Question: Please complete the following practice questions below. Exercise 8-1 (Static) Cost of plant assets LO C1 Rizio Company purchases a machine for $12,500, terms 2/10,n/60,FOB

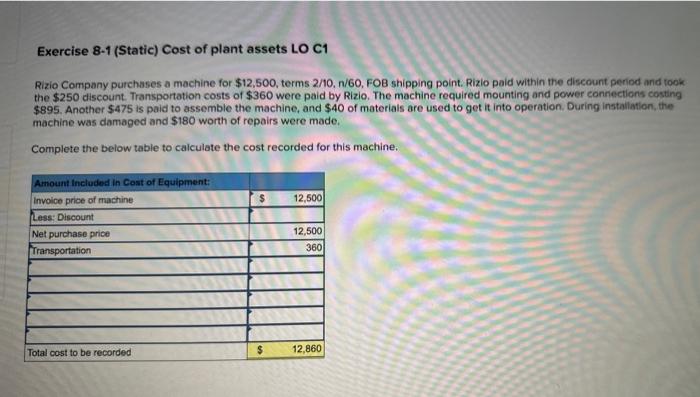

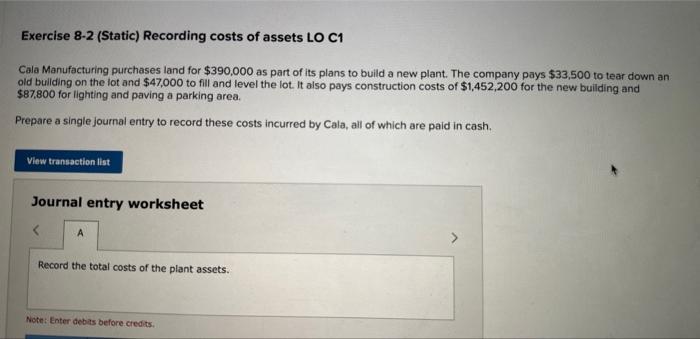

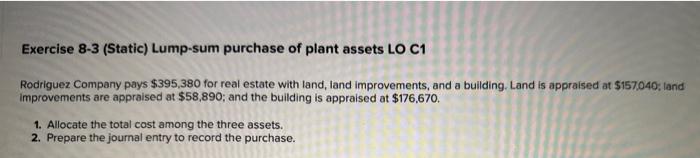

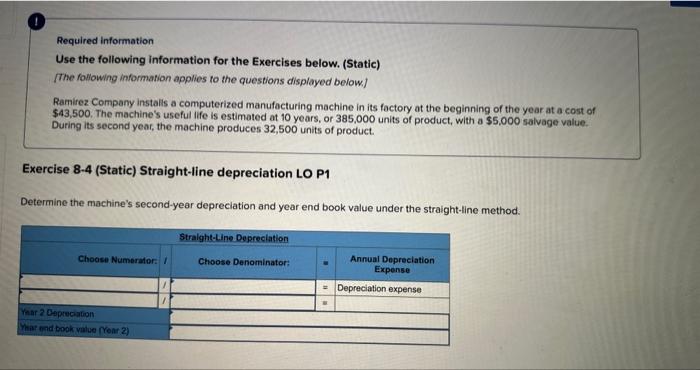

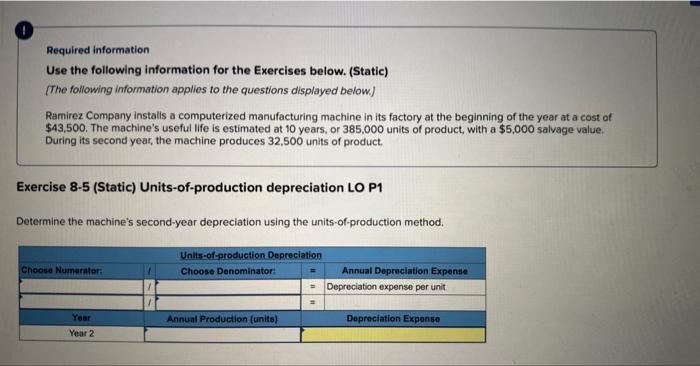

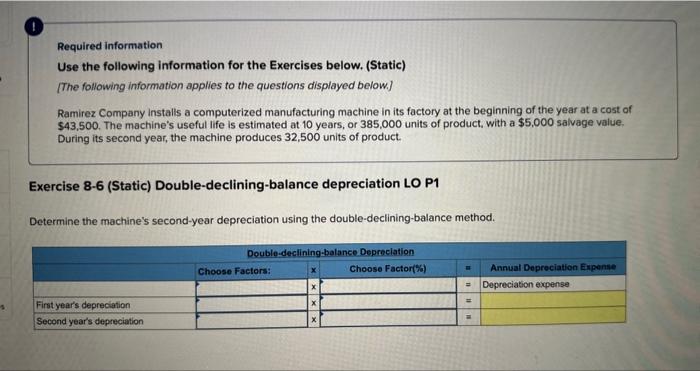

Exercise 8-1 (Static) Cost of plant assets LO C1 Rizio Company purchases a machine for $12,500, terms 2/10,n/60,FOB shipping point. Rizio paid within the discount period and took the $250 discount. Transportation costs of $360 were paid by Rizio. The machine required mounting and power connections costing $895. Another $475 is paid to assemble the machine, and $40 of materiais are used to get it into operation. During installation, the machine was damaged and $180 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine. Exercise 8-2 (Static) Recording costs of assets LO C1 Cala Manufacturing purchases land for $390,000 as part of its plans to build a new plant. The company pays $33,500 to tear down an old buliding on the lot and $47,000 to fill and level the lot. It also pays construction costs of $1,452,200 for the new building and $87,800 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash. Exercise 8-3 (Static) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $395,380 for real estate with land, land improvements, and a building. Land is appraised at $157,040; land improvements are appraised at $58,890; and the building is appraised at $176,670. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Required information Use the following information for the Exercises below. (Static) The following information applies to the questions displayed below] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500. The machine's useful life is estimated at 10 years, or 385,000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32,500 units of product. Exercise 8-4 (Static) Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method. Required information Use the following information for the Exercises below. (Static) [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500. The machine's useful life is estimated at 10 years, or 385,000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32,500 units of product. Exercise 8-5 (Static) Units-of-production depreciation LO P1 Determine the machine's second-year depreciation using the units-of-production method. Required information Use the following information for the Exercises below. (Static) [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500. The machine's useful life is estimated at 10 years, or 385,000 units of product, with a $5,000 salvage value, During its second year, the machine produces 32,500 units of product. Exercise 8-6 (Static) Double-declining-balance depreciation LO P1 Determine the machine's second-year depreciation using the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts