Question: Please correct the wrong answer Part I: T/F, Multiple Choice, and Computations 1. A PLAM mortgage reduces the lender's interest rate risk (relative to a

Please correct the wrong answer

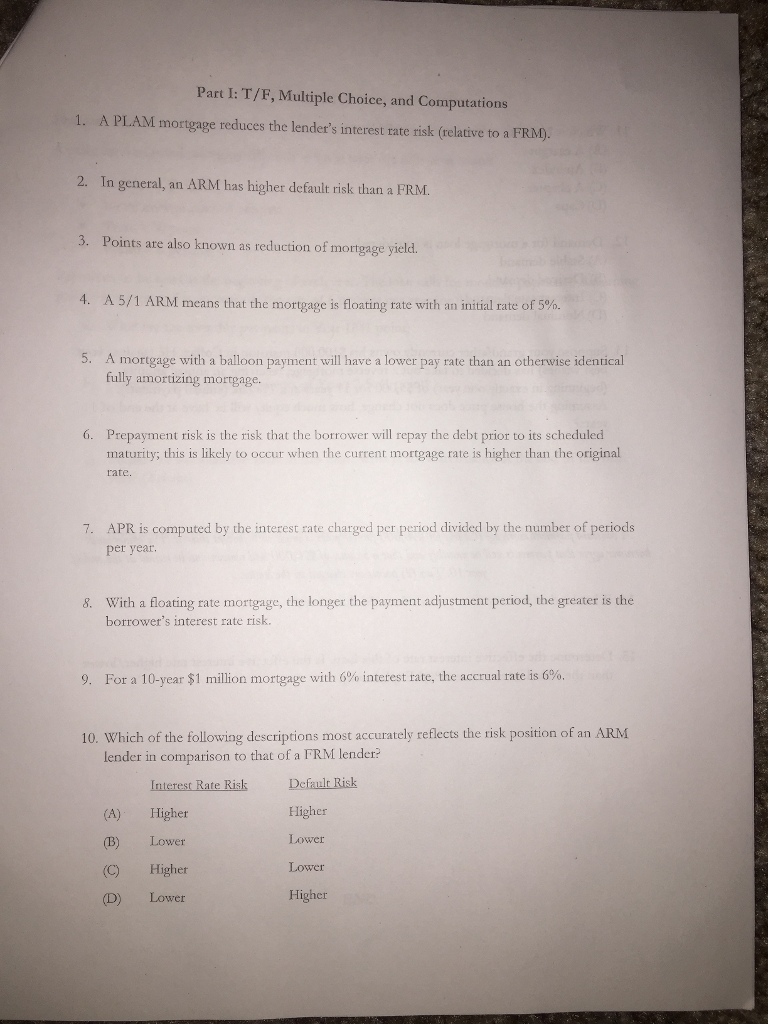

Part I: T/F, Multiple Choice, and Computations 1. A PLAM mortgage reduces the lender's interest rate risk (relative to a FRM) 2. In general, an ARM has higher default risk than a FRM 3. Points are also known as reduction of mortgage yield. 4 A 5/ 1 ARM means that the mortgage is floating rate with an initial rate of 5% 5. A mortgage with a balloon payment will have a lower pay rate than an otherwise identical fully amortizing morrgage. 6. Prepayment risk is the risk that the borrower will repay the debt prior to its scheduled maturity; this is likely to occur when the current mortgage rate is higher than the original rate. APR is computed by the interest rate charged per period divided by the number of periods per year. 7. With a floating rate mortgage, the longer the payment adjustment period, the greater is the borrower's interest rate risk. 8. 9, For a 10-year $1 million mortgage with 6% interest rate, the accrual rate is 6% 10. Which of the following descriptions most accurately reflects the risk position of an ARM lender in comparison to that of a FRM lender? Rate KiDcfait Risk (A) Higher (B) Lower (C) Higher (D) Lower Higher Lower Lower Higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts