Question: Please complete this in Excel using MACRS depreciation rates, be sure to show any formulas you use. The final cash flows should be yr 0

Please complete this in Excel using MACRS depreciation rates, be sure to show any formulas you use. The final cash flows should be yr 0 =$1,100,000 yr 1= $765,495 yr 2 = $786,108 yr 3=$772,108 yr 4= $762,108 yr 5= $1,458,180. Do not repost Chegg Textbook solution as it is incomplete in explanation. Thank you so very much!!

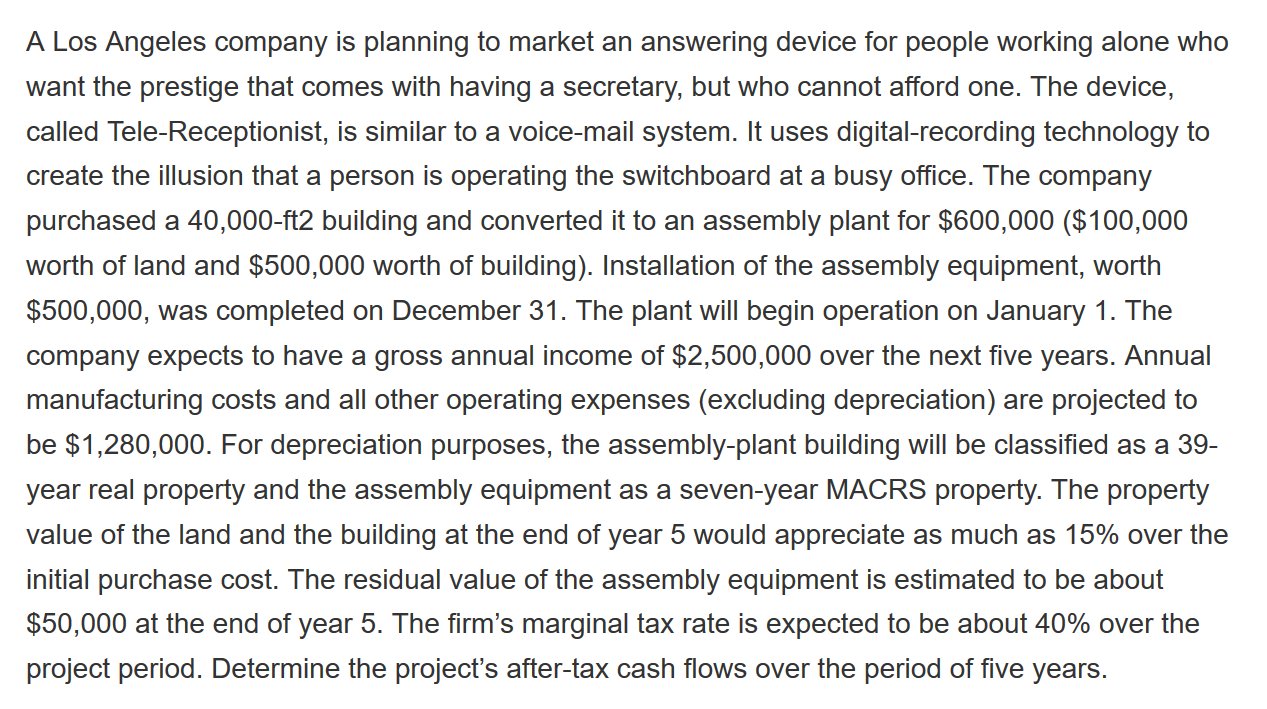

A Los Angeles company is planning to market an answering device for people working alone who want the prestige that comes with having a secretary, but who cannot afford one. The device, called Tele-Receptionist, is similar to a voice-mail system. It uses digital-recording technology to create the illusion that a person is operating the switchboard at a busy office. The company purchased a 40,000-ft2 building and converted it to an assembly plant for $600,000 ($100,000 worth of land and $500,000 worth of building). Installation of the assembly equipment, worth $500,000, was completed on December 31. The plant will begin operation on January 1. The company expects to have a gross annual income of $2,500,000 over the next five years. Annual manufacturing costs and all other operating expenses (excluding depreciation) are projected to be $1,280,000. For depreciation purposes, the assembly-plant building will be classified as a 39- year real property and the assembly equipment as a seven-year MACRS property. The property value of the land and the building at the end of year 5 would appreciate as much as 15% over the initial purchase cost. The residual value of the assembly equipment is estimated to be about $50,000 at the end of year 5. The firm's marginal tax rate is expected to be about 40% over the project period. Determine the project's after-tax cash flows over the period of five years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts