Question: Please construct a consolidation worksheet using the information above. 252 Chapter 5 LO 5-1, 5-2,5-3,5-4,5-5, 5-7 27. Pitino acquired 90 percent of Brey's outstanding shares

Please construct a consolidation worksheet using the information above.

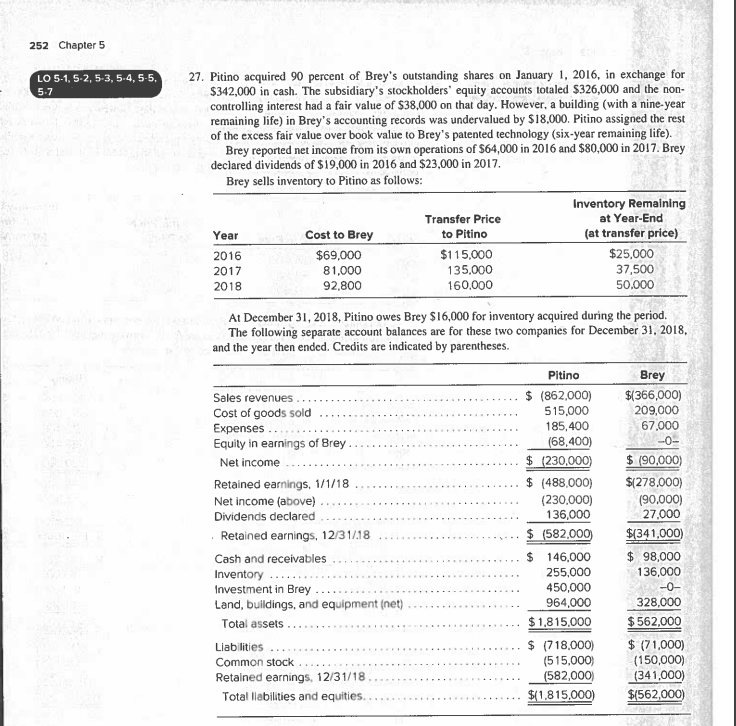

252 Chapter 5 LO 5-1, 5-2,5-3,5-4,5-5, 5-7 27. Pitino acquired 90 percent of Brey's outstanding shares on January 1, 2016, in exchange for $342,000 in cash. The subsidiary's stockholders' equity accounts totaled $326,000 and the non- controlling interest had a fair value of $38,000 on that day. However, a building (with a nine-year remaining life) in Brey's accounting records was undervalued by $18,000. Pitino assigned the rest of the excess fair value over book value to Brey's patented technology (six-year remaining life). Brey reported net income from its own operations of $64,000 in 2016 and $80,000 in 2017. Brey declared dividends of $19,000 in 2016 and $23,000 in 2017. Brey sells inventory to Pitino as follows: Inventory Remaining Transfer Price at Year-End Year Cost to Brey to Pitino (at transfer price) 2016 $69,000 $115,000 $25,000 2017 81,000 135,000 37,500 2018 92,800 160,000 50.000 At December 31, 2018, Pitino owes Brey $16,000 for inventory acquired during the period. The following separate account balances are for these two companies for December 31, 2018, and the year then ended. Credits are indicated by parentheses. Sales revenues Cost of goods sold Expenses .. Equity in earnings of Brey Net income Retained earnings, 1/1/18 Net income (above) Dividends declared Retained earnings, 12/31/18 Cash and receivables Inventory Investment in Brey Land, buildings, and equipment (net) Total assets Liabilities Common stock Retained earnings, 12/31/18 Total liabilities and equities. Pitino $ (862,000) 515,000 185,400 (68,400) $ 230,000) $ (488,000) (230,000) 136,000 $ (582,000 $ 146,000 255,000 450,000 964,000 $1,815,000 $ (718,000) (515,000) (582,000) $(1,815,000) Brey $(366,000) 209,000 67,000 -0- $ (90,000) $(278,000) (90,000) 27,000 $(341,000) $ 98,000 136,000 -0- 328,000 $562,000 $ (71,000) (150,000) (341,000) $(562,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts