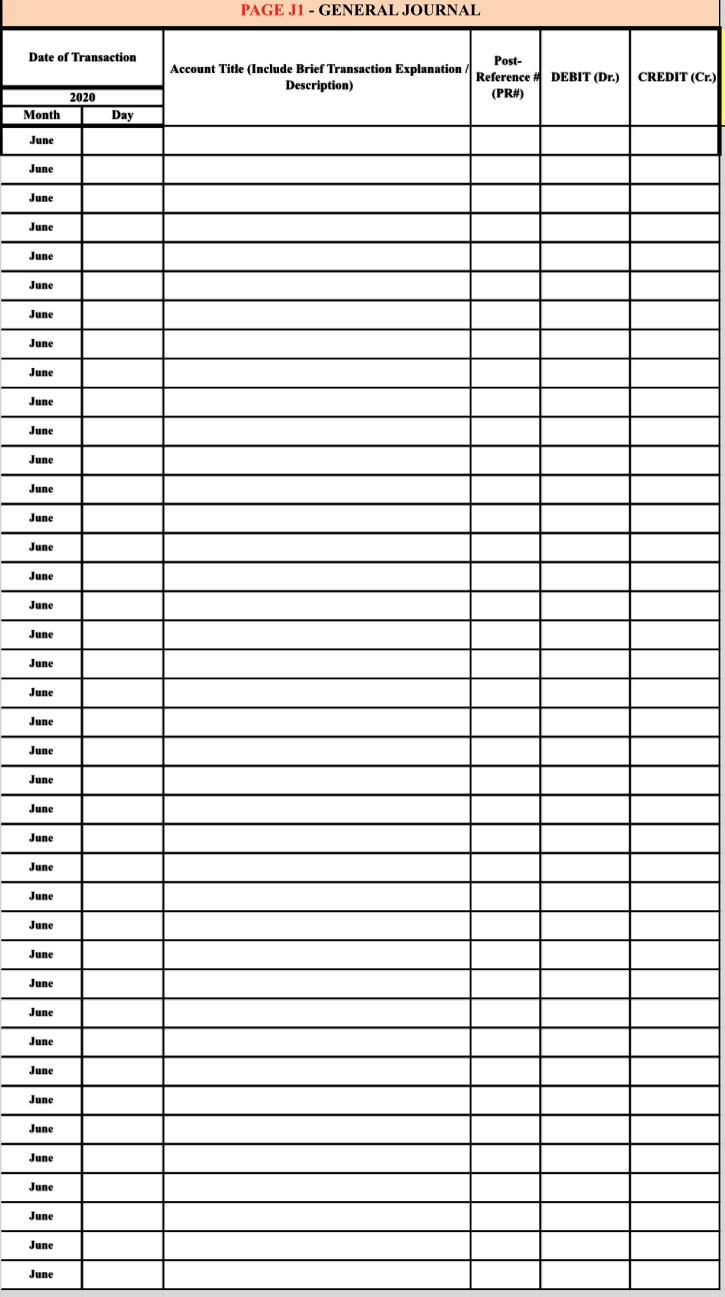

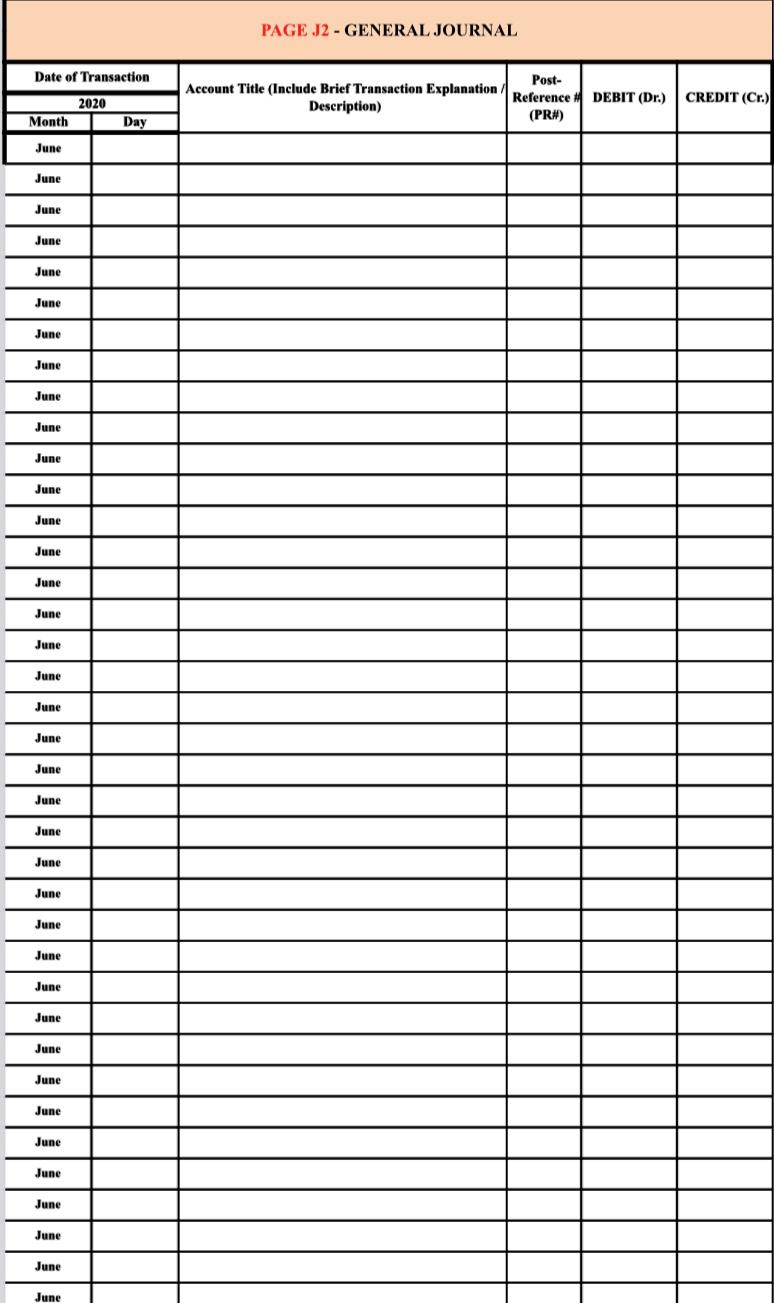

Question: Please complete the general journal chart. (You have to use this information as well: Compute and record the adjustment for supplies used during the month.

Please complete the general journal chart.

(You have to use this information as well:

- Compute and record the adjustment for supplies used during the month. An inventory showed supplies on hand of $750.

- Record the adjustment for depreciation of Office Equipment of $200 for the month.

- Record the adjustment for depreciation of Electric Sign of $100 for the month.

Please make a chart for the answer, not hand written. Thanks.

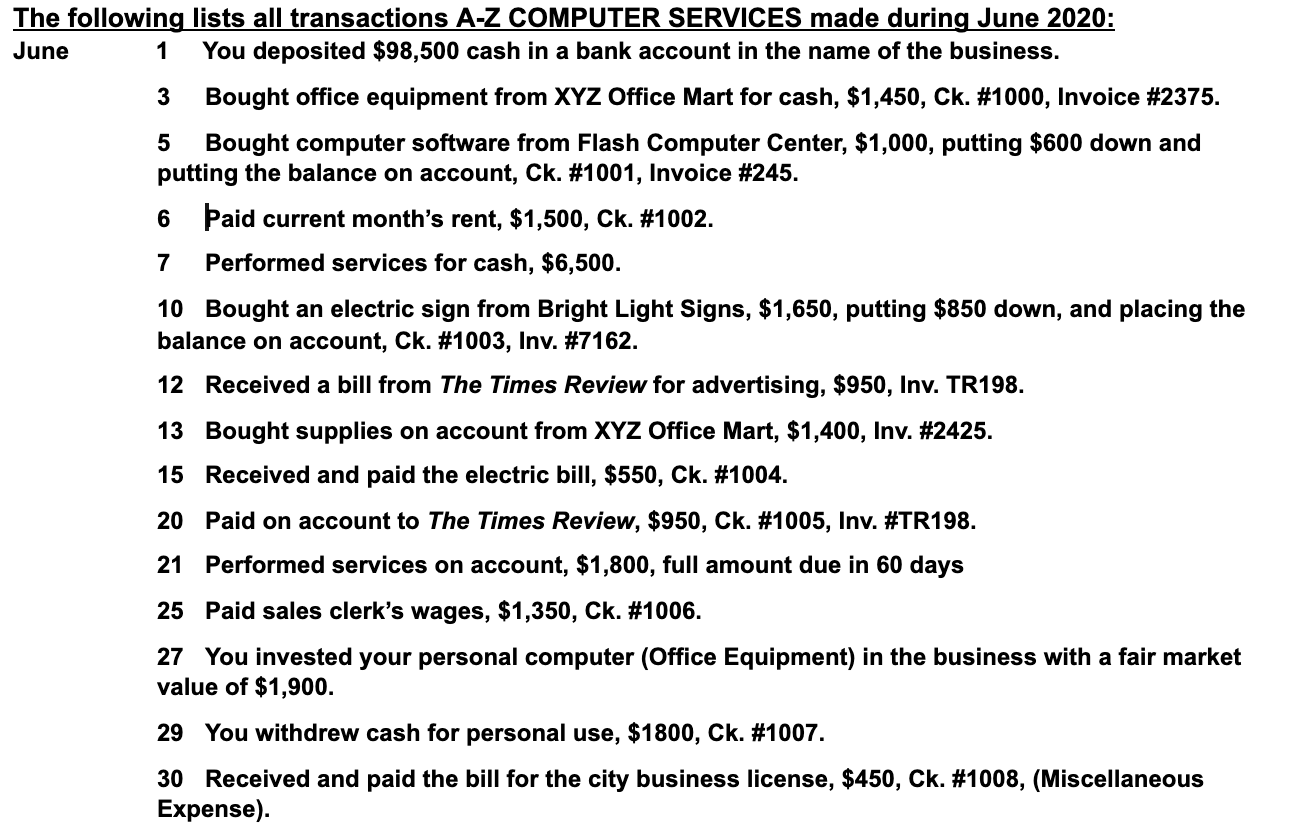

The following lists all transactions A-Z COMPUTER SERVICES made during June 2020: June 1 You deposited $98,500 cash in a bank account in the name of the business. 3 Bought office equipment from XYZ Office Mart for cash, $1,450, Ck. #1000, Invoice #2375. 5 Bought computer software from Flash Computer Center, $1,000, putting $600 down and putting the balance on account, Ck. #1001, Invoice #245. 6 aid current month's rent, $1,500, Ck. #1002. 7 Performed services for cash, $6,500. 10 Bought an electric sign from Bright Light Signs, $1,650, putting $850 down, and placing the balance on account, Ck. #1003, Inv. #7162. 12 Received a bill from The Times Review for advertising, $950, Inv. TR198. 13 Bought supplies on account from XYZ Office Mart, $1,400, Inv. #2425. 15 Received and paid the electric bill, $550, Ck. #1004. 20 Paid on account to The Times Review, $950, Ck. #1005, Inv. #TR198. 21 Performed services on account, $1,800, full amount due in 60 days 25 Paid sales clerk's wages, $1,350, Ck. #1006. 27 You invested your personal computer (Office Equipment) in the business with a fair market value of $1,900. 29 You withdrew cash for personal use, $1800, Ck. #1007. 30 Received and paid the bill for the city business license, $450, Ck. #1008, (Miscellaneous Expense). PAGE JI - GENERAL JOURNAL Date of Transaction Post- Account Title (Include Brief Transaction Explanation Reference # DEBIT (Dr.) CREDIT (Cr.) Description) 2020 (PR) Month Day June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June PAGE J2 - GENERAL JOURNAL Date of Transaction Account Title (Include Brief Transaction Explanation Reference DEBIT (Dr.) Post- Description) (PRN) 2020 CREDIT (Cr.) Month Day June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June June

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts