Question: Please could you show me the calculation. Thank you. Problem 7-29 (Algorithmic) (LO. 1) Monty loaned his friend Ned $19,000 three years ago. Ned signed

Please could you show me the calculation. Thank you.

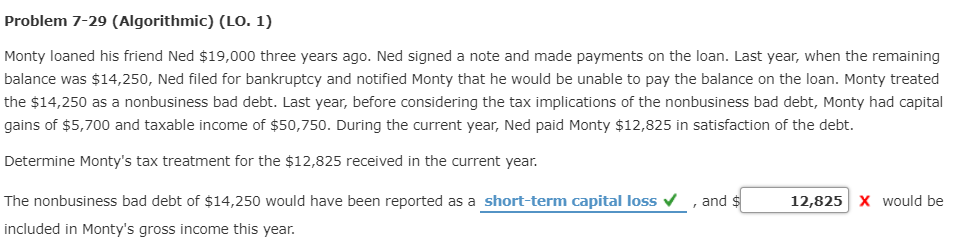

Problem 7-29 (Algorithmic) (LO. 1) Monty loaned his friend Ned $19,000 three years ago. Ned signed a note and made payments on the loan. Last year, when the remaining balance was $14,250, Ned filed for bankruptcy and notified Monty that he would be unable to pay the balance on the loan. Monty treated the $14,250 as a nonbusiness bad debt. Last year, before considering the tax implications of the nonbusiness bad debt, Monty had capital gains of $5,700 and taxable income of $50,750. During the current year, Ned paid Monty $12,825 in satisfaction of the debt. Determine Monty's tax treatment for the $12,825 received in the current year. The nonbusiness bad debt of $14,250 would have been reported as a short-term capital loss and $ 12,825 X would be included in Monty's gross income this year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts