Question: ! ! ! Please complete the entire question!!! Required: For parts A to I, assume that Sweeten Company uses departmental predetermined overhead rates with machine

Please complete the entire question!!!

Required:

For parts A to I, assume that Sweeten Company uses departmental predetermined overhead rates with machine

hours as the allocation base in both departments and Job P included units and Job Q included units. For parts

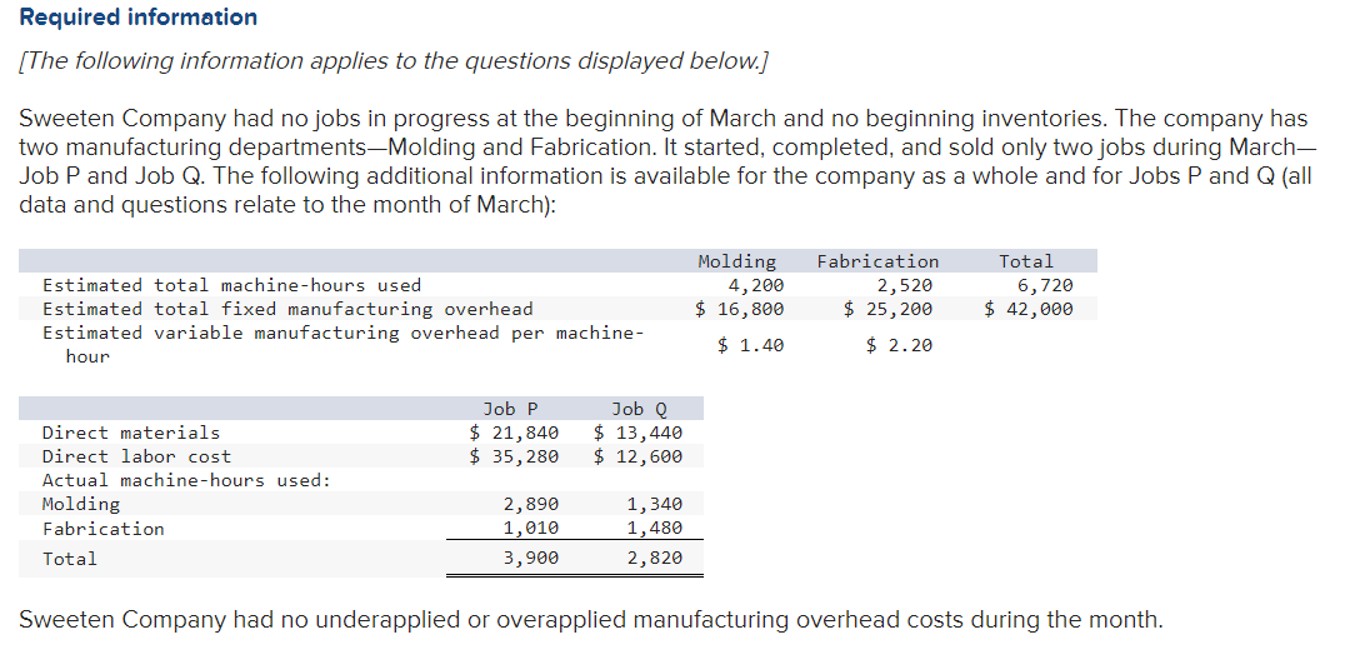

Required information

A What were the companys predetermined overhead rates in the Molding Department and the Fabrication Department? Round your answers to decimal places.

B How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job QDo not round intermediate calculations.

C How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job QDo not round intermediate calculations.

D What was the total manufacturing cost assigned to Job PDo not round intermediate calculations.

E If Job P included units, what was its unit product cost? Do not round intermediate calculations. Round your final answer to nearest whole

F What was the total manufacturing c

G If Job Q included units, what was its unit product cost? Do not round intermediate calculations. Round your final answer to neares

H Assume that Sweeten Company used costplus pricing and a markup percentage of of total manufacturing cost to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q What are the selling prices for both jobs when stated on a per unit basis? Do not round intermediate calculations. Round your final answers to nearest whole dollar.

I. What was Sweeten Companys cost of goods sold for March? Do not round intermediate calculations.

round intermediate calculations. Round your final answer to nearest whole dollar.

Please Complete the entire question!!!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock