Question: please complete will rate good QUESTION 3 In 2021, Sheryl is claimed as a dependent on her parent's tax return. Sheryl did not provide more

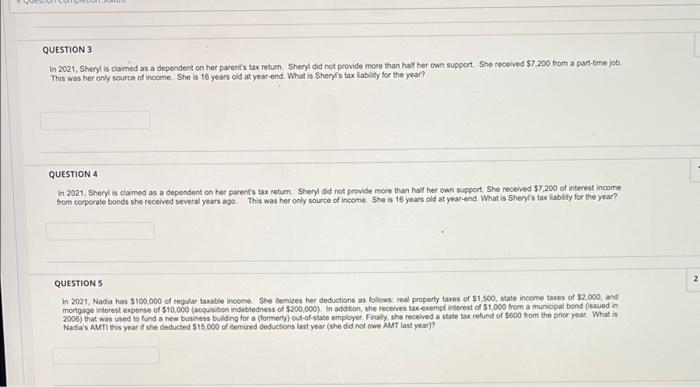

QUESTION 3 In 2021, Sheryl is claimed as a dependent on her parent's tax return. Sheryl did not provide more than half her own support She received $7.200 from a part-time job This was her only source of income. She is 16 years old at year-end. What is Shery's tax liability for the year? QUESTION 4 In 2021, Shery is claimed as a dependent on her parent's tax return Sheryl did not provide more than half her own support She received $7.200 of interest income from corporate bonds she received several years ago This was her only source of income. She is 16 years old at year-end What is Shen's tax liability for the year? 2 QUESTIONS in 2021. Nadia has $100,000 of regular baxable income Sheremes her deductions as follows real property taxes of $1.500, state income taxes of $2,000, and mortgage interest expense of $10.000 (acquiston indebtedness of $200,000). In addition, she receives tax exempt interest of $1.000 from a municipal bond (saved in 2006) that was used to find a new business building for a (formerly out of state employer. Finally, she received a state tax refund of $600 from the prior year. What is Nadia's AMTIthis year if she deducted 515,000 of itemized deductions last year (she did not owe AMT last year)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts