Question: please complete the worksheet On January 1, 2018, Smith Corp. issued 12,000 shares of its $1 par common stock with a fair value of $20

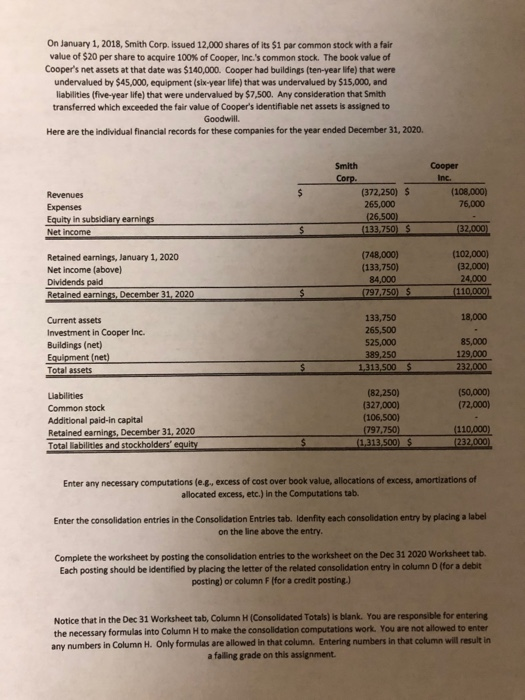

On January 1, 2018, Smith Corp. issued 12,000 shares of its $1 par common stock with a fair value of $20 per share to acquire 100% of Cooper, Inc.'s common stock. The book value of Cooper's net assets at that date was $140,000. Cooper had buildings (ten-year life) that were undervalued by $45,000, equipment (six-year life) that was undervalued by $15,000, and liabilities (five-year life) that were undervalued by $7,500. Any consideration that Smith transferred which exceeded the fair value of Cooper's identifiable net assets is assigned to Goodwill Here are the individual financial records for these companies for the year ended December 31, 2020. Smith Corp. (372,250) $ 265,000 (26,500) (133750 S Cooper Inc. (108,000) 76,000 Revenues Expenses Equity in subsidiary earnings Net Income (32.000 Retained earnings, January 1, 2020 Net Income (above) Dividends paid Retained earnings, December 31, 2020 (748,000) (133,750) 84,000 797 750) $ (102,000) (32,000) 24,000 (110,000) 18,000 Current assets Investment in Cooper Inc. Buildings (net) Equipment (net) Total assets 133,750 265,500 525,000 389,250 1.313,500 $ 85,000 129,000 232,000 (50,000) (72,000) Liabilities Common stock Additional paid-in capital Retained earnings, December 31, 2020 Total abilities and stockholders' equity (82,250) (327,000) (106,500) (797,750) (1.313.500 5 (110,000) 232.000) Enter any necessary computations (e.g.. excess of cost over book value, allocations of excess, amortizations of allocated excess, etc.) in the Computations tab. Enter the consolidation entries in the Consolidation Entries tab. Idenfity each consolidation entry by placing a label on the line above the entry. Complete the worksheet by posting the consolidation entries to the worksheet on the Dec 31 2020 Worksheet tab. Each posting should be identified by placing the letter of the related consolidation entry in column D (for a debit posting) or column Ffor a credit posting.) Notice that in the Dec 31 Worksheet tab, Column H (Consolidated Totals) is blank. You are responsible for entering the necessary formulas into Column H to make the consolidation computations work. You are not allowed to enter any numbers in Column H. Only formulas are allowed in that column. Entering numbers in that column will result in a failing grade on this assignment. On January 1, 2018, Smith Corp. issued 12,000 shares of its $1 par common stock with a fair value of $20 per share to acquire 100% of Cooper, Inc.'s common stock. The book value of Cooper's net assets at that date was $140,000. Cooper had buildings (ten-year life) that were undervalued by $45,000, equipment (six-year life) that was undervalued by $15,000, and liabilities (five-year life) that were undervalued by $7,500. Any consideration that Smith transferred which exceeded the fair value of Cooper's identifiable net assets is assigned to Goodwill Here are the individual financial records for these companies for the year ended December 31, 2020. Smith Corp. (372,250) $ 265,000 (26,500) (133750 S Cooper Inc. (108,000) 76,000 Revenues Expenses Equity in subsidiary earnings Net Income (32.000 Retained earnings, January 1, 2020 Net Income (above) Dividends paid Retained earnings, December 31, 2020 (748,000) (133,750) 84,000 797 750) $ (102,000) (32,000) 24,000 (110,000) 18,000 Current assets Investment in Cooper Inc. Buildings (net) Equipment (net) Total assets 133,750 265,500 525,000 389,250 1.313,500 $ 85,000 129,000 232,000 (50,000) (72,000) Liabilities Common stock Additional paid-in capital Retained earnings, December 31, 2020 Total abilities and stockholders' equity (82,250) (327,000) (106,500) (797,750) (1.313.500 5 (110,000) 232.000) Enter any necessary computations (e.g.. excess of cost over book value, allocations of excess, amortizations of allocated excess, etc.) in the Computations tab. Enter the consolidation entries in the Consolidation Entries tab. Idenfity each consolidation entry by placing a label on the line above the entry. Complete the worksheet by posting the consolidation entries to the worksheet on the Dec 31 2020 Worksheet tab. Each posting should be identified by placing the letter of the related consolidation entry in column D (for a debit posting) or column Ffor a credit posting.) Notice that in the Dec 31 Worksheet tab, Column H (Consolidated Totals) is blank. You are responsible for entering the necessary formulas into Column H to make the consolidation computations work. You are not allowed to enter any numbers in Column H. Only formulas are allowed in that column. Entering numbers in that column will result in a failing grade on this assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts