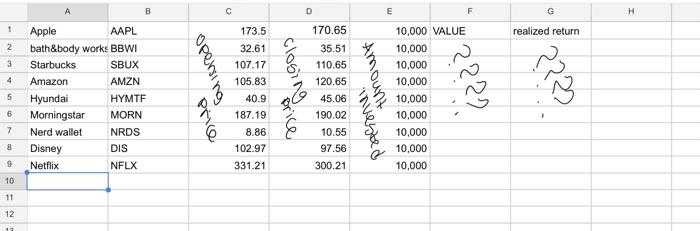

Question: please Create a document a exel document with 10 different stocks investing $10,000 and each one of them. on the excel document please state The

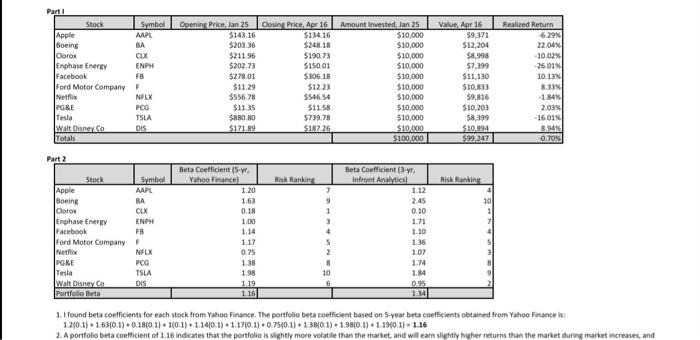

1. t found beta coefficients for each stock from Yahoo Finance. The portfolio beta coefficient based on 5-year beta coefficients oblained from Yahoo finance ia: 1.2(0.1)+1.63(0.1)+0.18(0.1)+1(0.1)+1.14(0.1)+1.17(0.1)+0.75(0.1)+1.38(0.1)+1.98(0.1)+1.19(0.1)=1.16 2. A portfolio beta coefficient of 1.16 indicates that the portfolio is slightly more volatile than the market. and wil earn slightly higher returns than the market during market increases, and 1. t found beta coefficients for each stock from Yahoo Finance. The portfolio beta coefficient based on 5-year beta coefficients oblained from Yahoo finance ia: 1.2(0.1)+1.63(0.1)+0.18(0.1)+1(0.1)+1.14(0.1)+1.17(0.1)+0.75(0.1)+1.38(0.1)+1.98(0.1)+1.19(0.1)=1.16 2. A portfolio beta coefficient of 1.16 indicates that the portfolio is slightly more volatile than the market. and wil earn slightly higher returns than the market during market increases, and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts