Question: Please could you help me with this problem? thank you 2nd Only the following securities are listed on the Madrid Stock Exchange: Assets with risk:

Please could you help me with this problem? thank you

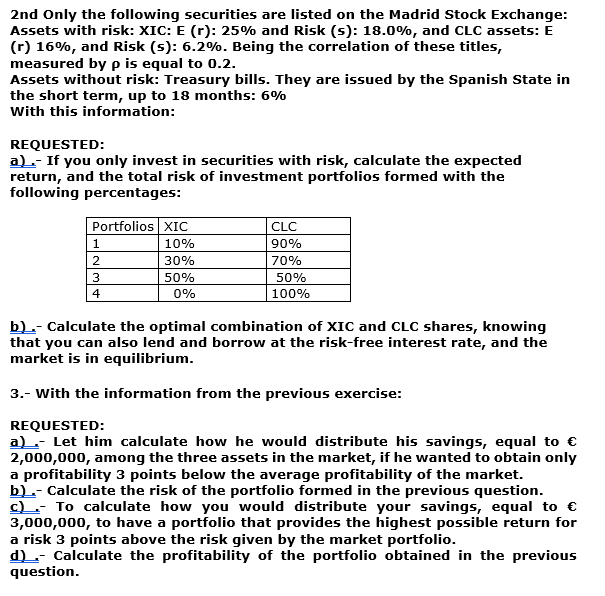

2nd Only the following securities are listed on the Madrid Stock Exchange: Assets with risk: XIC: E [r]: 25% and Risk [5]: 18.0%, and CLC assets: E {r} 16%, and Risk [5}: 6.2%. Being the correlation of these titles, measured by p is equal to 11.2. Assets without risk: Treasury bills. They are issued by the Spanish State in the short term, up to 18 months: 6% with this information: REQUESTED: g]__. If you only invest in securities with risk, calculate the expected return, and the total risk of investment portfolios formed with the following percentages: I_11 , Calculate the optimal combination of XIC and CLC shares, knowing that you can also lend and borrow at the riskfree interest rate, and the market is in equilibrium. 3.- With the information from the previous exercise: REQUESTED: g]=: Let him calculate how he would distribute his savings, equal to C 2,000,0[11], among the three assets in the market, if he wanted to obtain only a profitability 3 points below the average profitability of the market. l_1]:. Calculate the risk of the portfolio formed in the previous question. Q=.- To calculate how you would distribute your savings, equal to 3,000,0[11], to have a portfolio that provides the highest possible return for a risk 3 points above the risk given by the market portfolio. 4):; Calculate the profitability of the portfolio obtained in the previous

2nd Only the following securities are listed on the Madrid Stock Exchange: Assets with risk: XIC: E [r]: 25% and Risk [5]: 18.0%, and CLC assets: E {r} 16%, and Risk [5}: 6.2%. Being the correlation of these titles, measured by p is equal to 11.2. Assets without risk: Treasury bills. They are issued by the Spanish State in the short term, up to 18 months: 6% with this information: REQUESTED: g]__. If you only invest in securities with risk, calculate the expected return, and the total risk of investment portfolios formed with the following percentages: I_11 , Calculate the optimal combination of XIC and CLC shares, knowing that you can also lend and borrow at the riskfree interest rate, and the market is in equilibrium. 3.- With the information from the previous exercise: REQUESTED: g]=: Let him calculate how he would distribute his savings, equal to C 2,000,0[11], among the three assets in the market, if he wanted to obtain only a profitability 3 points below the average profitability of the market. l_1]:. Calculate the risk of the portfolio formed in the previous question. Q=.- To calculate how you would distribute your savings, equal to 3,000,0[11], to have a portfolio that provides the highest possible return for a risk 3 points above the risk given by the market portfolio. 4):; Calculate the profitability of the portfolio obtained in the previous

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock