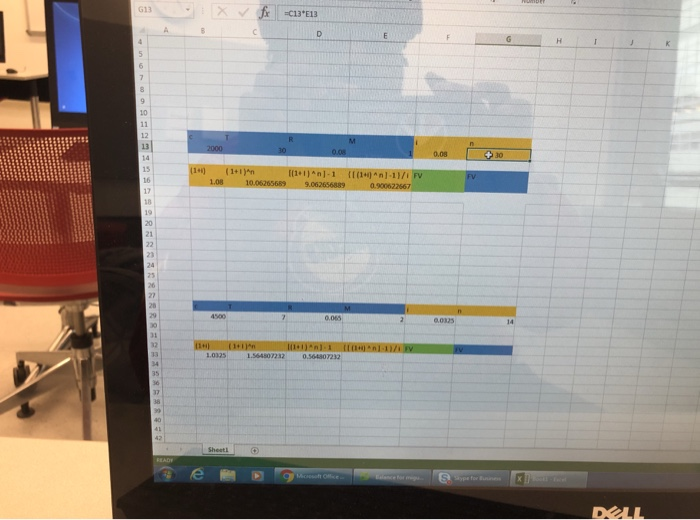

Question: Please compute using excel :) The second photo is just an example, but could you please format it like this. Thank you ! Date Assigned:

Date Assigned: Wednesday, February 20, 2019 Date Due: Friday, February 22, 2019 before class. No late homework will be accepted. Homework 8 .Please notice that all work must be shown in a professional way with attention to detail No credit will be given for incomplete or disorderly work . Please use a cover letter stating your name, course number, date due, and homework number Unstapled homework will not be collected as this is part of the assignment .All work must be individual with emphasis on numerical accuracy Any homework submitted after it is collected by the instructor is considered officially late (25% late fee) . Please use Excel to sove all problems as shown in clas 1. Exercise One: A representative from Fiterman Insurance Company offers you arn annuity that pays $2,500 at the end of each year-for the next 10 years. If the interest rate is 5.75%, using the annuity discount formula, (a) what is the fair price of this annuity today? (b) Suppose they modify the deal, and offer you an annuity that pays the same coupon, but on a semi-annual basis, what is the fair price of this instrument? Exercise Two: After winning the lottery, you are promised to receive $500,000 semi- annually for the next 30 years -should you choose your award to be paid in future installments. If you rather have the total amount disbursed in a single lump sum today-how much would this payment be? Assume that the interest rate is 4.15%. 2. Exercise Three: Suppose you want to start your own business, and you plan to invest $1,200 guarterly in an interest bearing account with an annual interest rate of 4.25%. If you plan to start your business in 10 years, how much money will you have then? 3. 4. Exercise Four: As part of your early retirement plan, and you plan to save $1,500 monthly in an interest bearing account with an annual interest rate of 4.25%. If you plan to retire in 30 years, how much money will you have then for retirement? G13 C13 E13 13 15 20 21 27 564807232 0 564807232

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts