Question: please correct the problem Brief Exercise 11-14 (Algo) Change in estimate; useful life of equipment (LO11-5) At the beginning of 2019, Robotics Inc. acquired a

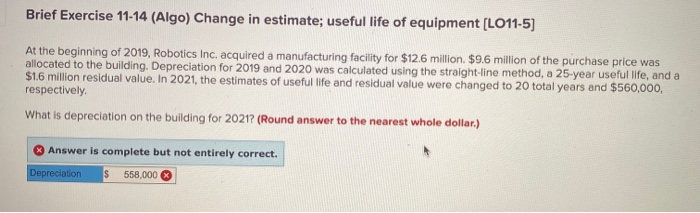

Brief Exercise 11-14 (Algo) Change in estimate; useful life of equipment (LO11-5) At the beginning of 2019, Robotics Inc. acquired a manufacturing facility for $12.6 million. $9.6 million of the purchase price was allocated to the building. Depreciation for 2019 and 2020 was calculated using the straight-line method, a 25-year useful life, and a $1.6 million residual value. In 2021, the estimates of useful life and residual value were changed to 20 total years and $560,000, respectively What is depreciation on the building for 2021? (Round answer to the nearest whole dollar.) Answer is complete but not entirely correct. Depreciation $ 558,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts