Question: Please could someone help answer these questions, especially part ii. a. Suppose that your company will receive 300 units of certain foreign currency (FC) in

Please could someone help answer these questions, especially part ii.

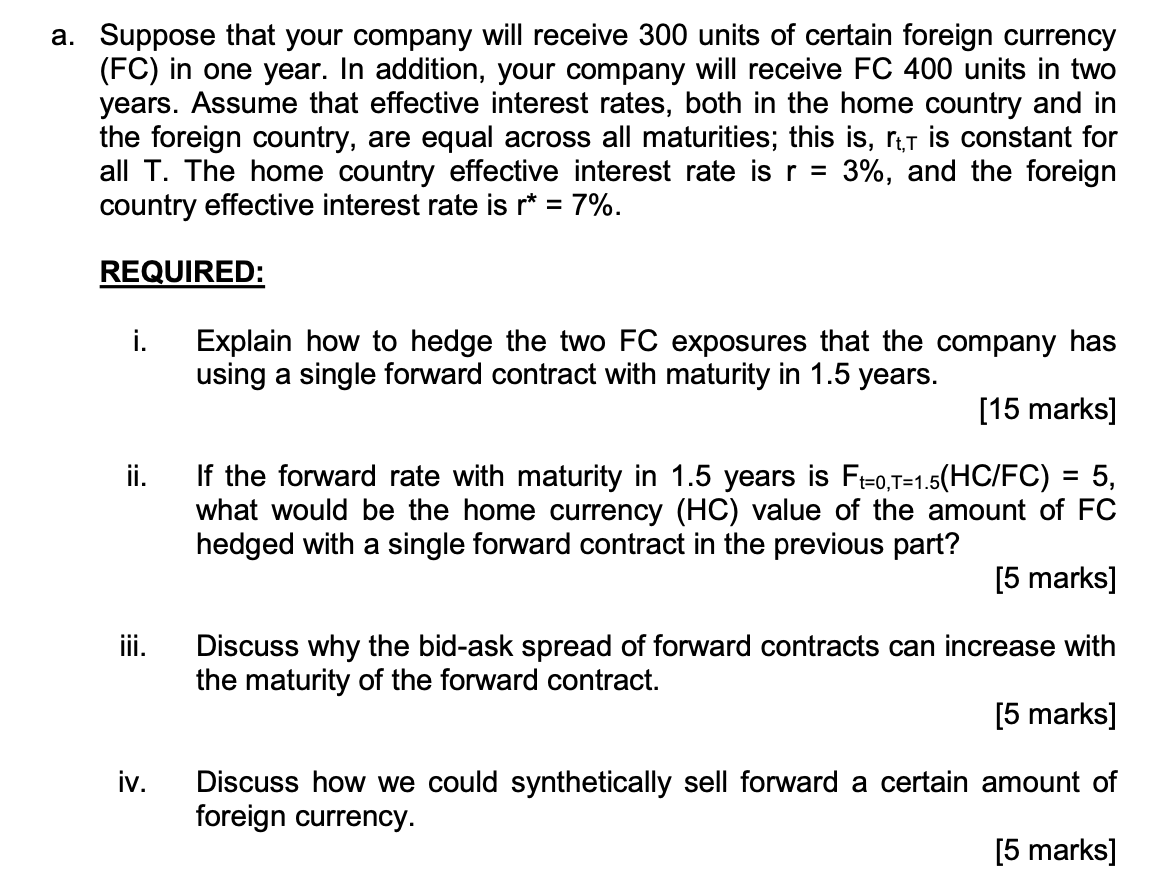

a. Suppose that your company will receive 300 units of certain foreign currency (FC) in one year. In addition, your company will receive FC 400 units in two years. Assume that effective interest rates, both in the home country and in the foreign country, are equal across all maturities; this is, rt,t is constant for all T. The home country effective interest rate is r = 3%, and the foreign country effective interest rate is r* = 7%. REQUIRED: i. Explain how to hedge the two FC exposures that the company has using a single forward contract with maturity in 1.5 years. [15 marks] ii. If the forward rate with maturity in 1.5 years is Ft=0,1=1.5(HC/FC) = 5, what would be the home currency (HC) value of the amount of FC hedged with a single forward contract in the previous part? [5 marks] iii. Discuss why the bid-ask spread of forward contracts can increase with the maturity of the forward contract. [5 marks] iv. Discuss how we could synthetically sell forward a certain amount of foreign currency. [5 marks] a. Suppose that your company will receive 300 units of certain foreign currency (FC) in one year. In addition, your company will receive FC 400 units in two years. Assume that effective interest rates, both in the home country and in the foreign country, are equal across all maturities; this is, rt,t is constant for all T. The home country effective interest rate is r = 3%, and the foreign country effective interest rate is r* = 7%. REQUIRED: i. Explain how to hedge the two FC exposures that the company has using a single forward contract with maturity in 1.5 years. [15 marks] ii. If the forward rate with maturity in 1.5 years is Ft=0,1=1.5(HC/FC) = 5, what would be the home currency (HC) value of the amount of FC hedged with a single forward contract in the previous part? [5 marks] iii. Discuss why the bid-ask spread of forward contracts can increase with the maturity of the forward contract. [5 marks] iv. Discuss how we could synthetically sell forward a certain amount of foreign currency. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts