Question: please create a journal entry begin{tabular}{|l|l|l|l|} hline 19. & 1/22/23 & Ck # 1009 & Mr.SlantjoinedtheElPasoChamberofCommerce.Hepaidtheregistrationfeeof$200. hline 20. & 1/23/23 & & Mr.Slantparticipatedinaskiandsnowboardexhibitionheldattheconventioncenter.Hefeltthiswasagoodwaytopublicizehisnewbusiness.

please create a journal entry

please create a journal entry

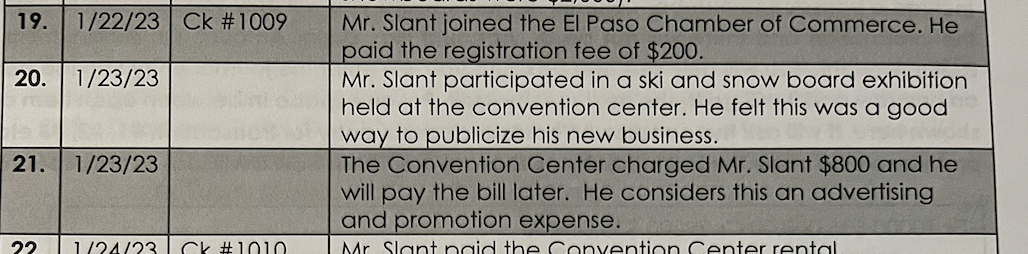

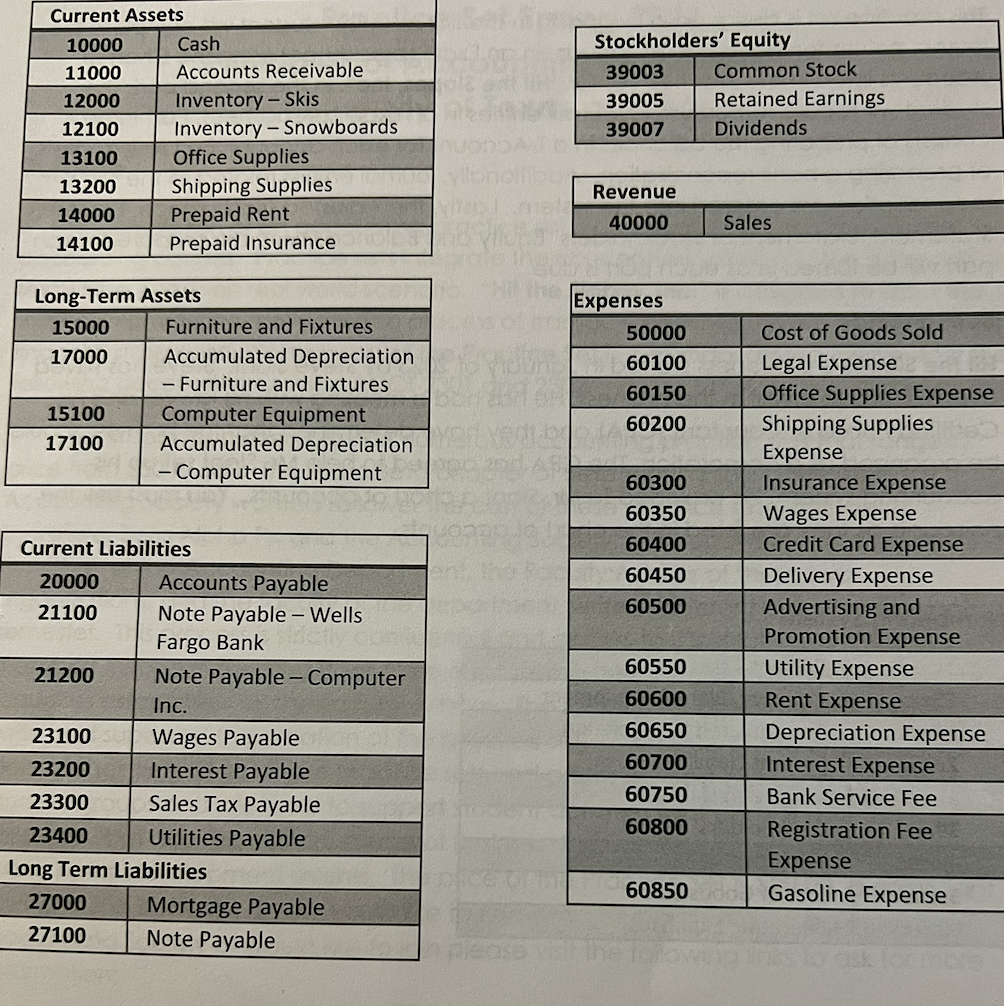

\begin{tabular}{|l|l|l|l|} \hline 19. & 1/22/23 & Ck \# 1009 & Mr.SlantjoinedtheElPasoChamberofCommerce.Hepaidtheregistrationfeeof$200. \\ \hline 20. & 1/23/23 & & Mr.Slantparticipatedinaskiandsnowboardexhibitionheldattheconventioncenter.Hefeltthiswasagoodwaytopublicizehisnewbusiness. \\ \hline 21. & 1/23/23 & TheConventionCenterchargedMr.Slant$800andhewillpaythebilllater.Heconsidersthisanadvertisingandpromotionexpense. \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline \multicolumn{2}{|c|}{ Current Assets } \\ \hline 10000 & Cash \\ \hline 11000 & Accounts Receivable \\ \hline 12000 & Inventory - Skis \\ \hline 12100 & Inventory - Snowboards \\ \hline 13100 & Office Supplies \\ \hline 13200 & Shipping Supplies \\ \hline 14000 & Prepaid Rent \\ \hline 14100 & Prepaid Insurance \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|l|}{ Stockholders' Equity } \\ \hline 39003 & Common Stock \\ \hline 39005 & Retained Earnings \\ \hline 39007 & Dividends \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline \multicolumn{2}{|c|}{ Revenue } \\ \hline 40000 & Sales \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline \multicolumn{2}{|c|}{ Long-Term Assets } \\ \hline 15000 & Furniture and Fixtures \\ \hline 17000 & AccumulatedDepreciation-FurnitureandFixtures \\ \hline 15100 & Computer Equipment \\ \hline 17100 & AccumulatedDepreciation-ComputerEquipment \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline \multicolumn{2}{|l|}{ Current Liabilities } \\ \hline 20000 & Accounts Payable \\ \hline 21100 & NotePayable-WellsFargoBank \\ \hline 21200 & NotePayable-ComputerInc. \\ \hline 23100 & Wages Payable \\ \hline 23200 & Interest Payable \\ \hline 23300 & Sales Tax Payable \\ \hline 23400 & Utilities Payable \\ \hline Long Term Liabilities \\ \hline 27000 & Mortgage Payable \\ \hline 27100 & Note Payable \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline \multicolumn{2}{|l|}{} \\ \hline 50penses & Cost of Goods Sold \\ \hline 60100 & Legal Expense \\ \hline 60150 & Office Supplies Expense \\ \hline 60200 & ShippingSuppliesExpense \\ \hline 60300 & Insurance Expense \\ \hline 60350 & Wages Expense \\ \hline 60400 & Credit Card Expense \\ \hline 60450 & Delivery Expense \\ \hline 60500 & AdvertisingandPromotionExpense \\ \hline 60550 & Utility Expense \\ \hline 60600 & Rent Expense \\ \hline 60650 & Depreciation Expense \\ \hline 60700 & Interest Expense \\ \hline 60750 & Bank Service Fee \\ \hline 60800 & RegistrationFeeExpense \\ \hline 60850 & Gasoline Expense \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts