Question: Please correct the answers that are wrong outlined in red. Also please note that the accounts need to be corrected too. Blue Spruce Corporation is

Please correct the answers that are wrong outlined in red. Also please note that the accounts need to be corrected too.

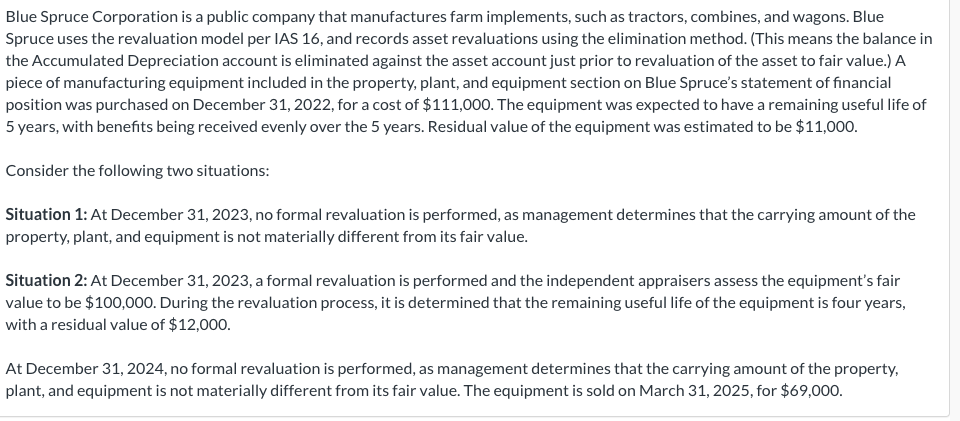

Blue Spruce Corporation is a public company that manufactures farm implements, such as tractors, combines, and wagons. Blue Spruce uses the revaluation model per IAS and records asset revaluations using the elimination method. This means the balance in the Accumulated Depreciation account is eliminated against the asset account just prior to revaluation of the asset to fair value. A piece of manufacturing equipment included in the property, plant, and equipment section on Blue Spruce's statement of financial position was purchased on December for a cost of $ The equipment was expected to have a remaining useful life of years, with benefits being received evenly over the years. Residual value of the equipment was estimated to be $

Consider the following two situations:

Situation : At December no formal revaluation is performed, as management determines that the carrying amount of the property, plant, and equipment is not materially different from its fair value.

Situation : At December a formal revaluation is performed and the independent appraisers assess the equipment's fair value to be $ During the revaluation process, it is determined that the remaining useful life of the equipment is four years, with a residual value of $

At December no formal revaluation is performed, as management determines that the carrying amount of the property, plant, and equipment is not materially different from its fair value. The equipment is sold on March for $

Assume that Blue Spruce uses the proportional method to record asset revaluations under the revaluation model. Prepare any

journal entries required under situation described above for: the fiscal year ended December ; the fiscal year

ended December ; and the disposal of the equipment on March Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for

the amounts. List all debit entries before credit entries. Do not round intermediate calculations and round answers to decimal places, eg

Account Titles and Explanation

Credit

Depreciation Expense

Accumulated Depreciation Equipment

To record depreciation on equipment

Accumulated Depreciation Equipment

Revaluation Surplus OCI

To record revaluation surplus OCl

Depreciation Expense

Accumulated Depreciation Equipment

To record depreciation on equipment

Accumulated Depreciation Equipment

To record depreciation on equipment

Accumulated Depreciation Equipment

Loss on Disposal of Equipment

To record disposal of equipment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock