Question: please complete will upvote Current Attempt in Progress The reported net incomes for the first 2 years of Windsor Products, Inc., were as follows: 2025,$148,400;2026,$172,000.

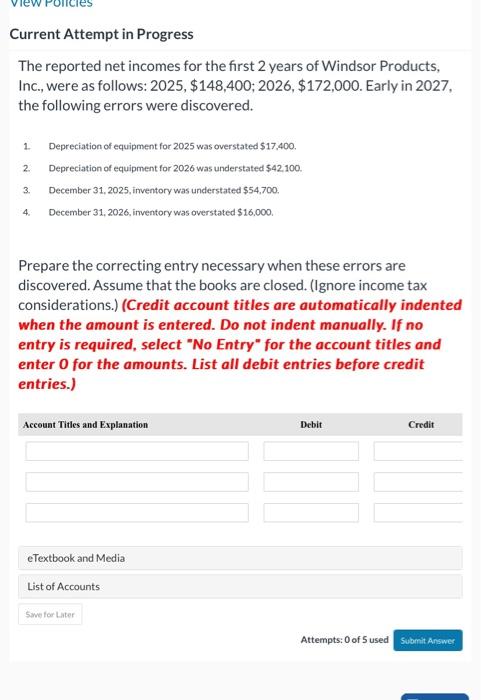

Current Attempt in Progress The reported net incomes for the first 2 years of Windsor Products, Inc., were as follows: 2025,$148,400;2026,$172,000. Early in 2027 . the following errors were discovered. 1. Depreciation of equipment for 2025 was overstated $17,400. 2. Depreciation of equipment for 2026 was understated $42100. 3. December 31,2025 , inventory was understated $54,700. 4. December 31,2026 , inventory was overstated $16,000. Prepare the correcting entry necessary when these errors are discovered. Assume that the books are closed. (Ignore income tax considerations.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts