Question: Please correct what is wrong. This is due in 30 mins!! Payroll Entries Widmer Company had gross wages of $248,000 during the week ended June

Please correct what is wrong. This is due in 30 mins!!

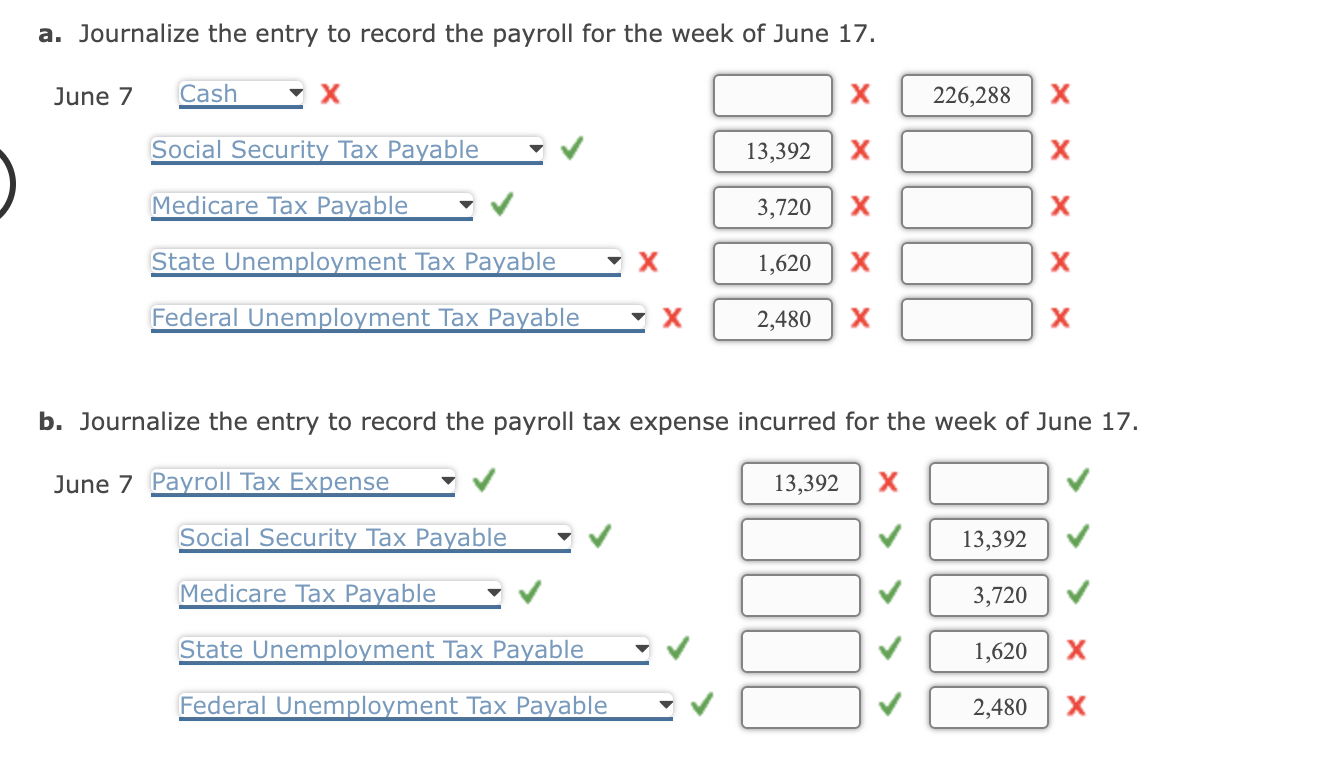

Payroll Entries

Widmer Company had gross wages of $248,000 during the week ended June 17. The amount of wages subject to social security tax was $223,200, while the amount of wages subject to federal and state unemployment taxes was $31,000. Tax rates are as follows:

Social security6.0%Medicare1.5%State unemployment5.4%Federal unemployment0.8%

The total amount withheld from employee wages for federal taxes was $49,600.

If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places.

Question Content Area

a. Journalize the entry to record the payroll for the week of June 17 . JL b. Journalize the entry to record the payroll tax expense incurred for the week of June 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts