Question: Please complete the journal entries for the below activities. 1-14. Please complete a statement of revenue , expenditures, and changes in fund balance for the

Please complete the journal entries for the below activities. 1-14. Please complete a statement of revenue , expenditures, and changes in fund balance for the year 2020. Please also complete a balance sheet at year-end.

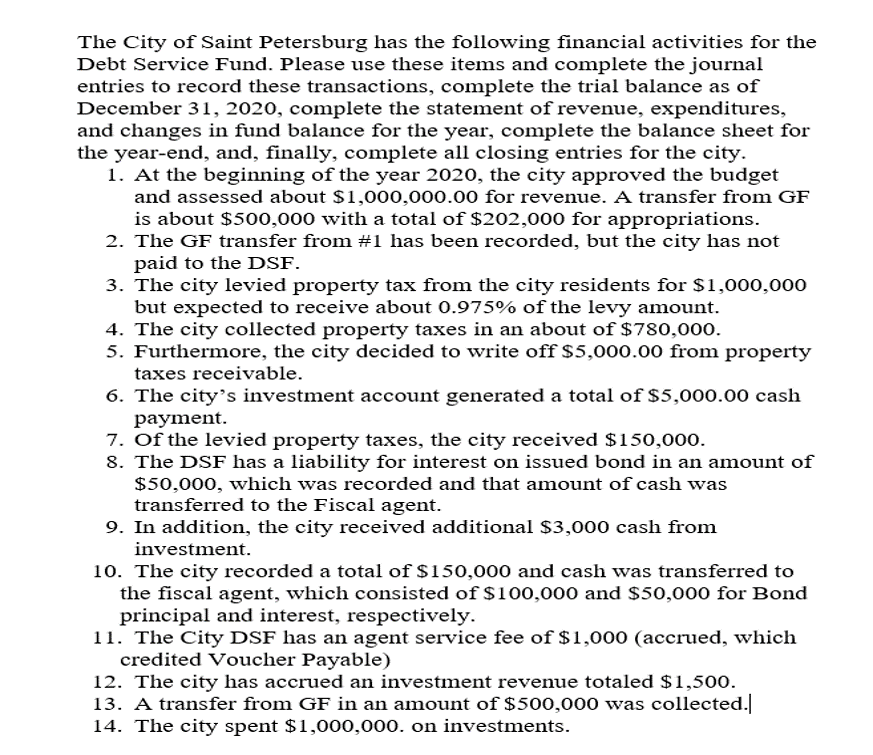

The City of Saint Petersburg has the following financial activities for the Debt Service Fund. Please use these items and complete the journal entries to record these transactions, complete the trial balance as of December 31, 2020, complete the statement of revenue, expenditures, and changes in fund balance for the year, complete the balance sheet for the year-end, and, finally, complete all closing entries for the city. 1. At the beginning of the year 2020, the city approved the budget and assessed about $1,000,000.00 for revenue. A transfer from GF is about $500,000 with a total of $202,000 for appropriations. 2. The GF transfer from #1 has been recorded, but the city has not paid to the DSF. 3. The city levied property tax from the city residents for $1,000,000 but expected to receive about 0.975% of the levy amount. 4. The city collected property taxes in an about of $780,000. 5. Furthermore, the city decided to write off $5,000.00 from property taxes receivable. 6. The city's investment account generated a total of $5,000.00 cash payment. 7. Of the levied property taxes, the city received $150,000. 8. The DSF has a liability for interest on issued bond in an amount of $50,000, which was recorded and that amount of cash was transferred to the Fiscal agent. 9. In addition, the city received additional $3,000 cash from investment. 10. The city recorded a total of $150,000 and cash was transferred to the fiscal agent, which consisted of $100,000 and $50,000 for Bond principal and interest, respectively. 11. The City DSF has an agent service fee of $1,000 (accrued, which credited Voucher Payable) 12. The city has accrued an investment revenue totaled $1,500. 13. A transfer from GF in an amount of $500,000 was collected.| 14. The city spent $1,000,000. on investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts