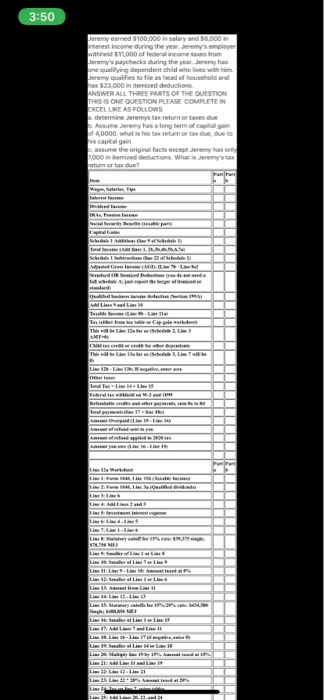

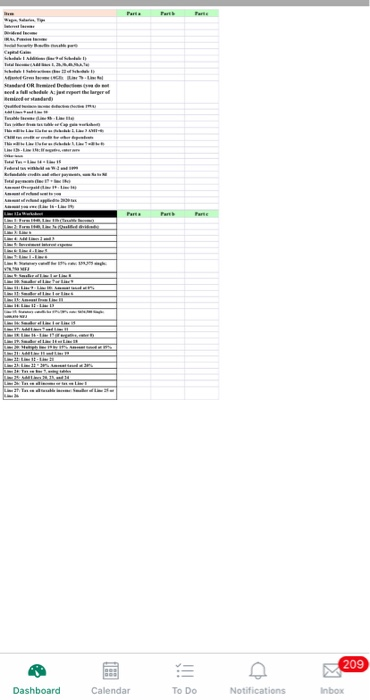

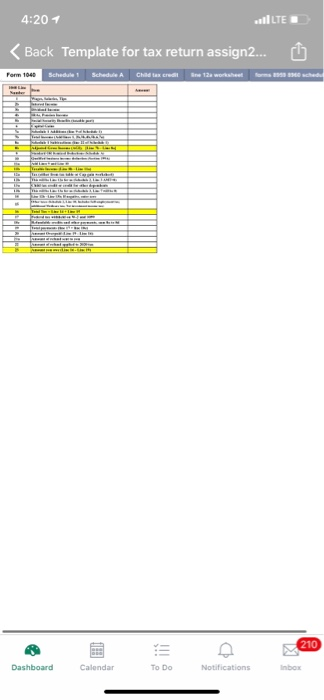

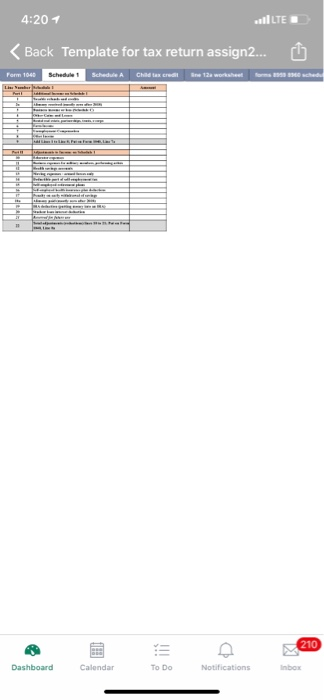

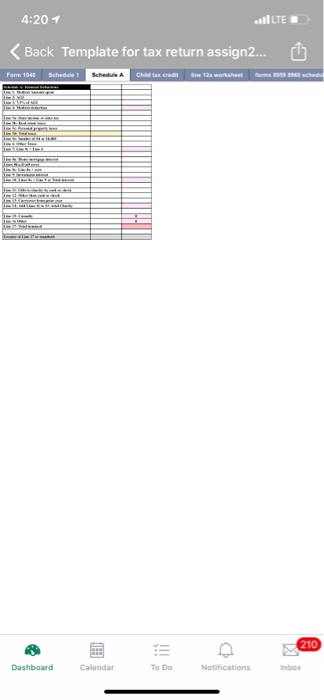

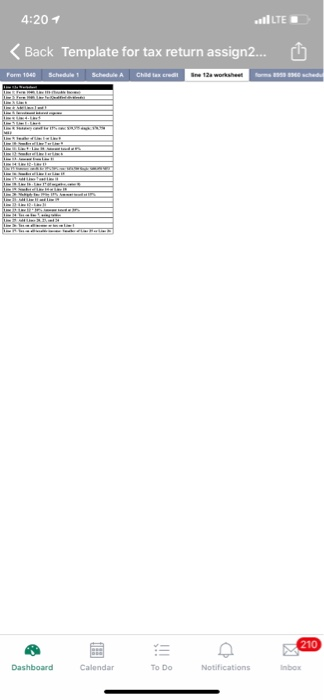

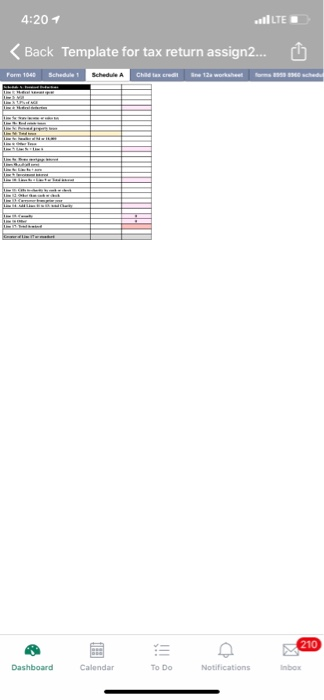

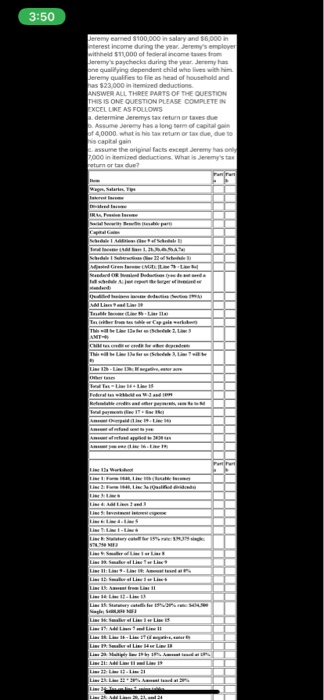

Question: please complete this in excel with the exact template below. is this clear??? 3:50 Jeremy earned 100.000 in salary and 0.000 nterest income during the

3:50 Jeremy earned 100.000 in salary and 0.000 nterest income during the year. Jeremy's employer withheld S1000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has pre qualifying dependent did who lives wim Jeremy qualifiesto file as head of household and as $23,000 in terme deductions ANSWER ALL THREE PARTS OF THE QUESTION THIS IS ONE QUESTION PLEASE COMPLETE IN PXCEL LIKE E AS FOLLOWS determine tax retu aportade, due to assume the original facts except Jeremy hason 000 in mid deductions. What is Jeremy's tax Mager, Salaries. The TRA where TELASAN Shree Shtratin e de Mjestel Gran Sanderd het daterede Jespere Die Besten edusti Set Land Tener from the Capgais ko Case Lih erus Aldi 1. 188 Add 388 Tel 01, Bosales Time: 1641. In de Red Bridade med Time Statement Le Roury color Line Sur Lot Law Les Ad Lim18 ALL Parte Cape www SandwOR Deere od fallcode A: juergeet the larger od Hemostaden Talleres . Parte Feb takda GLS . Doordar These IS 209 D Dashboard Calendar To Do Notifications Inbox 4:20 1 ullLTE1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts