Question: Please correct the cross marks cells During the year, Wright Company sells 390 remote-control airplanes for $120 each. The company has the following inventory purchase

Please correct the cross marks cells

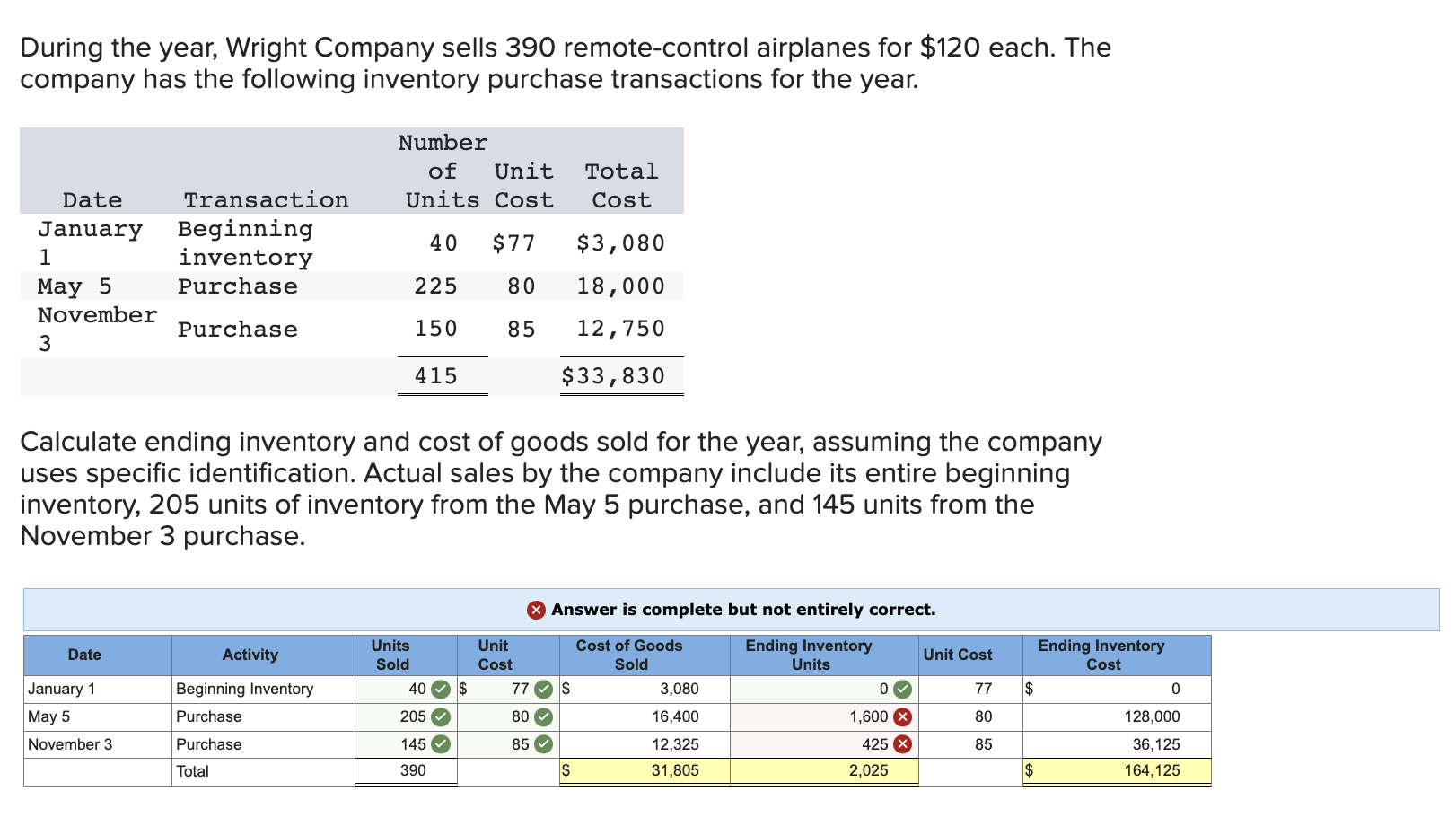

During the year, Wright Company sells 390 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Date January 1 May 5 November 3 Date Transaction Beginning inventory Purchase Purchase Calculate ending inventory and cost of goods sold for the year, assuming the company uses specific identification. Actual sales by the company include its entire beginning inventory, 205 units of inventory from the May 5 purchase, and 145 units from the November 3 purchase. January 1 May 5 November 3 Activity Number of Unit Total Units Cost Cost 40 $77 $3,080 225 80 18,000 150 85 12,750 415 $33,830 Beginning Inventory Purchase Purchase Total Units Sold 40 205 145 390 300 $ Unit Cost Answer is complete but not entirely correct. Cost of Goods Sold Ending Inventory Units 77 $ 80 85 $ 3,080 16,400 12,325 31,805 0 1,600 X 425 X 2,025 Unit Cost 77 80 85 $ $ Ending Inventory Cost 0 128,000 36,125 164, 125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts