Question: please complete the journal entry sheet Exercise 8-9 (Static) Record payroll (LO8-3) Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for

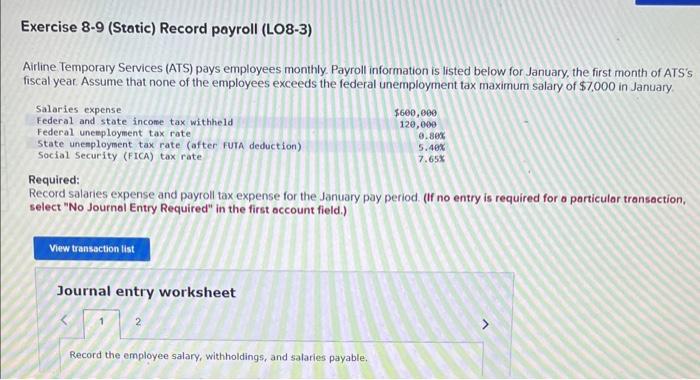

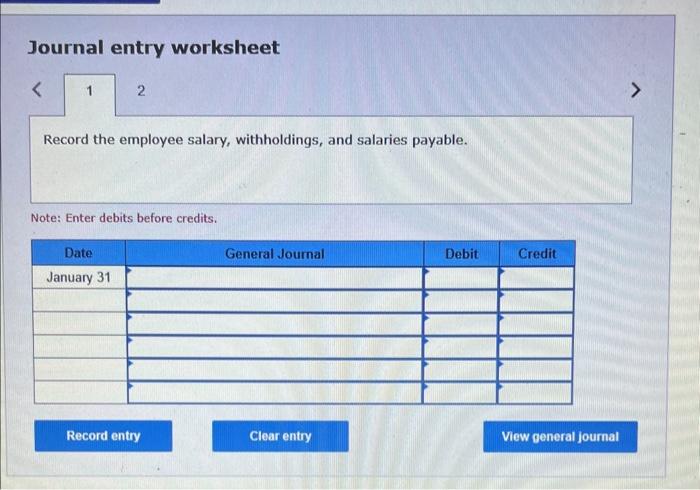

Exercise 8-9 (Static) Record payroll (LO8-3) Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS's fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for o particular transaction, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the employee salary, withholdings, and salaries payable. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts