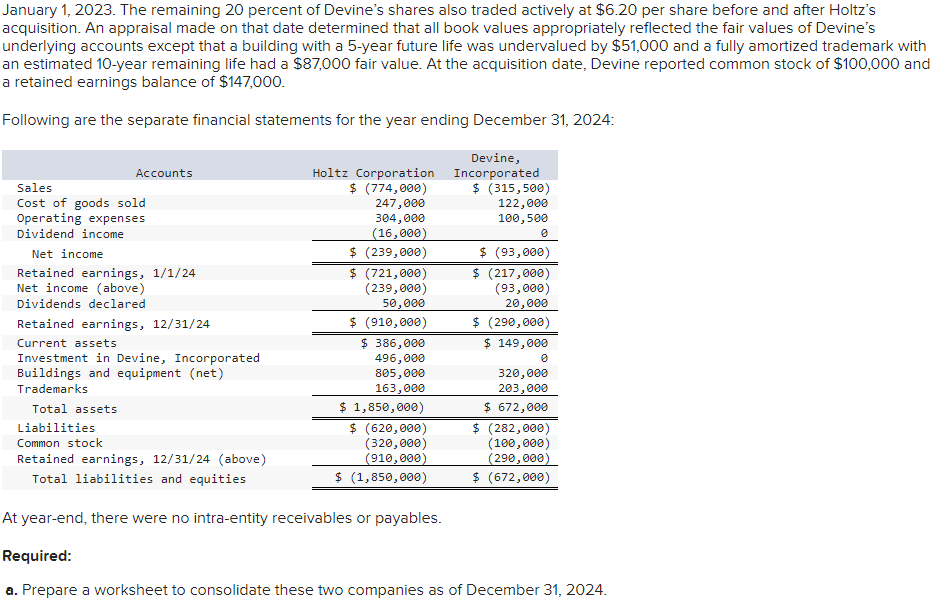

Question: Please complete the table in the picture provided. January 1 , 2 0 2 3 . The remaining 2 0 percent of Devine's shares also

Please complete the table in the picture provided. January The remaining percent of Devine's shares also traded actively at $ per share before and after Holtz's tableHOLTZ CORPORATION AND DEVINE, INCORPORATEDConsolidation WorksheetFor Year Ending December AccountstableHoltzCorporationtableDevineIncorporatedConsolidation Entries,tableNoncontrollingInteresttableConsolidatedTotalsDebitCreditSales$ $ $ Cost of goods sold,Operating expenses,Dividend income,Separate company net income,$ $ Consolidated net income,,,,,,Net income attributable to noncontrolling interest,,,,,,Net income attributable to Holtz Corporation,,,,,,Retained earnings, $$Net income,Dividends declared,Retained earnings, $ $Current assets,$ $ Investment in Devine, Incorporated,Buildings and equipment netTrademarksGoodwillTotal assets,$ $ Liabilities$ $Common stock,Retained earnings, aboveNoncontrolling interest in Devine, Noncontrolling interest in Devine, Total liabilities and equities,$$$table$

acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Devine's

underlying accounts except that a building with a year future life was undervalued by $ and a fully amortized trademark with

an estimated year remaining life had a $ fair value. At the acquisition date, Devine reported common stock of $ and

a retained earnings balance of $

Following are the separate financial statements for the year ending December :

At yearend, there were no intraentity receivables or payables.

Required:

a Prepare a worksheet to consolidate these two companies as of December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock