Question: Please complete the question posted below *There is no need to refer to Figure 24.11 as part a) has already been answered providing the only

Please complete the question posted below

*There is no need to refer to Figure 24.11 as part a) has already been answered providing the only necessary information to complete the question, Thank you.*

***It is 1000 barrels of oil per contract, and they purchase only 1 contract as stated in the question for clarification***

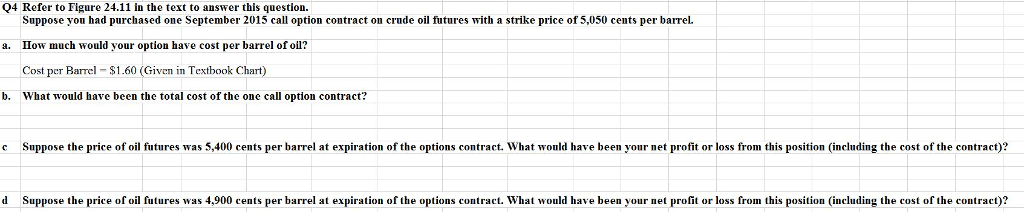

Q4 Refer to Figure 24.11 in the text to answer this question Suppose you had purchased one September 2015 call option contract on crude oil futures with a strike price of 5,050 cents per barrel. a. How much would your option have cost per barrel of oil? Cost per B $1.60 (G ven in Textbook Chart b. What would have been the total cost of the one call option contract? c Smppose the price of oil futures was 5,4 cents per barrel at expiration of the option contract. What would have been your net profit or loss from this position (including the cost of the contract? d Suppose the price of oil futures was 4,900 cents per barrel a expiration of the options contract. What would have been your net profit or loss from this position (including the cost of the contract)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts