Question: Please could someone help with this NPV past paper question. In the answers we are given this: But i don't know if it means =

Please could someone help with this NPV past paper question.

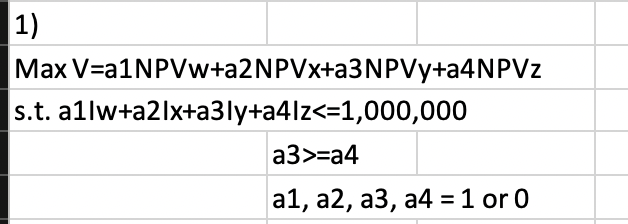

In the answers we are given this:

But i don't know if it means = a1 x NPV of w

or if it means = a1 x NPV x investment amount

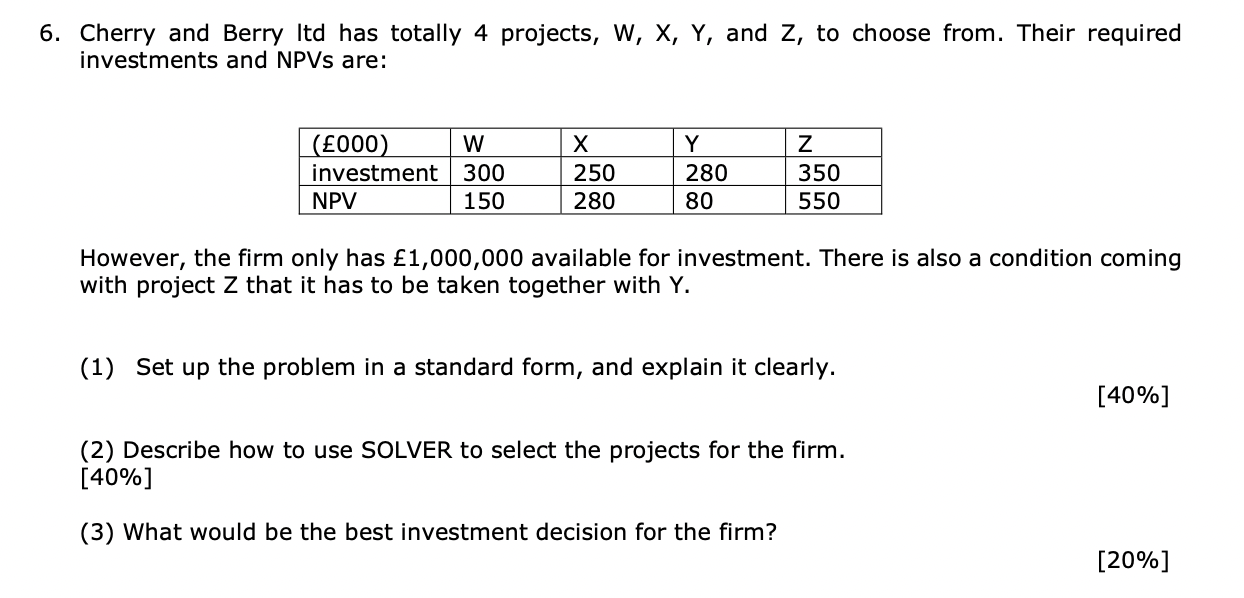

6. Cherry and Berry Itd has totally 4 projects, W, X, Y, and Z, to choose from. Their required investments and NPVs are: (000) W investment 300 NPV 150 X 250 280 Y 280 80 Z 350 550 However, the firm only has 1,000,000 available for investment. There is also a condition coming with project Z that it has to be taken together with Y. (1) Set up the problem in a standard form, and explain it clearly. [40%] (2) Describe how to use SOLVER to select the projects for the firm. [40%] (3) What would be the best investment decision for the firm? [20%] 1) Max V=a1NPVw+a2NPVx+a3NPVy+a4NPVZ s.t. allw+a21x+a3ly+a4lz=a4 a1, a2, a3, a4 = 1 or 0 6. Cherry and Berry Itd has totally 4 projects, W, X, Y, and Z, to choose from. Their required investments and NPVs are: (000) W investment 300 NPV 150 X 250 280 Y 280 80 Z 350 550 However, the firm only has 1,000,000 available for investment. There is also a condition coming with project Z that it has to be taken together with Y. (1) Set up the problem in a standard form, and explain it clearly. [40%] (2) Describe how to use SOLVER to select the projects for the firm. [40%] (3) What would be the best investment decision for the firm? [20%] 1) Max V=a1NPVw+a2NPVx+a3NPVy+a4NPVZ s.t. allw+a21x+a3ly+a4lz=a4 a1, a2, a3, a4 = 1 or 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts