Question: please complete the Comprehensive Problem and all requirments in excel. thank you! COMPREHENSIVE PROBLEM > Comprehensive Problem for Appendix D Analyzing a company for its

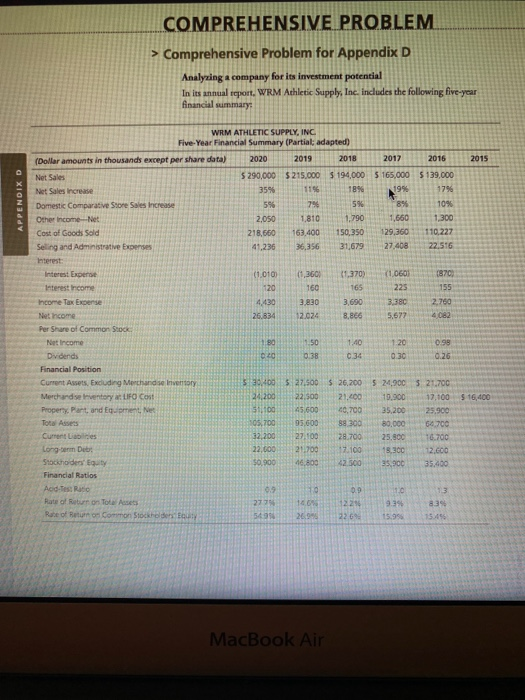

COMPREHENSIVE PROBLEM > Comprehensive Problem for Appendix D Analyzing a company for its investment potential In its annual report, WRM Athletic Supply, Inc. includes the following five-year financial summary: 2015 195 APPENDIXD 27.408 WRM ATHLETIC SUPPLY, INC Five-Year Financial Summary (Partial adapted) (Dollar amounts in thousands except per share data) 2020 2019 2018 2017 2016 Net Sales 5 290,000 $215.000 194,000 5 165,000 5 139,000 Net Sales Increase 35% 1196 18% Domestic Comparative Store Sales Increase 5% 790 5% 8% 10% Other Income Net 2,050 1,810 1.790 1,660 1,300 Cost of Goods Sold 218,660 163,400 150,350 129,360 110,227 Seling and Administrative Expenses 41.236 36,356 31.679 22.516 Interest Interest Expert (1.010) (1.3608 (1.370 (1.0601 1870 Interest income 120 160 165 225 155 Income Tax Expense 4.430 3.830 3.690 3.380 2.760 Net Income 26.834 12.024 8.866 5,677 4,082 Per Share of Common Stock Net Income 80 1.40 120 0.99 Dividends 020 0.38 0.30 0.26 Financial Position Current Assets, Exduding Merchandise Inventory 52000 527,500 $ 26,2005 24900 5 21.700 Merchandise trentory LIFO CON 24,200 22.500 21,400 19.900 17,100 Property Part, and Equipment, et S11 45,600 40,700 35,200 25.900 Total Assets 205,700 95,600 88300 80.000 64.700 Current Les 32,200 27,00 28.700 25,800 16.700 Long.com Deb 22.600 21.700 17.100 18.300 12.600 Stochodes' Equity $0.900 46.800 42.300 95.900 Financial Ratios Address Radio 0.9 10 09 1.0 13 Rate of Return on Tote Assets 2779 10.6 1224 9.39 835 Rate of Return on Common Stockholders Et 5495 269 226 15.99 15496 150 $ 16,400 35,400 MacBook Air Requirements 1. Analyze the company's financial summary for the fiscal years 2016-2020 to decide whether to invest in the common stock of WRM. Include the following sections in your analysis, and fully explain your final decision. a Trend analysis for net sales and net income (use 2016 as the base year). b. Profitability analysis, c. Evaluation of the ability to sell merchandise inventory (WRM uses the LIFO method). d. Evaluation of the ability to pay debts. e Evaluation of dividends. RITICAL THINKING cision Case D-1 COMPREHENSIVE PROBLEM > Comprehensive Problem for Appendix D Analyzing a company for its investment potential In its annual report, WRM Athletic Supply, Inc. includes the following five-year financial summary: 2015 195 APPENDIXD 27.408 WRM ATHLETIC SUPPLY, INC Five-Year Financial Summary (Partial adapted) (Dollar amounts in thousands except per share data) 2020 2019 2018 2017 2016 Net Sales 5 290,000 $215.000 194,000 5 165,000 5 139,000 Net Sales Increase 35% 1196 18% Domestic Comparative Store Sales Increase 5% 790 5% 8% 10% Other Income Net 2,050 1,810 1.790 1,660 1,300 Cost of Goods Sold 218,660 163,400 150,350 129,360 110,227 Seling and Administrative Expenses 41.236 36,356 31.679 22.516 Interest Interest Expert (1.010) (1.3608 (1.370 (1.0601 1870 Interest income 120 160 165 225 155 Income Tax Expense 4.430 3.830 3.690 3.380 2.760 Net Income 26.834 12.024 8.866 5,677 4,082 Per Share of Common Stock Net Income 80 1.40 120 0.99 Dividends 020 0.38 0.30 0.26 Financial Position Current Assets, Exduding Merchandise Inventory 52000 527,500 $ 26,2005 24900 5 21.700 Merchandise trentory LIFO CON 24,200 22.500 21,400 19.900 17,100 Property Part, and Equipment, et S11 45,600 40,700 35,200 25.900 Total Assets 205,700 95,600 88300 80.000 64.700 Current Les 32,200 27,00 28.700 25,800 16.700 Long.com Deb 22.600 21.700 17.100 18.300 12.600 Stochodes' Equity $0.900 46.800 42.300 95.900 Financial Ratios Address Radio 0.9 10 09 1.0 13 Rate of Return on Tote Assets 2779 10.6 1224 9.39 835 Rate of Return on Common Stockholders Et 5495 269 226 15.99 15496 150 $ 16,400 35,400 MacBook Air Requirements 1. Analyze the company's financial summary for the fiscal years 2016-2020 to decide whether to invest in the common stock of WRM. Include the following sections in your analysis, and fully explain your final decision. a Trend analysis for net sales and net income (use 2016 as the base year). b. Profitability analysis, c. Evaluation of the ability to sell merchandise inventory (WRM uses the LIFO method). d. Evaluation of the ability to pay debts. e Evaluation of dividends. RITICAL THINKING cision Case D-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts