Question: please create statement of cahs flow using direct method begin{tabular}{|l|r|r|} hline Cument portian: Loan - Magola Bark. & (250000) & (500000) hline Shareholden for

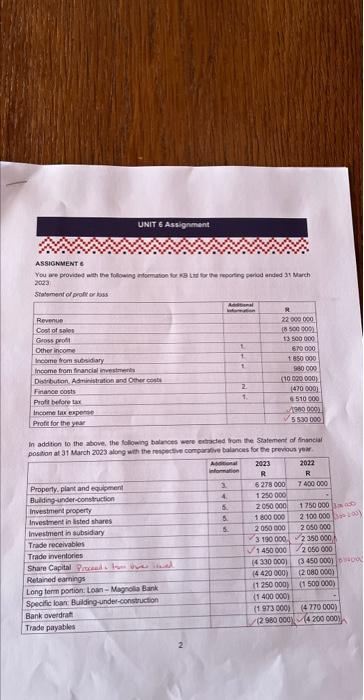

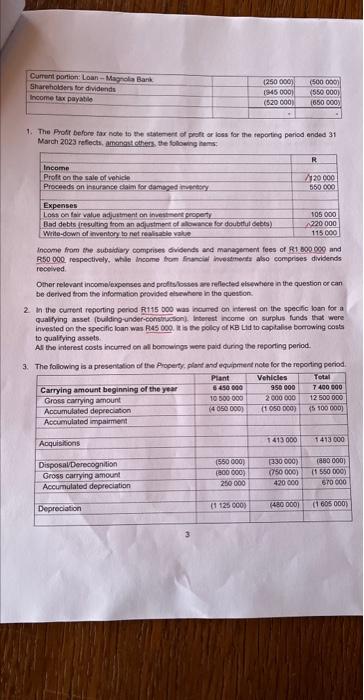

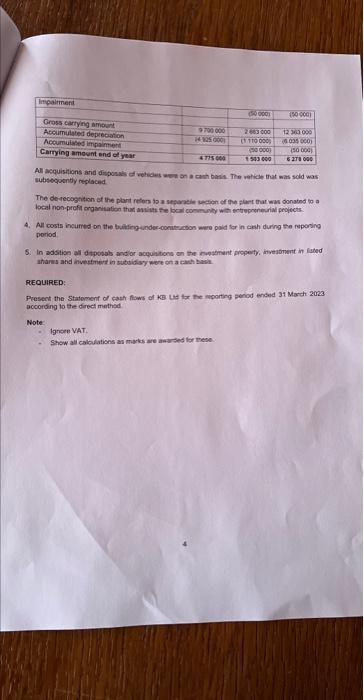

\begin{tabular}{|l|r|r|} \hline Cument portian: Loan - Magola Bark. & (250000) & (500000) \\ \hline Shareholden for dividends & (345000) & (550000) \\ \hline Income tax payathe & (520000) & (650000) \\ \hline & & \\ \hline \end{tabular} March 2023 refecth, amangst cthess the folowing hems: Income from the sutbiltay combrises dividends and management fees of Rt 800000 and B50 000 respectively, while income form finuncid investmerta also comprises dividends recelived. Other relevant inocemeloupooses and proftelossios are reflected etsewhere in the question or can be derived trom the information provided elsewhore in the question. 2. in the curent reporting period. R115 000 was incurted on ieterest on the specfic loan for a qualfying asset (bulding-under-corstruction). interest income on surplus funds that were invested on the specific loan was R.5 .000, in is the policy of KB Lid to caplalise borrowing costs to qualfying assets. As the kingrest costs incured on all bonowings were paid during the reporting period. 3. The following is a presentakion of the Aroperty, plant and equipment ncte fer the reporting period. 3 All acquisitions and disposabs ef vetides wee on a cah barlis. The velicle that was sold was subsequently neplacad. poriod ahares and investmert in subsidisy were on a cauh bask. REQUIRED: Present the Statoment of cash flows of KB Lud lar the mporting penod ended 31 March 2023 according to the direct methed Note: Igrees VAT. Show all calculations an marks are anarsed for mese. \begin{tabular}{|l|r|r|} \hline Cument portian: Loan - Magola Bark. & (250000) & (500000) \\ \hline Shareholden for dividends & (345000) & (550000) \\ \hline Income tax payathe & (520000) & (650000) \\ \hline & & \\ \hline \end{tabular} March 2023 refecth, amangst cthess the folowing hems: Income from the sutbiltay combrises dividends and management fees of Rt 800000 and B50 000 respectively, while income form finuncid investmerta also comprises dividends recelived. Other relevant inocemeloupooses and proftelossios are reflected etsewhere in the question or can be derived trom the information provided elsewhore in the question. 2. in the curent reporting period. R115 000 was incurted on ieterest on the specfic loan for a qualfying asset (bulding-under-corstruction). interest income on surplus funds that were invested on the specific loan was R.5 .000, in is the policy of KB Lid to caplalise borrowing costs to qualfying assets. As the kingrest costs incured on all bonowings were paid during the reporting period. 3. The following is a presentakion of the Aroperty, plant and equipment ncte fer the reporting period. 3 All acquisitions and disposabs ef vetides wee on a cah barlis. The velicle that was sold was subsequently neplacad. poriod ahares and investmert in subsidisy were on a cauh bask. REQUIRED: Present the Statoment of cash flows of KB Lud lar the mporting penod ended 31 March 2023 according to the direct methed Note: Igrees VAT. Show all calculations an marks are anarsed for mese

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts