Question: please could anyone help with this Question? QUESTION 2. Evaluate the following investment project according to the Internal Rate of Return (IRR) Criterion and advise

please could anyone help with this Question?

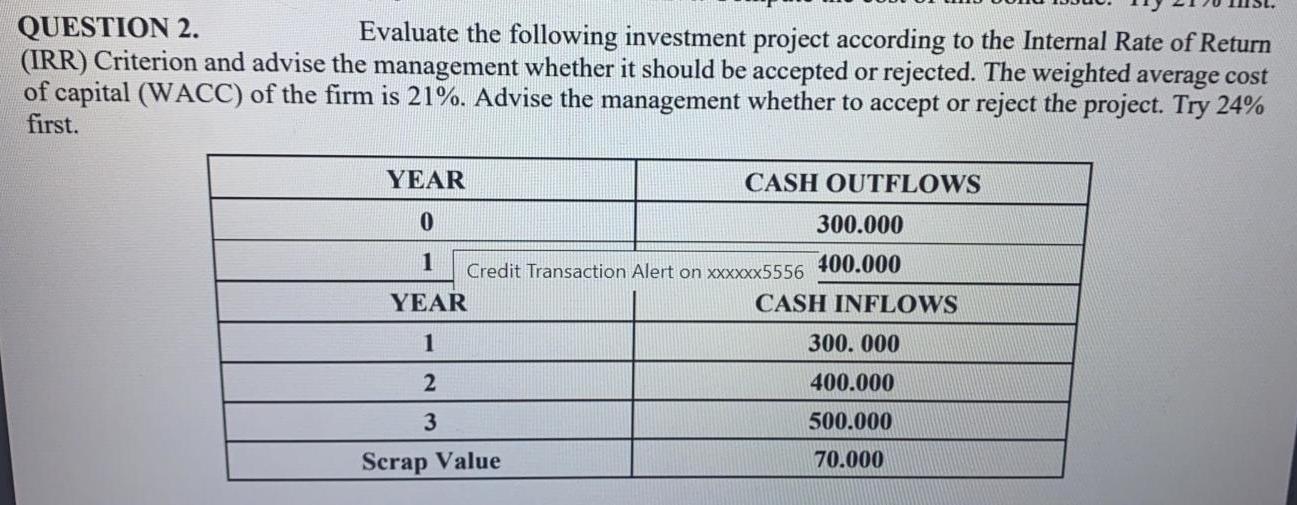

QUESTION 2. Evaluate the following investment project according to the Internal Rate of Return (IRR) Criterion and advise the management whether it should be accepted or rejected. The weighted average cost of capital (WACC) of the firm is 21%. Advise the management whether to accept or reject the project. Try 24% first. YEAR CASH OUTFLOWS 0 300.000 1 Credit Transaction Alert on xxxxxx5556 400.000 YEAR CASH INFLOWS 1 300.000 2 400.000 3 500.000 Scrap Value 70.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts