Question: PLEASE CORRECT MY WORK TOP URGENT Return to question 4 On 3 January 20X4, Windsor Company purchased 10% of the shares of Brampton for $670,000

PLEASE CORRECT MY WORK TOP URGENT

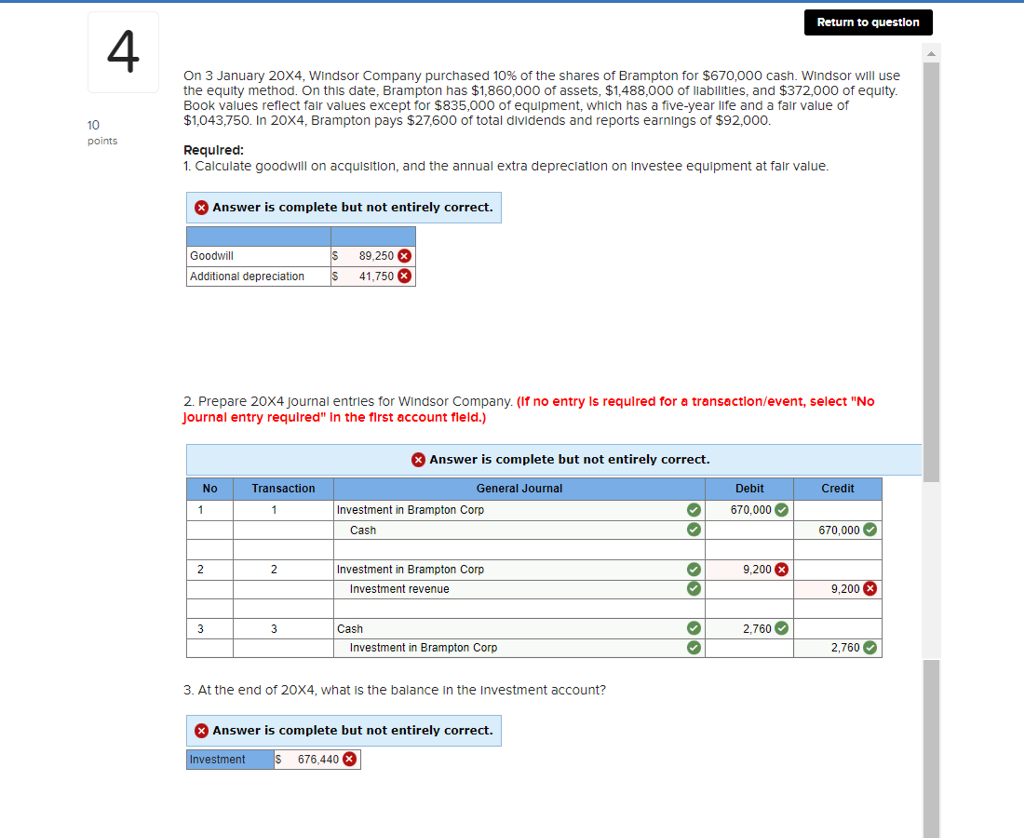

Return to question 4 On 3 January 20X4, Windsor Company purchased 10% of the shares of Brampton for $670,000 cash. Windsor will use the equity method. On this date, Brampton has $1,860,000 of assets, $1,488,000 of liabilities, and $372,000 of equity. Book values reflect fair values except for $835,000 of equipment, which has a five-year life and a fair value of $1,043,750. In 20X4, Brampton pays $27,600 of total dividends and reports earnings of $92,000. 10 points Required: 1. Calculate goodwill on acquisition, and the annual extra depreciation on investee equipment at fair value. X Answer is complete but not entirely correct. 89,250 X Goodwill Additional depreciation S 41,750 X 2. Prepare 20X4 journal entries for Windsor Company. (if no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) Answer is complete but not entirely correct. No Transaction Debit Credit 1 1 General Journal Investment in Brampton Corp Cash 670,000 670,000 Oo oo 2 2 9,200 X Investment in Brampton Corp Investment revenue 9,200 3 3 Cash Investment in Brampton Corp olol 2,760 2,760 3. At the end of 20X4, what is the balance in the Investment account? * Answer is complete but not entirely correct. Investment 676,440 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts