Question: please complete the question It is long but It all goes together! Each tab needs to be complete. Church Company completes these transactions and events

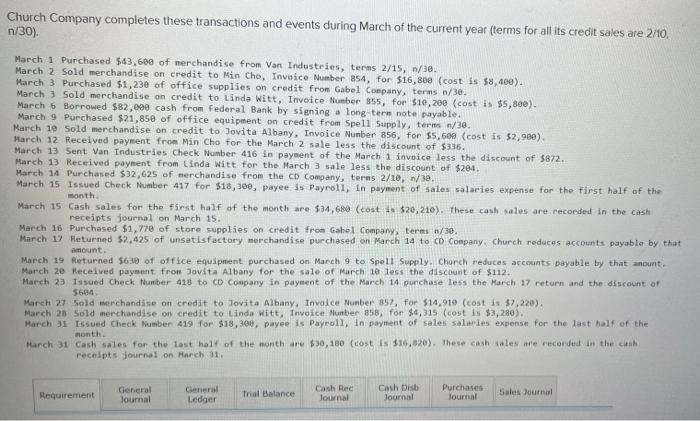

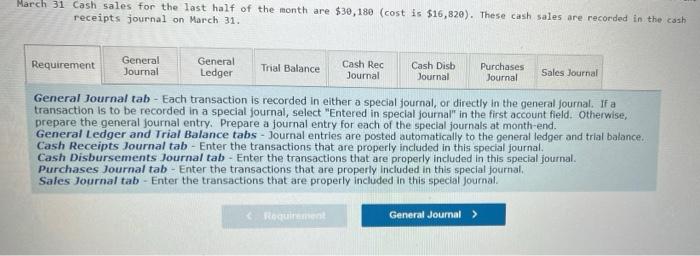

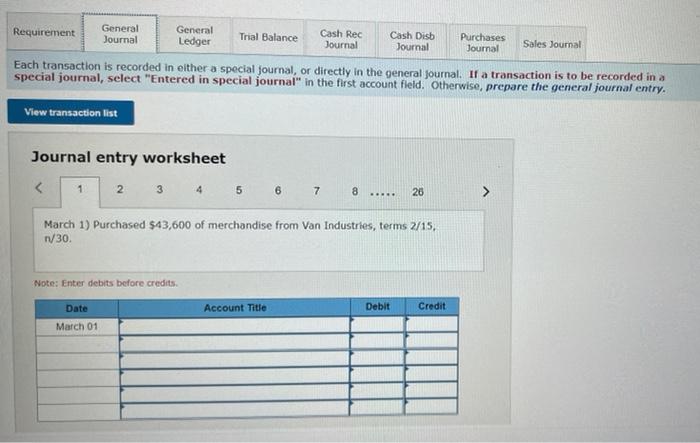

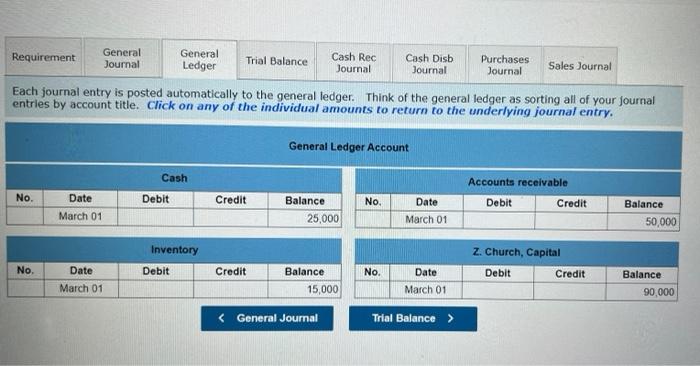

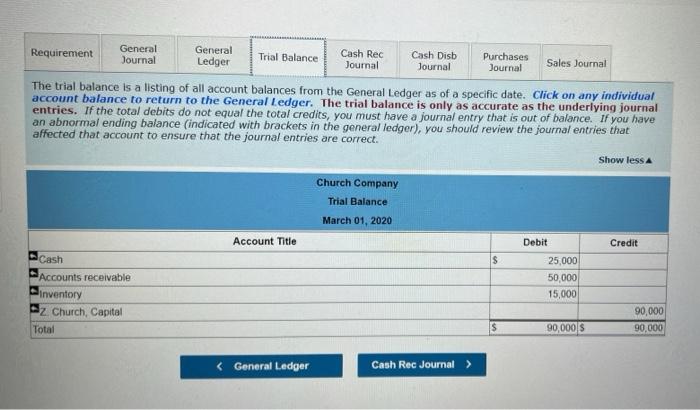

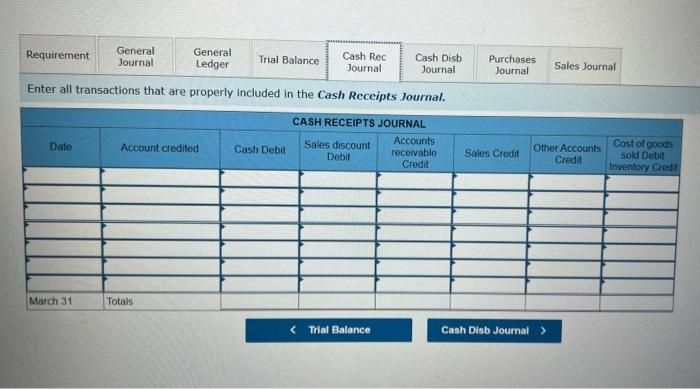

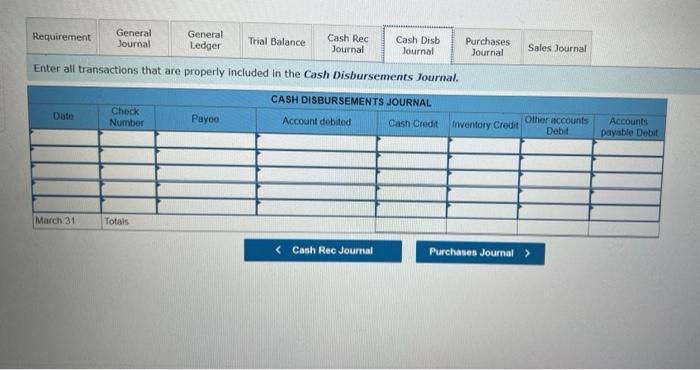

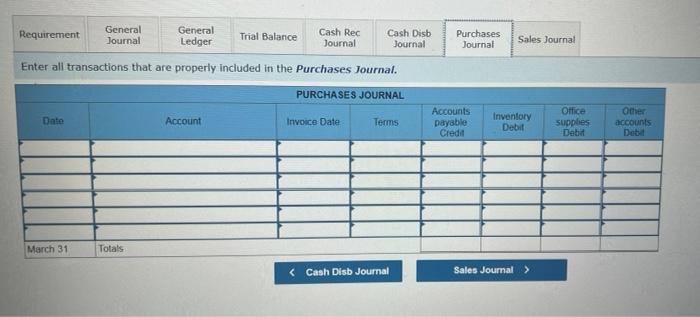

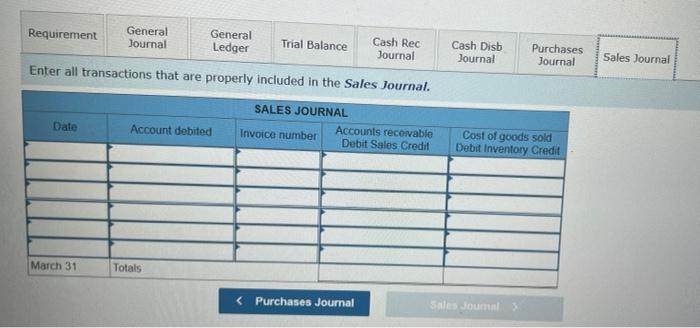

Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). March 1 Purchased $43,600 of merchandise from Van Industries, teras 2/15, 1/30. March 2 Sold merchandise on credit to Min Cho, Invoice Number 854, for $16,800 (cost is $8,400). March 3 Purchased $1,230 of office supplies on credit from Gabel Company, terms w/30. March 3 Sold merchandise on credit to Linda Witt, Invoice Number 355, for $10,200 (cost is $5,800). March 6 Borrowed $82,000 cash from Federal Bank by signing a long-term note payable. March 9 Purchased $21,85e of office equipment on credit from Spell Supply, term /30. March 19 Sold merchandise on credit to Jovita Albany, Invoice Number 856) for $5,600 (cost is 52,980) March 12 Received payment from Man Cho for the March 2 sale less the discount of $336. March 13 Sent Van Industries Check Number 416 in payment of the March 1 invoice less the discount of $872. March 13 Received payment from Linda Witt for the March 3 sale less the discount of $204. March 14 Purchased $32,625 of merchandise from the CD Company, terns 2/10, 1/30. March 15 Issued Check Number 417 for $18,300, payee Is Payroll, in payment of sales salaries expense for the first half of the month March 15 Cash sales for the first half of the month are $34,680 (cost $20, 210). These cash sales are recorded in the cash receipts journal on March 15. March 16 Purchased $1,770 of store supplies on credit from Gabel Company, teri 1/30. March 12 Returned $2,425 of unsatisfactory merchandise purchased on March 14 to CD Company Church reduces accounts payable by that amount. March 19 Returned 5630 of office equipment purchased on March 9 to Spell Supply. Chorch reduces accounts payable by that anount. March 20 Received payment from Jovita Albany for the sale of March 1e less the discount of $112. March 23 Issued Check Number 418 to co Company in payment of the March 14 purchase less the March 17 return and the discount of 5664 March 27 Sold merchandise on credit to Jovita Albany, Invoice Number 85%, for $14,910 (cost is $2,220). March 25 Sold merchandise on credit to Linda Witt, Invoice Number 858, for $4,315 (cost is $3,280). March 31 Issued Check Number 419 for $18,300, payee is Payroll, in payment of sales salaries expense for the last half of the month March 31 Cash sales for the last half of the month are $30,180 (cost is $16,320). These cash sales are recorded in the cash receipts Journal on March 31. Requirement General Journal General Ledger Trial Balance Cash Red Journal Cash Disb Journal Purchases Tournal Sales Journal March 31 Cash sales for the last half of the month are $30, 180 (cost is $16,820). These cash sales are recorded in the cash receipts journal on March 31. Requirement General General Trial Balance Cash Rec Cash Disb Purchases Journal Ledger Sales Journal Journal Journal Journal General Journal tab - Each transaction is recorded in either a special Journal, or directly in the general Journal. If a transaction is to be recorded in a special journal, select "Entered in special journal" in the first account field. Otherwise, prepare the general journal entry. Prepare a journal entry for each of the special journals at month-end. General Ledger and Trial Balance tabs - Journal entries are posted automatically to the general ledger and trial balance Cash Receipts Journal tab - Enter the transactions that are properly included in this special Journal. Cash Disbursements Journal tab - Enter the transactions that are properly included in this special journal. Purchases Journal tab - Enter the transactions that are properly included in this special journal. Sales Journal tab - Enter the transactions that are properly included in this special Journal Requirement General Journal General Ledger Trial Balance Cash Rec Journal Cash Disb Journal Purchases Journal Sales Journal Each transaction is recorded in either a special Journal, or directly in the general journal. If a transaction is to be recorded in a special journal, select "Entered in special journal" in the first account field. Otherwise, prepare the general journal entry. View transaction list Journal entry worksheet Requirement General Journal General Ledger Trial Balance Cash Rec Journal Cash Disb Journal Purchases Journal Sales Journal The trial balance is a listing of all account balances from the General Ledger as of a specific date. Click on any individual account balance to return to the General Ledger. The trial balance is only as accurate as the underlying journal entries. If the total debits do not equal the total credits, you must have a journal entry that is out of balance. If you have an abnormal ending balance indicated with brackets in the general ledger), you should review the journal entries that affected that account to ensure that the journal entries are correct. Show less Church Company Trial Balance March 01, 2020 Account Title Credit $ Cash Accounts receivable inventory z Church, Capital Total Debit 25,000 50,000 15,000 90,000 90,000 $ 90,000 $ Requirement General Journal General Ledger Trial Balance Cash Rec Journal Cash Disb Journal Purchases Journal Sales Journal Enter all transactions that are properly included in the Cash Receipts Journal. CASH RECEIPTS JOURNAL Sales discount Accounts Date Account credited Cash Debit receivabla Debit Credit Sales Credit Cost of goods Other Accounts sold Debit Credit Inventory Credit March 31 Totals Requirement General Journal General Ledger Trial Balance Cash Rec Journal Cash Disb Journal Purchases Journal Sales Journal Enter all transactions that are properly included in the Cash Disbursements Journal. Check Number CASH DISBURSEMENTS JOURNAL Other accounts Account dobited Cash Credit Inventory Credit Debit Puyo Accounts payable Debit March 31 Totals Requirement General Journal General Ledger Trial Balance Cash Rec Journal Cash Disb Journal Purchases Journal Sales Journal Enter all transactions that are properly included in the Purchases Journal. PURCHASES JOURNAL Date Account Invoice Date Terms Accounts payable Credit Inventory Debit Office supplies Debit Other accounts Debel March 31 Totals Cash Disb Journal Sales Journal > Requirement General Journal General Ledger Trial Balance Cash Rec Journal Cash Disb Journal Purchases Journal Sales Journal Enter all transactions that are properly included in the Sales Journal. Date Account debited SALES JOURNAL Accounts receivable Invoice number Debit Sales Credit Cost of goods sold Debit Inventory Credit March 31 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts