Question: please correct what is marked incorrect The information necessary for preparing the 2024 year-end adjusting entries for Winter Storage appears below. Winter's fiscal yearend is

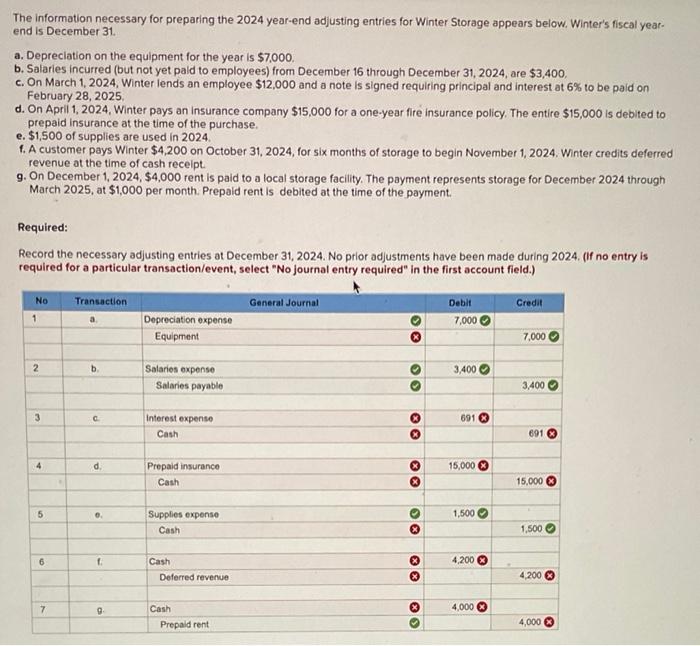

The information necessary for preparing the 2024 year-end adjusting entries for Winter Storage appears below. Winter's fiscal yearend is December 31 . a. Depreciation on the equipment for the year is $7,000. b. Salaries incurred (but not yet pald to employees) from December 16 through December 31,2024 , are $3,400, c. On March 1, 2024, Winter lends an employee $12,000 and a note is signed requiring principal and interest at 6% to be paid on February 28, 2025, d. On April 1, 2024, Winter pays an insurance company $15,000 for a one-year fire insurance policy. The entire $15,000 is debited to prepaid insurance at the time of the purchase. e. $1,500 of supplies are used in 2024. f. A customer pays Winter $4,200 on October 31,2024 , for six months of storage to begin November 1,2024 . Winter credits deferred revenue at the time of cash receipt. 9. On December 1, 2024, $4,000 rent is paid to a local storage facility. The payment represents storage for December 2024 through March 2025, at $1,000 per month. Prepaid rent is debited at the time of the payment. Required: Record the necessary adjusting entries at December 31, 2024. No prior adjustments have been made during 2024. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts