Question: Please correct the cross marks cells During the year, TRC Corporation has the following inventory transactions. Date January 1 April 7 July 16 October 6

Please correct the cross marks cells

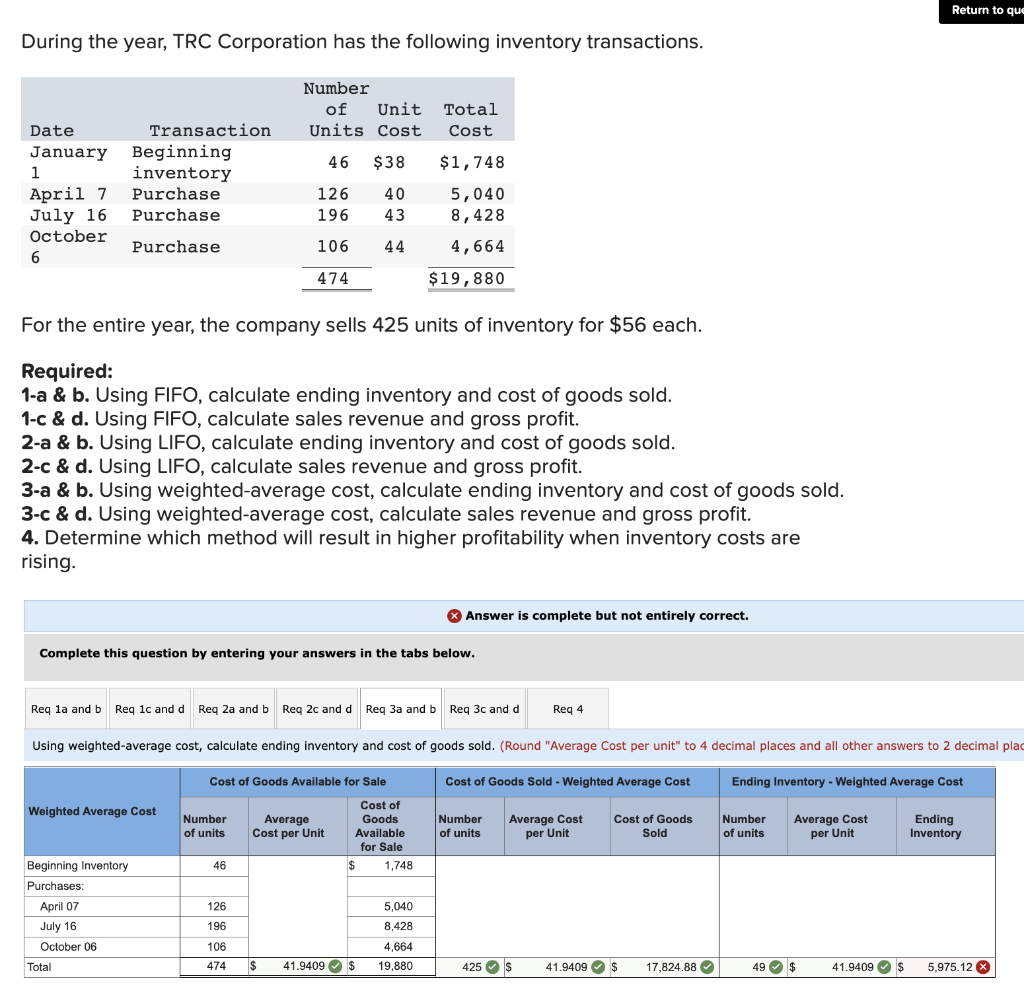

During the year, TRC Corporation has the following inventory transactions. Date January 1 April 7 July 16 October 6 Transaction Beginning inventory Purchase Purchase Purchase For the entire year, the company sells 425 units of inventory for $56 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising. Beginning Inventory Purchases: Complete this question by entering your answers in the tabs below. Weighted Average Cost April 07 July 16 October 06 Req 1a and b Req 1c and d Reg 2a and b Req 2c and d Req 3a and b Req 3c and d Total Number of Unit Total Units Cost Cost 46 $38 $1,748 5,040 8,428 4,664 $19,880 126 40 196 43 106 44 474 Using weighted-average cost, calculate ending inventory and cost of goods sold. (Round "Average Cost per unit" to 4 decimal places and all other answers to 2 decimal plac Ending Inventory - Weighted Average Cost Number of units Cost of Goods Available for Sale 46 126 196 106 474 $ Average Cost per Unit Cost of Goods Available for Sale $ 41.9409 $ X Answer is complete but not entirely correct. 1,748 5,040 8,428 4,664 19,880 Req 4 Cost of Goods Sold - Weighted Average Cost Number of units Average Cost per Unit 425 $ Cost of Goods Sold 41.9409 $ 17,824.88 Number of units Average Cost per Unit 49 $ Return to que 41.9409 $ Ending Inventory 5,975.12 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts