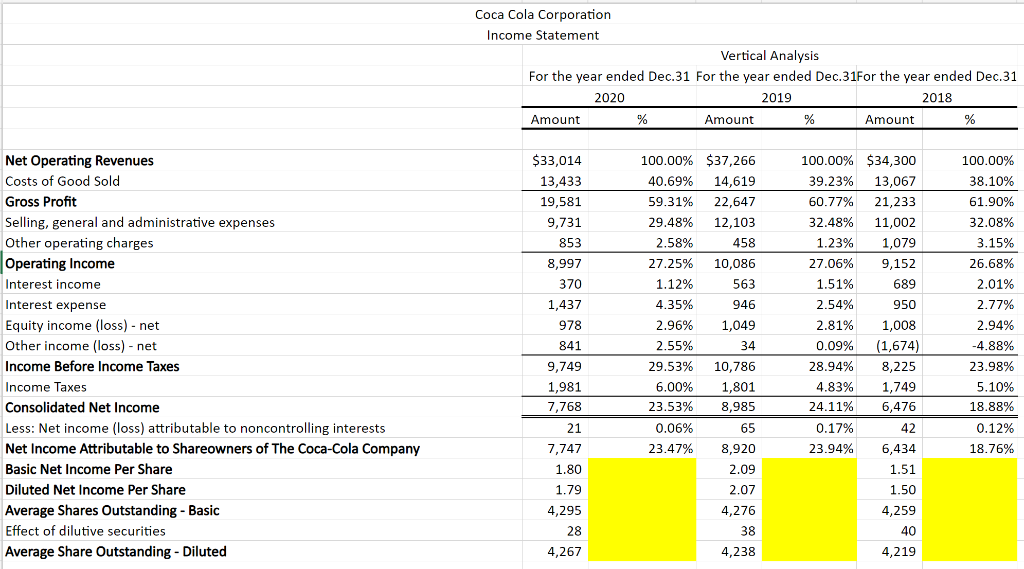

Question: Please complete the vertical analysis for the highlighted fields below and please show what math you did to arrive at that answer - thank you.

Please complete the vertical analysis for the highlighted fields below and please show what math you did to arrive at that answer - thank you.

Coca Cola Corporation Income Statement Vertical Analysis For the year ended Dec.31 For the year ended Dec.31For the year ended Dec.31 2020 2019 2018 Amount % Amount % Amount % $33,014 13,433 19,581 9,731 853 8,997 370 1,437 978 Net Operating Revenues Costs of Good Sold Gross Profit Selling, general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) - net Other income (loss) - net Income Before Income Taxes Income Taxes Consolidated Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share Diluted Net Income Per Share Average Shares Outstanding - Basic Effect of dilutive securities Average Share Outstanding - Diluted 100.00% $34,300 39.23% 13,067 60.77% 21,233 32.48% 11,002 1.23% 1,079 27.06% 9,152 1.51% 689 2.54% 950 2.81% 1,008 0.09% (1,674) 28.94% 8,225 4.83% 1,749 24.11% 6,476 0.17% 42 23.94% 6,434 1.51 1.50 4,259 841 100.00% $37,266 40.69% 14,619 59.31% 22,647 29.48% 12,103 2.58% 458 27.25% 10,086 1.12% 563 4.35% 946 2.96% 1,049 2.55% 34 29.53% 10,786 6.00% 1,801 23.53% 8,985 0.06% 65 23.47% 8,920 2.09 2.07 4,276 38 4,238 100.00% 38.10% 61.90% 32.08% 3.15% 26.68% 2.01% 2.77% 2.94% -4.88% 23.98% 5.10% 18.88% 0.12% 18.76% 9,749 1,981 7,768 21 7,747 1.80 1.79 4,295 28 40 4,267 4,219

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts