Question: Please correct the wrong answer. Thank you very much. QUESTION 3 Partially correct Mark 0.80 out of 1.00 P Flag question Edit question Estimating Uncollectible

Please correct the wrong answer. Thank you very much.

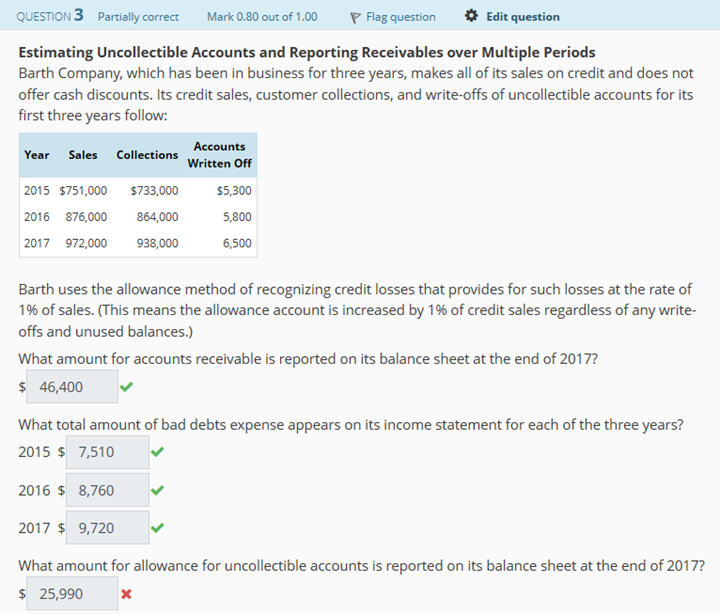

QUESTION 3 Partially correct Mark 0.80 out of 1.00 P Flag question Edit question Estimating Uncollectible Accounts and Reporting Receivables over Multiple Periods Barth Company, which has been in business for three years, makes all of its sales on credit and does not offer cash discounts. Its credit sales, customer collections, and write-offs of uncollectible accounts for its first three years follow: Accounts Year Sales Collections Written Off 2015 $71000 $733,000 $5,300 2016 876,000 864,000 5,800 2017 972,000 938,000 6,500 Barth uses the allowance method of recognizing credit losses that provides for such losses at the rate of 1% of sales. (This means the allowance account is increased by 1% of credit sales regardless of any write- offs and unused balances.) What amount for accounts receivable is reported on its balance sheet at the end of 2017? $ 46,400 What total amount of bad debts expense appears on its income statement for each of the three years? 2015 $7,510 2016 $ 8,760 2017 $ 9,720 What amount for allowance for uncollectible accounts is reported on its balance sheet at the end of 2017? $ 25,990

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts