Question: Please compute the risk aversion for Adam using the Non-Linear Programming model. Please answer within an hour. I solved it thank you please help with

Please compute the risk aversion for Adam using the Non-Linear Programming model. Please answer within an hour.

Please compute the risk aversion for Adam using the Non-Linear Programming model. Please answer within an hour.

I solved it thank you please help with the others I posted.

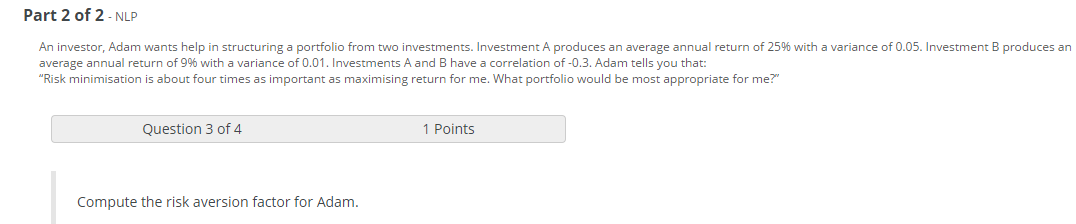

Part 2 of 2 - NLP An investor, Adam wants help in structuring a portfolio from two investments. Investment A produces an average annual return of 25% with a variance of 0.05. Investment B produces an average annual return of 9% with a variance of 0.01. Investments A and B have a correlation of -0.3. Adam tells you that: "Risk minimisation is about four times as important as maximising return for me. What portfolio would be most appropriate for me?" Question 3 of 4 1 Points Compute the risk aversion factor for Adam. Part 2 of 2 - NLP An investor, Adam wants help in structuring a portfolio from two investments. Investment A produces an average annual return of 25% with a variance of 0.05. Investment B produces an average annual return of 9% with a variance of 0.01. Investments A and B have a correlation of -0.3. Adam tells you that: "Risk minimisation is about four times as important as maximising return for me. What portfolio would be most appropriate for me?" Question 3 of 4 1 Points Compute the risk aversion factor for AdamStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts