Question: please correct this answer Problem 18-14 Beta and Leverage Estefan Industries has a new project available that requires an initial investment of $5.1 million. The

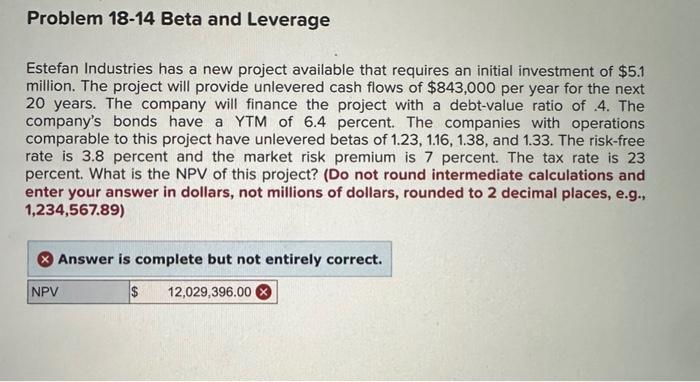

Problem 18-14 Beta and Leverage Estefan Industries has a new project available that requires an initial investment of $5.1 million. The project will provide unlevered cash flows of $843,000 per year for the next 20 years. The company will finance the project with a debt-value ratio of 4 . The company's bonds have a YTM of 6.4 percent. The companies with operations comparable to this project have unlevered betas of 1.23,1.16,1.38, and 1.33 . The risk-free rate is 3.8 percent and the market risk premium is 7 percent. The tax rate is 23 percent. What is the NPV of this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts