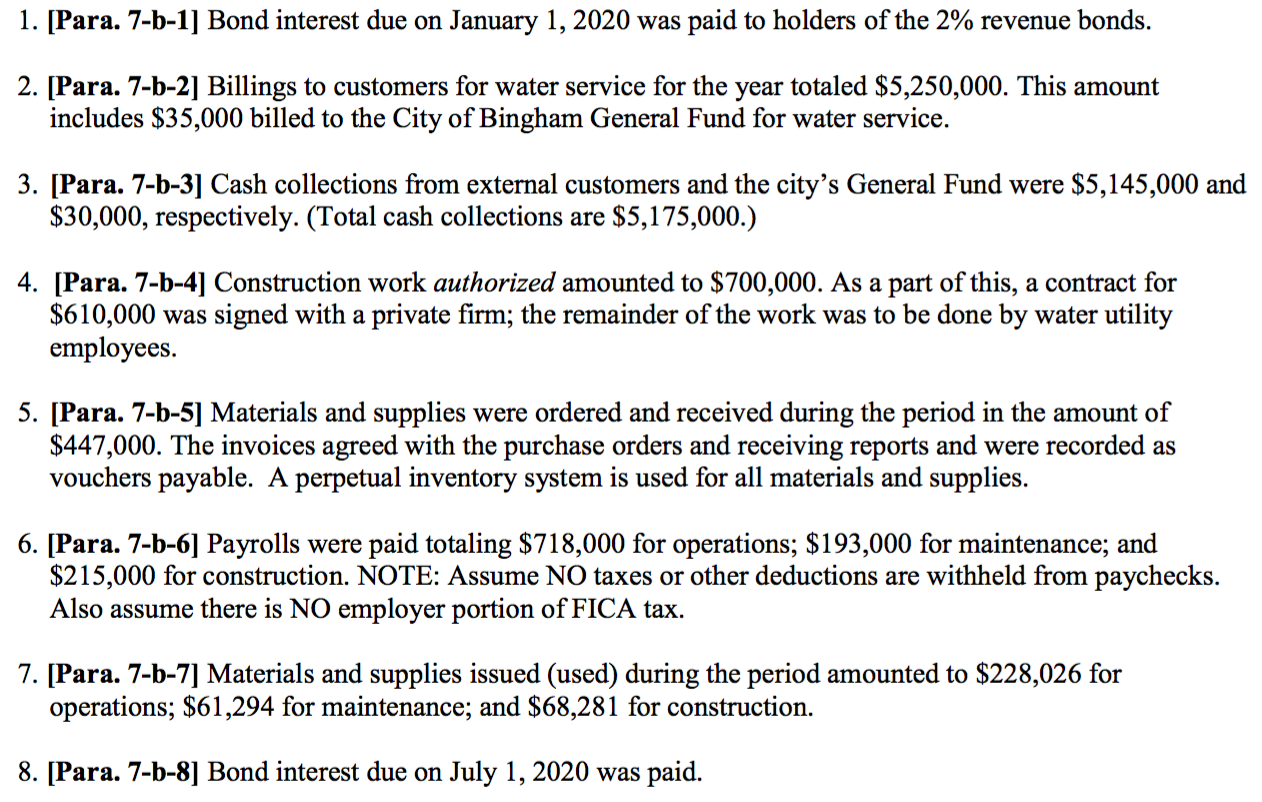

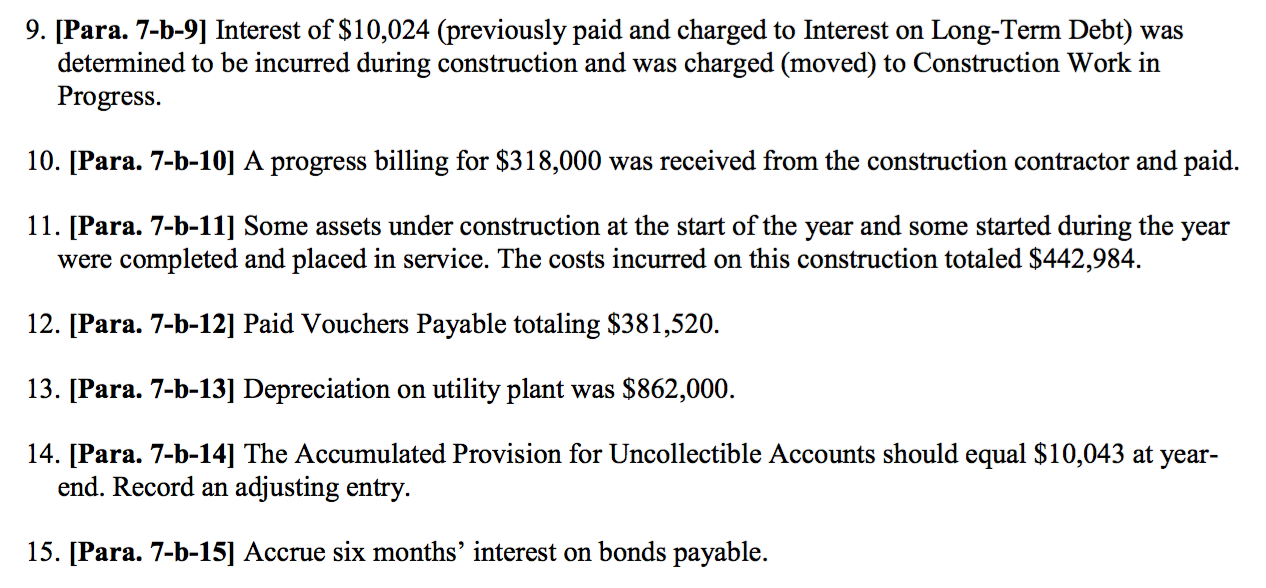

Chapter 7 Recording Transactions Affecting the Enterprise Fund and Business-Type Activities The city water utility is owned and operated by the City of Bingham. The water utility was originally constructed and operated by a private corporation, but it was sold to the city 30 years before the year for which transactions are given. The post-closing trial balance of the Water Utility Fund, as of December 31, 2019, follows: City of Bingham Water Utility Fund Post-Closing Trial Balance As of December 31, 2019 Credits Debits 1,121,000 195,000 9,750 260,000 30,000 33,000,000 Account Title Cash Customer Accounts Receivable Accumulated Provision for Uncollectible Amounts Inventory of Supplies Due from Other Funds Utility Plant in Service Accumulated Depreciation - Utility Plant Construction Work in Progress Vouchers Payable Accrued Interest Payable Revenue Bonds Payable Net Position - Net Investment in Capital Assets Net Position - Unrestricted Totals 13,860,000 2,320,000 29,900 52,500 3,500,000 17,960,000 1,513,850 36,926,000 $ 36,926,000 $ Accrued Interest Payable as of December 31, 2019 above represents six months' accrual of interest on the revenue bonds payable liability. Interest is payable semiannually on January 1 and July 1 of each year. Required a. Prepare general journal entries to record the December 31, 2019, accounts and balances for the Water Utility Fund, selecting the corresponding accounts from drop-down [Account] menu. Be sure to enter 7-a as your paragraph number in the [Description] box and enter the appropriate paragraph number for all subsequent journal entries. Verify accuracy of your journal entry and post to general ledger by clicking (Post Entries). Remember, you are only recording entries within the enterprise fund. Transactions affecting other funds have already been recorded in preceding chapters of this project. NOTE: The accounting software only includes the governmental activities journal at the government-wide level. Therefore, the entries in this enterprise fund will not be recorded at the government-wide level within the software. Furthermore, since enterprise funds and business-type activities at the government- wide level are both accounted for using the same (accrual) basis of accounting and same (economic 16 resources) measurement focus, the same information recorded in the accounts of the enterprise fund can also be reported as business-type activities at the government-wide level. b. Record the following events and transactions, which occurred during the year ended December 31, 2020. Be sure to enter the paragraph number shown for each transaction in the [Description] box. 1. [Para. 7-b-1] Bond interest due on January 1, 2020 was paid to holders of the 2% revenue bonds. 2. [Para. 7-b-2] Billings to customers for water service for the year totaled $5,250,000. This amount includes $35,000 billed to the City of Bingham General Fund for water service. 3. [Para. 7-b-3] Cash collections from external customers and the city's General Fund were $5,145,000 and $30,000, respectively. (Total cash collections are $5,175,000.) 4. [Para. 7-b-4) Construction work authorized amounted to $700,000. As a part of this, a contract for $610,000 was signed with a private firm; the remainder of the work was to be done by water utility employees. 5. [Para. 7-b-5] Materials and supplies were ordered and received during the period in the amount of $447,000. The invoices agreed with the purchase orders and receiving reports and were recorded as vouchers payable. A perpetual inventory system is used for all materials and supplies. 6. [Para. 7-b-6] Payrolls were paid totaling $718,000 for operations; $ 193,000 for maintenance; and $215,000 for construction. NOTE: Assume NO taxes or other deductions are withheld from paychecks. Also assume there is NO employer portion of FICA tax. 7. [Para. 7-b-7] Materials and supplies issued (used) during the period amounted to $228,026 for operations; $61,294 for maintenance; and $68,281 for construction. 8. [Para. 7-b-8] Bond interest due on July 1, 2020 was paid. 9. [Para. 7-b-9] Interest of $10,024 (previously paid and charged to Interest on Long-Term Debt) was determined to be incurred during construction and was charged (moved) to Construction Work in Progress. 10. [Para. 7-b-10] A progress billing for $318,000 was received from the construction contractor and paid. 11. [Para. 7-b-11] Some assets under construction at the start of the year and some started during the year were completed and placed in service. The costs incurred on this construction totaled $442,984. 12. [Para. 7-b-12] Paid Vouchers Payable totaling $381,520. 13. [Para. 7-b-13] Depreciation on utility plant was $862,000. 14. [Para. 7-b-14] The Accumulated Provision for Uncollectible Accounts should equal $10,043 at year- end. Record an adjusting entry. 15. [Para. 7-b-15) Accrue six months' interest on bonds payable. c. From your pre-closing trial balance, prepare closing entries for the Water Utility Fund. This includes making an adjustment to the net position accounts to properly reflect both unrestricted and restricted net assets. 17 Review your trial balances for reasonableness. You should also have no negative balances. There should be NO temporary accounts on the post-closing trial balance. Export the trial balances to Excel to create financial statements. Chapter 7 Recording Transactions Affecting the Enterprise Fund and Business-Type Activities The city water utility is owned and operated by the City of Bingham. The water utility was originally constructed and operated by a private corporation, but it was sold to the city 30 years before the year for which transactions are given. The post-closing trial balance of the Water Utility Fund, as of December 31, 2019, follows: City of Bingham Water Utility Fund Post-Closing Trial Balance As of December 31, 2019 Credits Debits 1,121,000 195,000 9,750 260,000 30,000 33,000,000 Account Title Cash Customer Accounts Receivable Accumulated Provision for Uncollectible Amounts Inventory of Supplies Due from Other Funds Utility Plant in Service Accumulated Depreciation - Utility Plant Construction Work in Progress Vouchers Payable Accrued Interest Payable Revenue Bonds Payable Net Position - Net Investment in Capital Assets Net Position - Unrestricted Totals 13,860,000 2,320,000 29,900 52,500 3,500,000 17,960,000 1,513,850 36,926,000 $ 36,926,000 $ Accrued Interest Payable as of December 31, 2019 above represents six months' accrual of interest on the revenue bonds payable liability. Interest is payable semiannually on January 1 and July 1 of each year. Required a. Prepare general journal entries to record the December 31, 2019, accounts and balances for the Water Utility Fund, selecting the corresponding accounts from drop-down [Account] menu. Be sure to enter 7-a as your paragraph number in the [Description] box and enter the appropriate paragraph number for all subsequent journal entries. Verify accuracy of your journal entry and post to general ledger by clicking (Post Entries). Remember, you are only recording entries within the enterprise fund. Transactions affecting other funds have already been recorded in preceding chapters of this project. NOTE: The accounting software only includes the governmental activities journal at the government-wide level. Therefore, the entries in this enterprise fund will not be recorded at the government-wide level within the software. Furthermore, since enterprise funds and business-type activities at the government- wide level are both accounted for using the same (accrual) basis of accounting and same (economic 16 resources) measurement focus, the same information recorded in the accounts of the enterprise fund can also be reported as business-type activities at the government-wide level. b. Record the following events and transactions, which occurred during the year ended December 31, 2020. Be sure to enter the paragraph number shown for each transaction in the [Description] box. 1. [Para. 7-b-1] Bond interest due on January 1, 2020 was paid to holders of the 2% revenue bonds. 2. [Para. 7-b-2] Billings to customers for water service for the year totaled $5,250,000. This amount includes $35,000 billed to the City of Bingham General Fund for water service. 3. [Para. 7-b-3] Cash collections from external customers and the city's General Fund were $5,145,000 and $30,000, respectively. (Total cash collections are $5,175,000.) 4. [Para. 7-b-4) Construction work authorized amounted to $700,000. As a part of this, a contract for $610,000 was signed with a private firm; the remainder of the work was to be done by water utility employees. 5. [Para. 7-b-5] Materials and supplies were ordered and received during the period in the amount of $447,000. The invoices agreed with the purchase orders and receiving reports and were recorded as vouchers payable. A perpetual inventory system is used for all materials and supplies. 6. [Para. 7-b-6] Payrolls were paid totaling $718,000 for operations; $ 193,000 for maintenance; and $215,000 for construction. NOTE: Assume NO taxes or other deductions are withheld from paychecks. Also assume there is NO employer portion of FICA tax. 7. [Para. 7-b-7] Materials and supplies issued (used) during the period amounted to $228,026 for operations; $61,294 for maintenance; and $68,281 for construction. 8. [Para. 7-b-8] Bond interest due on July 1, 2020 was paid. 9. [Para. 7-b-9] Interest of $10,024 (previously paid and charged to Interest on Long-Term Debt) was determined to be incurred during construction and was charged (moved) to Construction Work in Progress. 10. [Para. 7-b-10] A progress billing for $318,000 was received from the construction contractor and paid. 11. [Para. 7-b-11] Some assets under construction at the start of the year and some started during the year were completed and placed in service. The costs incurred on this construction totaled $442,984. 12. [Para. 7-b-12] Paid Vouchers Payable totaling $381,520. 13. [Para. 7-b-13] Depreciation on utility plant was $862,000. 14. [Para. 7-b-14] The Accumulated Provision for Uncollectible Accounts should equal $10,043 at year- end. Record an adjusting entry. 15. [Para. 7-b-15) Accrue six months' interest on bonds payable. c. From your pre-closing trial balance, prepare closing entries for the Water Utility Fund. This includes making an adjustment to the net position accounts to properly reflect both unrestricted and restricted net assets. 17 Review your trial balances for reasonableness. You should also have no negative balances. There should be NO temporary accounts on the post-closing trial balance. Export the trial balances to Excel to create financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts