Question: Please Complete the prompts given, I will give thumbs up! For each separate case below, follow the three-step process for adjusting the Supplies asset account

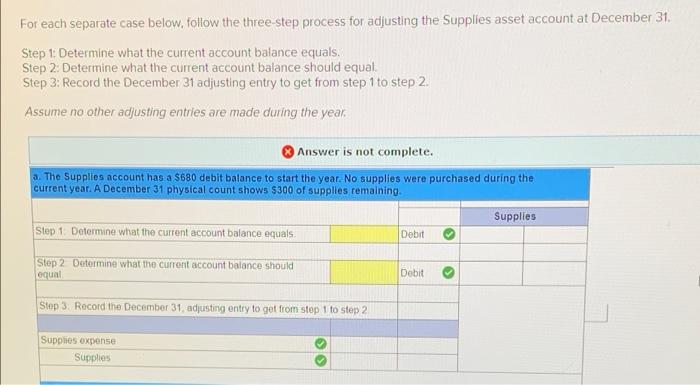

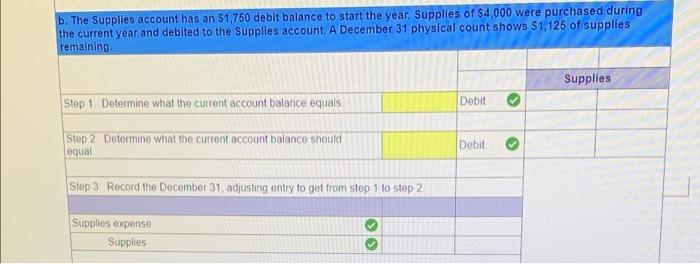

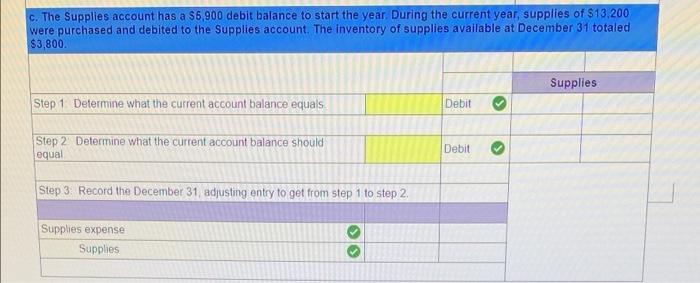

For each separate case below, follow the three-step process for adjusting the Supplies asset account at December 31 Step 1: Determine what the current account balance equals. Step 2. Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. Answer is not complete. 3. The Supplies account has a $680 debit balance to start the year. No supplies were purchased during the current year. A December 31 physical count shows $300 of supplies remaining. Supplies Step 1 Determine what the current account balance equals Debit Step 2 Determine what the current account balance should equal Debit Step 3. Record the December 31, adjusting entry to get from step 1 to step 2 Supplies expense Supplies b. The Supplies account has an $1,750 debit balance to start the year. Supplies of S4,000 were purchased during the current year and debited to the Supplies account. A December 31 physical count shows $1,126 of supplies remaining Supplies > Step 1 Determine what the current account balance equals Debit Stop 2 Determine what the current account balance should equal Debit > Stop 3 Record the December 31, adjusting entry to get from step 1 to step 2. Supplies expense Supplies c. The Supplies account has a $6,900 debit balance to start the year. During the current year, supplies of $13,200 were purchased and debited to the Supplies account. The inventory of supplies available at December 31 totaled $3,800 Supplies Step 1 Determine what the current account balance equals Debit Step 2 Determine what the current account balance should equal Debit > Step 3 Record the December 31 adjusting entry to get from step 1 to step 2 Supplies expense Supplies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts