Question: Please complete the question and explain work. Problem FORW-35A Assume that LRI712 There exists an active market for standard forward contracts on XYZ stock with

Please complete the question and explain work.

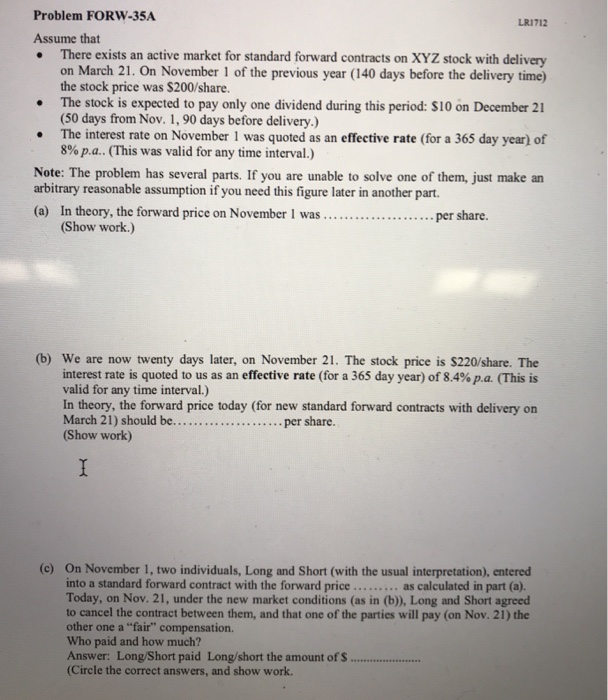

Problem FORW-35A Assume that LRI712 There exists an active market for standard forward contracts on XYZ stock with delivery on March 21. On November 1 of the previous year (140 days before the delivery time the stock price was $200/share. The stock is expected to pay only one dividend during this period: $10 on December 21 (50 days from Nov. 1, 90 days before delivery.) The interest rate on November 1 was quoted as an effective rate (for a 365 day year) of 8% pa.. (This was valid for any time interval.) Note: The problem has several parts. If you are unable to solve one of them, just make an arbitrary reasonable assumption if you need this figure later in another part (a) In theory, the forward price on November 1 was.................. per share. (Show work.) (b) We are now twenty days later, on November 21. The stock price is $220/share. The interest rate is quoted to us as an effective rate (for a 365 day year) of 8.4%pa (This is valid for any time interval.) In theory, the forward price today (for new standard forward contracts with delivery on (Show work) On November 1, two individuals, Long and Short (with the usual interpretation), entered into a standard forward contract with the forward price as calculated in part (a) Today, on Nov. 21, under the new market conditions (as in (b)), Long and Short agreed to cancel the contract between them, and that one of the parties will pay (on Nov. 21) the other one a "fair" compensation. Who paid and how much? Answer: Long/Short paid Long/short the amount of s... (Circle the correct answers, and show work. (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts