Question: Tax return-problem C corporation Instructions: Please complete Tiger Catering, Inc.'s 2018 tax return based upon the information provided below. If required information is missing,

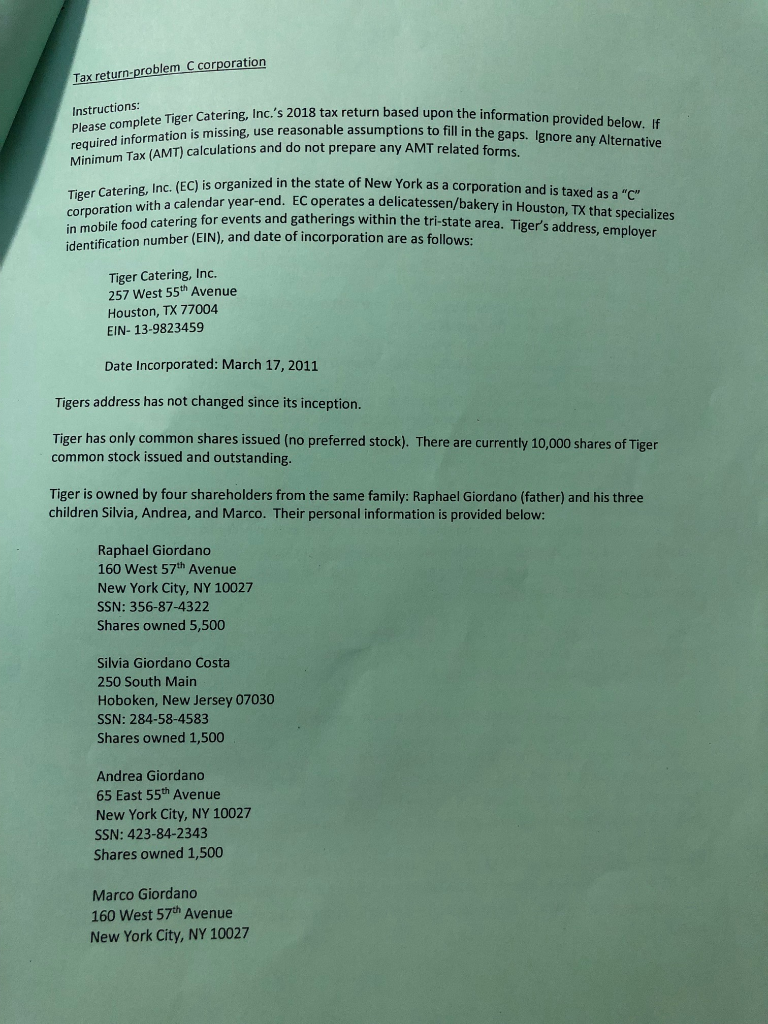

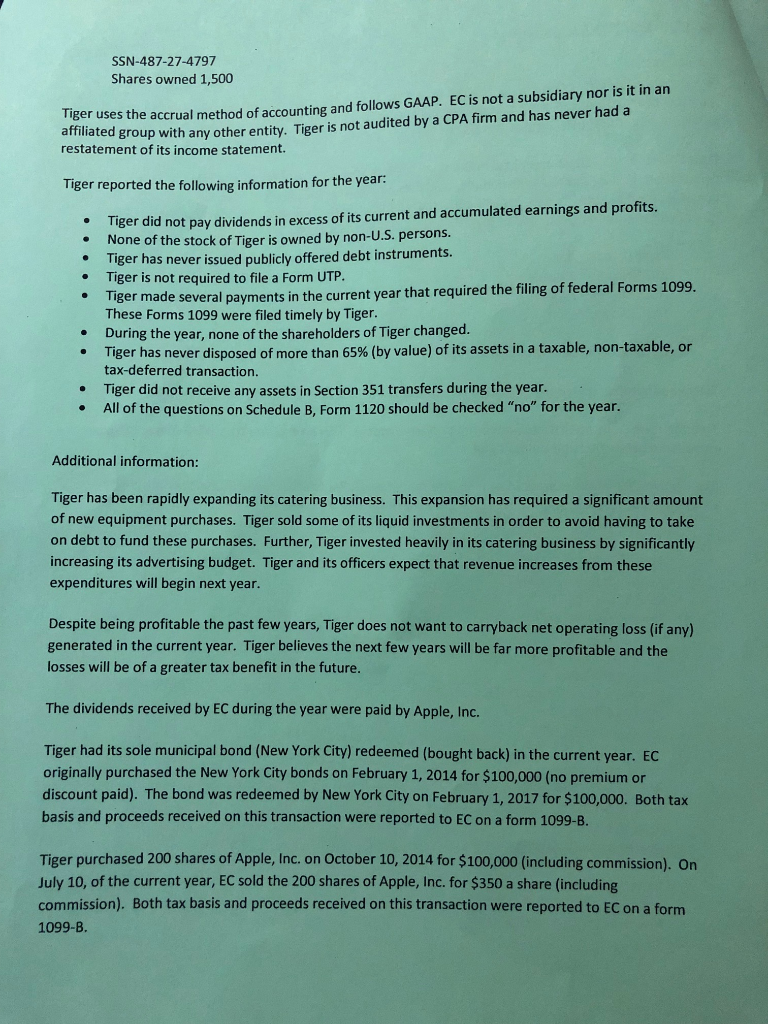

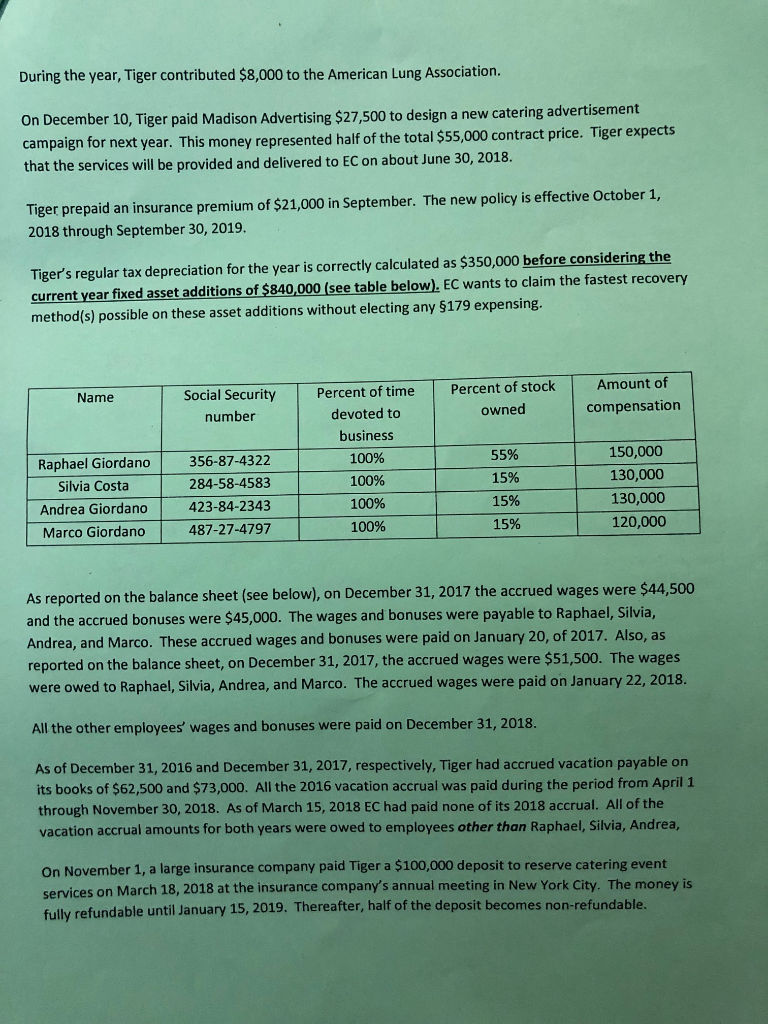

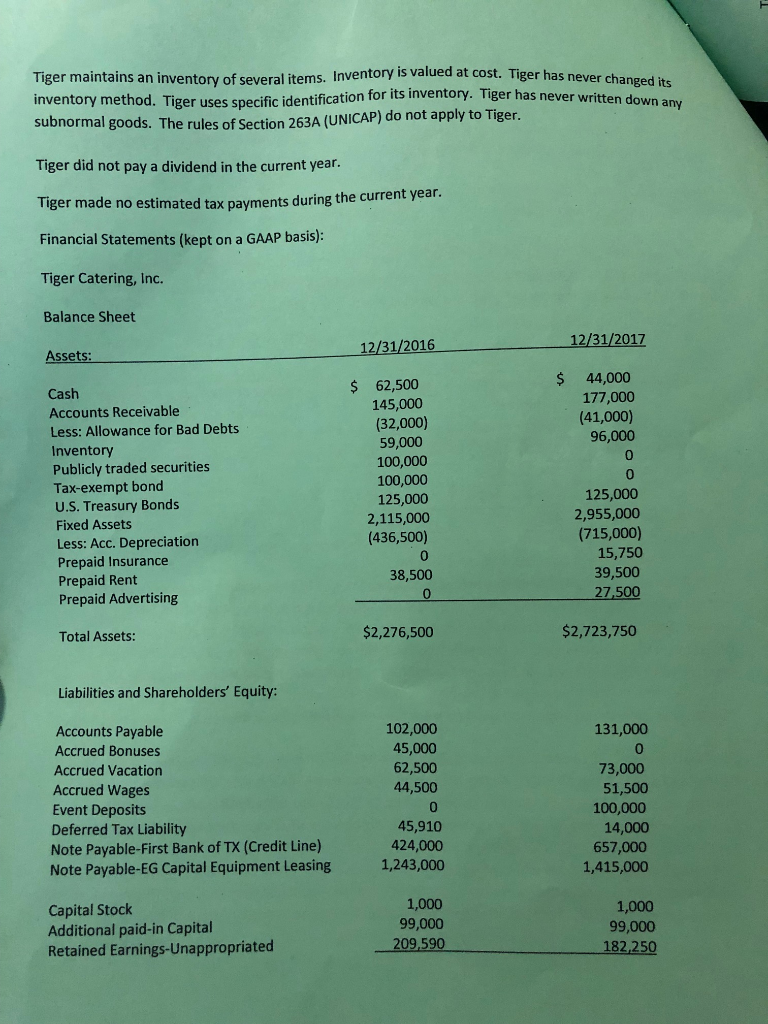

Tax return-problem C corporation Instructions: Please complete Tiger Catering, Inc.'s 2018 tax return based upon the information provided below. If required information is missing, use reasonable assumptions to fill in the gaps. Ignore any Alternative Minimum Tax (AMT) calculations and do not prepare any AMT related forms. Tiger Catering, Inc. (EC) is organized in the state of New York as a corporation and is taxed as a "C" in mobile food catering for events and gatherings within the tri-state area. Tiger's address, employer corporation with a calendar year-end. EC operates a delicatessen/bakery in Houston, TX that specializes identification number (EIN), and date of incorporation are as follows: Tiger Catering, Inc. 257 West 55th Avenue Houston, TX 77004 EIN-13-9823459 Date Incorporated: March 17, 2011 Tigers address has not changed since its inception. Tiger has only common shares issued (no preferred stock). There are currently 10,000 shares of Tiger common stock issued and outstanding. Tiger is owned by four shareholders from the same family: Raphael Giordano (father) and his three children Silvia, Andrea, and Marco. Their personal information is provided below: Raphael Giordano 160 West 57th Avenue New York City, NY 10027 SSN: 356-87-4322 Shares owned 5,500 Silvia Giordano Costa 250 South Main Hoboken, New Jersey 07030 SSN: 284-58-4583 Shares owned 1,500 Andrea Giordano 65 East 55th Avenue New York City, NY 10027 SSN: 423-84-2343 Shares owned 1,500 Marco Giordano 160 West 57th Avenue New York City, NY 10027 SSN-487-27-4797 Shares owned 1,500 Tiger uses the accrual method of accounting and follows GAAP. EC is not a subsidiary nor is it in an affiliated group with any other entity. Tiger is not audited by a CPA firm and has never had a restatement of its income statement. Tiger reported the following information for the year: . . Tiger did not pay dividends in excess of its current and accumulated earnings and profits. None of the stock of Tiger is owned by non-U.S. persons. Tiger has never issued publicly offered debt instruments. Tiger is not required to file a Form UTP. Tiger made several payments in the current year that required the filing of federal Forms 1099. These Forms 1099 were filed timely by Tiger. During the year, none of the shareholders of Tiger changed. Tiger has never disposed of more than 65% (by value) of its assets in a taxable, non-taxable, or tax-deferred transaction. Tiger did not receive any assets in Section 351 transfers during the year. All of the questions on Schedule B, Form 1120 should be checked "no" for the year. Additional information: Tiger has been rapidly expanding its catering business. This expansion has required a significant amount of new equipment purchases. Tiger sold some of its liquid investments in order to avoid having to take on debt to fund these purchases. Further, Tiger invested heavily in its catering business by significantly increasing its advertising budget. Tiger and its officers expect that revenue increases from these expenditures will begin next year. Despite being profitable the past few years, Tiger does not want to carryback net operating loss (if any) generated in the current year. Tiger believes the next few years will be far more profitable and the losses will be of a greater tax benefit in the future. The dividends received by EC during the year were paid by Apple, Inc. Tiger had its sole municipal bond (New York City) redeemed (bought back) in the current year. EC originally purchased the New York City bonds on February 1, 2014 for $100,000 (no premium or discount paid). The bond was redeemed by New York City on February 1, 2017 for $100,000. Both tax basis and proceeds received on this transaction were reported to EC on a form 1099-B. Tiger purchased 200 shares of Apple, Inc. on October 10, 2014 for $100,000 (including commission). On July 10, of the current year, EC sold the 200 shares of Apple, Inc. for $350 a share (including commission). Both tax basis and proceeds received on this transaction were reported to EC on a form 1099-B. During the year, Tiger contributed $8,000 to the American Lung Association. On December 10, Tiger paid Madison Advertising $27,500 to design a new catering advertisement campaign for next year. This money represented half of the total $55,000 contract price. Tiger expects that the services will be provided and delivered to EC on about June 30, 2018. Tiger prepaid an insurance premium of $21,000 in September. The new policy is effective October 1, 2018 through September 30, 2019. Tiger's regular tax depreciation for the year is correctly calculated as $350,000 before considering the current year fixed asset additions of $840,000 (see table below). EC wants to claim the fastest recovery method(s) possible on these asset additions without electing any $179 expensing. Name Social Security number Percent of time devoted to Percent of stock owned Amount of compensation business Raphael Giordano 356-87-4322 100% 55% 150,000 Silvia Costa 284-58-4583 100% 15% 130,000 Andrea Giordano 423-84-2343 100% 15% 130,000 Marco Giordano 487-27-4797 100% 15% 120,000 As reported on the balance sheet (see below), on December 31, 2017 the accrued wages were $44,500 and the accrued bonuses were $45,000. The wages and bonuses were payable to Raphael, Silvia, Andrea, and Marco. These accrued wages and bonuses were paid on January 20, of 2017. Also, as reported on the balance sheet, on December 31, 2017, the accrued wages were $51,500. The wages were owed to Raphael, Silvia, Andrea, and Marco. The accrued wages were paid on January 22, 2018. All the other employees' wages and bonuses were paid on December 31, 2018. As of December 31, 2016 and December 31, 2017, respectively, Tiger had accrued vacation payable on its books of $62,500 and $73,000. All the 2016 vacation accrual was paid during the period from April 1 through November 30, 2018. As of March 15, 2018 EC had paid none of its 2018 accrual. All of the vacation accrual amounts for both years were owed to employees other than Raphael, Silvia, Andrea, On November 1, a large insurance company paid Tiger a $100,000 deposit to reserve catering event services on March 18, 2018 at the insurance company's annual meeting in New York City. The money is fully refundable until January 15, 2019. Thereafter, half of the deposit becomes non-refundable. Tiger maintains an inventory of several items. Inventory is valued at cost. Tiger has never changed its inventory method. Tiger uses specific identification for its inventory. Tiger has never written down any subnormal goods. The rules of Section 263A (UNICAP) do not apply to Tiger. Tiger did not pay a dividend in the current year. Tiger made no estimated tax payments during the current year. Financial Statements (kept on a GAAP basis): Tiger Catering, Inc. Balance Sheet Assets: Cash 12/31/2016 12/31/2017 $ 62,500 $ 44,000 Accounts Receivable Less: Allowance for Bad Debts Inventory Publicly traded securities 145,000 (32,000) 59,000 177,000 (41,000) 96,000 100,000 0 Tax-exempt bond 100,000 0 U.S. Treasury Bonds 125,000 125,000 Fixed Assets 2,115,000 2,955,000 Less: Acc. Depreciation (436,500) (715,000) Prepaid Insurance 0 15,750 Prepaid Rent 38,500 39,500 Prepaid Advertising 0 27,500 Total Assets: $2,276,500 $2,723,750 Liabilities and Shareholders' Equity: Accounts Payable 102,000 131,000 Accrued Bonuses 45,000 0 Accrued Vacation Accrued Wages Event Deposits 62,500 73,000 44,500 51,500 0 100,000 Deferred Tax Liability 45,910 14,000 Note Payable-First Bank of TX (Credit Line) 424,000 657,000 Note Payable-EG Capital Equipment Leasing 1,243,000 1,415,000 Capital Stock 1,000 1,000 Additional paid-in Capital 99,000 99,000 Retained Earnings-Unappropriated 209,590 182,250 Total Liabilities and Shareholders' Equity: $2,276,500 $2,723,750 000

Step by Step Solution

There are 3 Steps involved in it

To complete Tiger Catering Incs 2018 C Corporation tax return Form 1120 well follow these steps Note that detailed calculations involve assumptions ba... View full answer

Get step-by-step solutions from verified subject matter experts