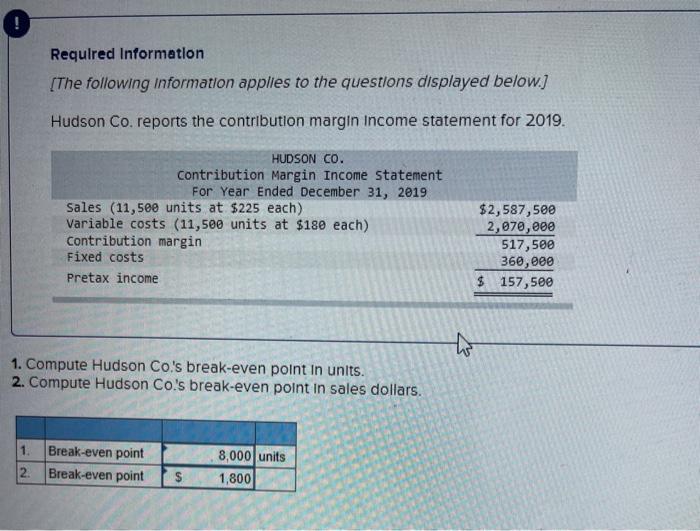

Question: please correct any mistakes and fill the empty spots Required Information [The following information applies to the questions displayed below.] Hudson Co. reports the contribution

![[The following information applies to the questions displayed below.] Hudson Co. reports](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eef26373546_65166eef2630fcb5.jpg)

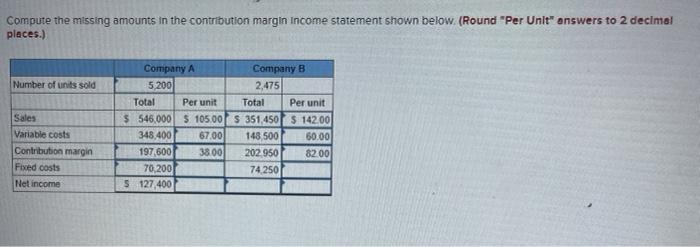

Required Information [The following information applies to the questions displayed below.] Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income statement For Year Ended December 31, 2019 Sales (11,500 units at $225 each) Variable costs (11,500 units at $180 each) Contribution margin Fixed costs Pretax income $2,587,500 2,070,000 517,500 360,000 $ 157,500 1. Compute Hudson Co.'s break-even point in units. 2. Compute Hudson Co.'s break-even point in sales dollars. 1. Break-even point 2. Break-even point 8,000 units 1,800 $ Required Information [The following information applies to the questions displayed below) Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. contribution Margin Income Statement For Year Ended Decenber 31, 2019 Sales (11,5ee units at $225 each) Variable costs (11,500 units at $180 each) Contribution margin Fixed costs Pretax income $2,587,500 2,870,000 517,500 360, eee $ 157,500 1. Assume Hudson Co. has a target pretax income of $154,000 for 2020. What amount of sales (In dollars) is needed to produce this target Income? 2. If Hudson achieves its target pretax income for 2020, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) 1. Amount of sales 2. Margin of safety Compute the missing amounts in the contribution margin Income statement shown below. (Round "Per Unit" answers to 2 decimal places.) Number of units sold Sales Variable costs Contribution margin Fixed costs Net income Company A Company B 5.200 2.475 Total Per unit Total Per unit $ 545,000 5 105.00 $ 351,450 $ 142.00 348.400 67.00 148,500 60.00 197,600 38.00 202.950 8200 70,200 74250 5 127,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts