Question: please complete the full cashflow statement as given in image and also find out yellow blanks in income statement. Unless you are told otherwise, assume

please complete the full cashflow statement as given in image and also find out yellow blanks in income statement. Unless you are told otherwise, assume all cash inows and outflows are evenly distributed over months.

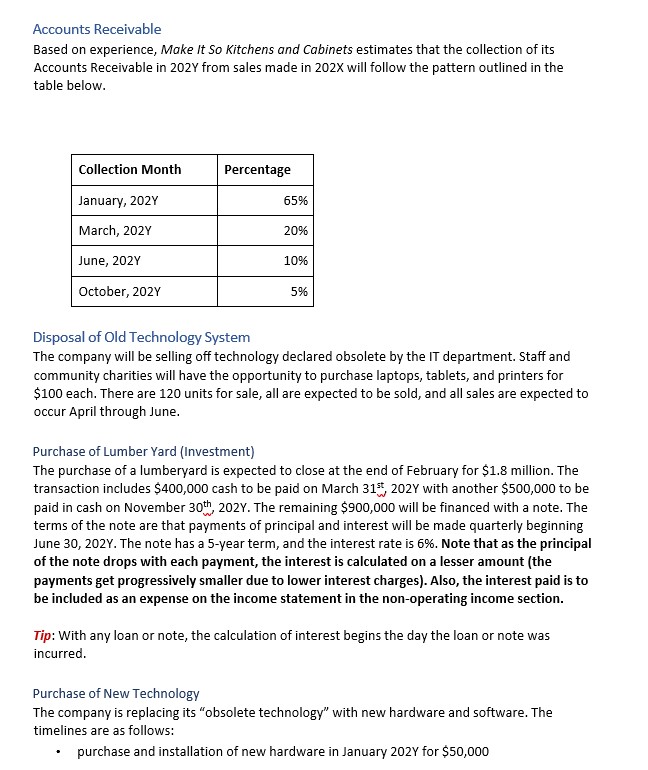

Income Statement and Balance Sheet Assumptions

With respect to projected revenue, NonOperating Income consists entirely of interest earned on investments. The sale of stock does not impact revenue. For the distribution of revenue and expenses, assume the following:

that refurbishing sales are evenly distributed throughout the year,

March st through October st accounts for of cabinet sales while the remaining of sales occur between November st and February th

for Personnel Costs, Marketing Expenses, and Office Expenses in the Selling, General & Admin Expenses category, assume that each expense is evenly distributed over the course of the year. For all other expenses in this category, use the information provided in the case and use separate line items for each.

Accounts Payable for X were $ Assume that payments will be made in equal thirds over the first three months of Y

Accounts Receivable are addressed separately in point below.

Selling Costs

Make It So Kitchen & Cabinets salespeople earn the following commissions:

sale of cabinets:

refurbishing sales:

Make sure you accurately distribute these commissions in the cash ow statement.

Stock Situation

The company has outstanding Common Stock shares valued at $share The company anticipates paying out dividends of $share in May Y

There are currently preferred stock shares outstanding. They are valued at $share

Stock Sale

The company intends to sell its final shares of common stock at $share to raise capital for its purchase of the lumberyard see Item # They expect the issue to sell out within days of being oered on May nd of the purchases are expected to be made in the first month and the remaining purchases are expected to be made in June. The company chosen May as the launch date because the spring and summer are the times that are traditionally the highest revenue generating months. The issuance of stock does not result in the company being taxed on the funds it receives.

Expenditures for the Coming Year

The company is anticipating the following expenses:

a rent for the downtown offices will increase by on July Y Currently, the company pays $ per month.

b an increase of insurance premiums of due to a claim in November, X brings the annual insurance fee to a total of $ Insurance premiums are paid in full at the end of March each year.

c renovations connected to the insurance claim amount to $ over the first months of Y paid in equal monthly amounts

d Property taxes owing to the City amount to per year and they are paid at the end of June.

e The $ commercial paper that the company issued December stX will be paid out at the end of year including annual interest of

f The company took out a $ loan at the end of December X The interest, calculated at a rate of is paid at the end of the year on the amount outstanding at that time. The principal will be paid back over years in equal monthly payments. Note: In the cash ow statement, show principal and interest payments on separate lines.

g the mortgage is amortized over years at per annum. The payment is $ per month. Assume that this amount consists of $ in principal and $ in interest. Note: Again, the interest and principal is separated on the cash ow statement.

h the company intends to take advantage of an opportunity to make a balloon payment of $ against its mortgage on April thY

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock