Question: Please could you help me with this practise question my exam is on Monday and i don't understand I believe it uses the put option

Please could you help me with this practise question my exam is on Monday and i don't understand

I believe it uses the put option parity which is P= Current price + PV(X) - share price

I believe it uses the put option parity which is P= Current price + PV(X) - share price

I keep getting the wrong answer

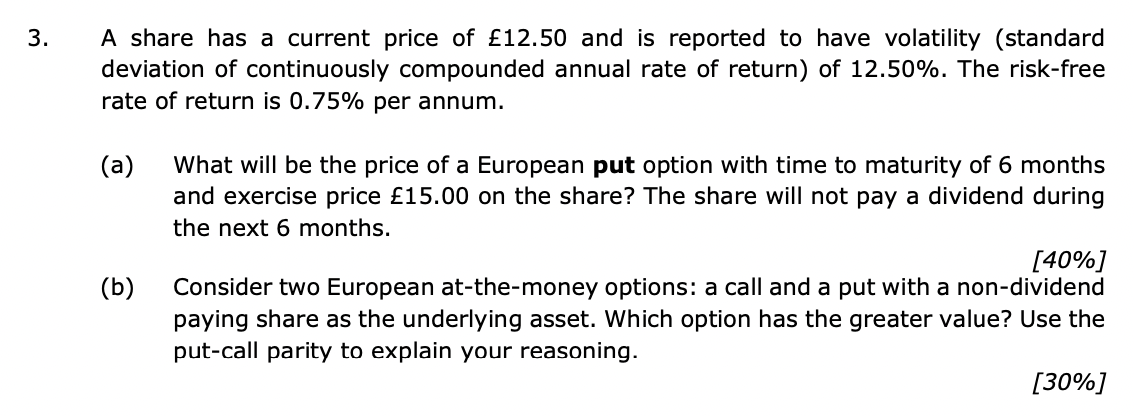

3. A share has a current price of 12.50 and is reported to have volatility (standard deviation of continuously compounded annual rate of return) of 12.50%. The risk-free rate of return is 0.75% per annum. (a) (b) What will be the price of a European put option with time to maturity of 6 months and exercise price 15.00 on the share? The share will not pay a dividend during the next 6 months. [40%] Consider two European at-the-money options: a call and a put with a non-dividend paying share as the underlying asset. Which option has the greater value? Use the put-call parity to explain your reasoning. [30%]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts