Question: Please complete the Excel ! PAYOFFS OUTCOMES Maximize EMV Alternatives Buy 1 Machine Buy 2 Machine Buy 3 Machine Probability Bid Accepted Bid Rejected EMV

Please complete the Excel !

Please complete the Excel !

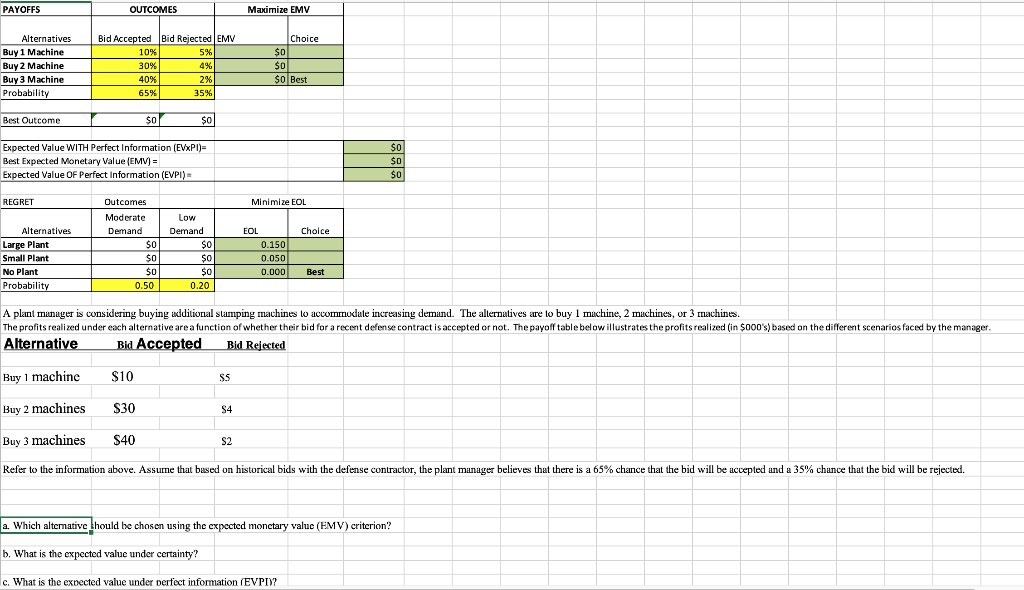

PAYOFFS OUTCOMES Maximize EMV Alternatives Buy 1 Machine Buy 2 Machine Buy 3 Machine Probability Bid Accepted Bid Rejected EMV 10% 5% 30% 40% 2% 65% 35% Choice $0 $0 $0 Best Best Outcome 1 $0 $0 Expected Value WITH Perfect Information (EVXPI)= Best Expected Monetary Value EMV] = Expected Value OF Perfect Information (EVP) $0 $0 $0 REGRET Outcomes Minimize EOL Low Dernand SO Choice Alternatives Large Plant Small Plant No Plant Probability Moderate Demand SO $0 sol 0.50 EOL 0.150 0.050 0.000 $0 $0 0.20 Best A plant manager is considering buying additional stamping machines to accommodate increasing demand. The alternatives are lo buy 1 machine, 2 machines, or 3 machines. The profits realized under each alternative are a function of whether their bid for a recent defense contract is accepted or not. The payoff table below illustrates the profits realized (in $000's) based on the different scenarios faced by the manager. Alternative Bid Accepted Bid Rejected Buy 1 machine $10 SS Buy 2 machines $30 S4 Buy 3 machines $40 S2 Refer to the information above. Assume that based on historical bids with the defense contractor, the plant manager believes that there is a 65% chance that the bid will be accepted and a 35% chance that the bid will be rejected. a. Which alternative thould be chosen using the expected monetary value (EMV) criterion? b. What is the expected value under certainty? c. What is the expected value under perfect information (EVPI)? PAYOFFS OUTCOMES Maximize EMV Alternatives Buy 1 Machine Buy 2 Machine Buy 3 Machine Probability Bid Accepted Bid Rejected EMV 10% 5% 30% 40% 2% 65% 35% Choice $0 $0 $0 Best Best Outcome 1 $0 $0 Expected Value WITH Perfect Information (EVXPI)= Best Expected Monetary Value EMV] = Expected Value OF Perfect Information (EVP) $0 $0 $0 REGRET Outcomes Minimize EOL Low Dernand SO Choice Alternatives Large Plant Small Plant No Plant Probability Moderate Demand SO $0 sol 0.50 EOL 0.150 0.050 0.000 $0 $0 0.20 Best A plant manager is considering buying additional stamping machines to accommodate increasing demand. The alternatives are lo buy 1 machine, 2 machines, or 3 machines. The profits realized under each alternative are a function of whether their bid for a recent defense contract is accepted or not. The payoff table below illustrates the profits realized (in $000's) based on the different scenarios faced by the manager. Alternative Bid Accepted Bid Rejected Buy 1 machine $10 SS Buy 2 machines $30 S4 Buy 3 machines $40 S2 Refer to the information above. Assume that based on historical bids with the defense contractor, the plant manager believes that there is a 65% chance that the bid will be accepted and a 35% chance that the bid will be rejected. a. Which alternative thould be chosen using the expected monetary value (EMV) criterion? b. What is the expected value under certainty? c. What is the expected value under perfect information (EVPI)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts