Question: Please create these accounts: Step 5: Prepare the Worksheet Enter the balances from the General Ledger in Trial Balance columns of the worksheet. Enter the

Please create these accounts:

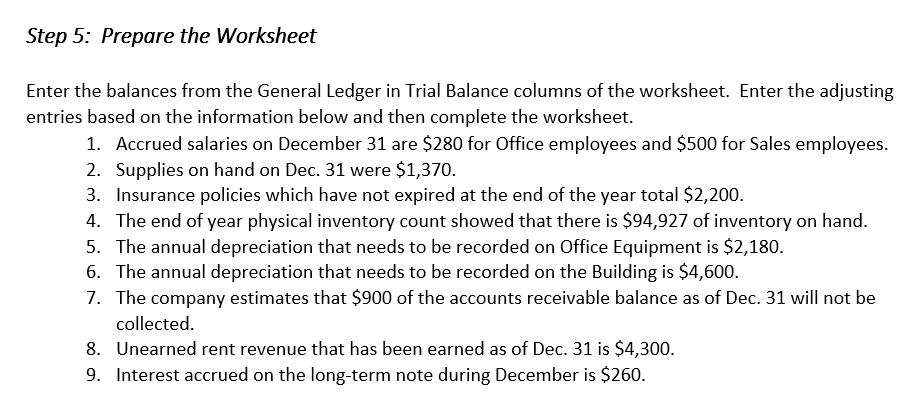

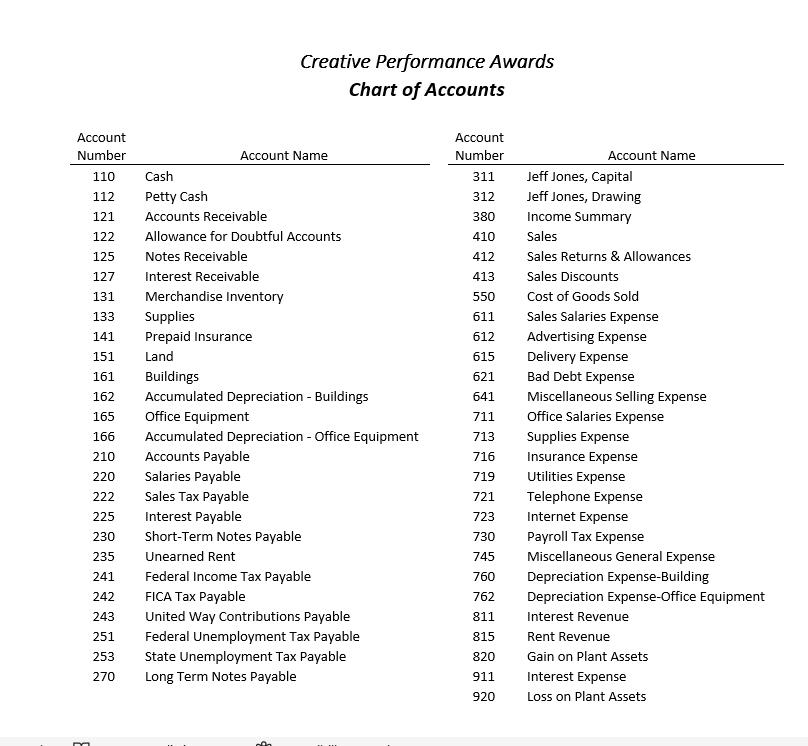

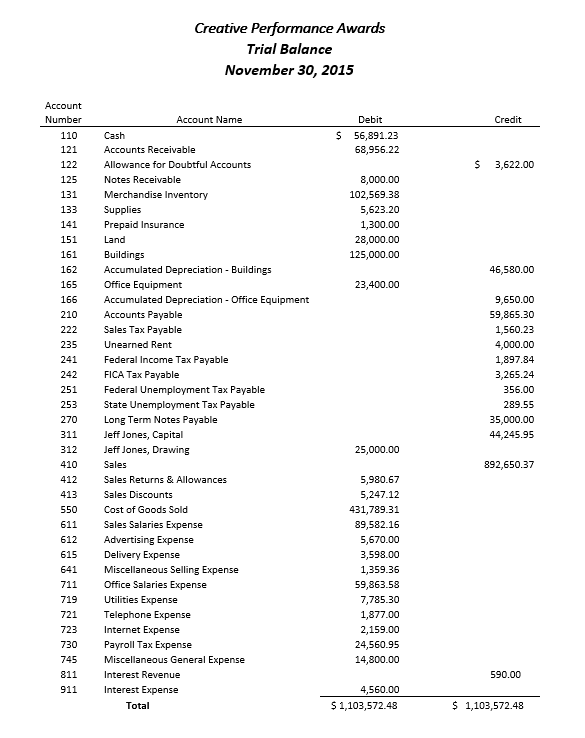

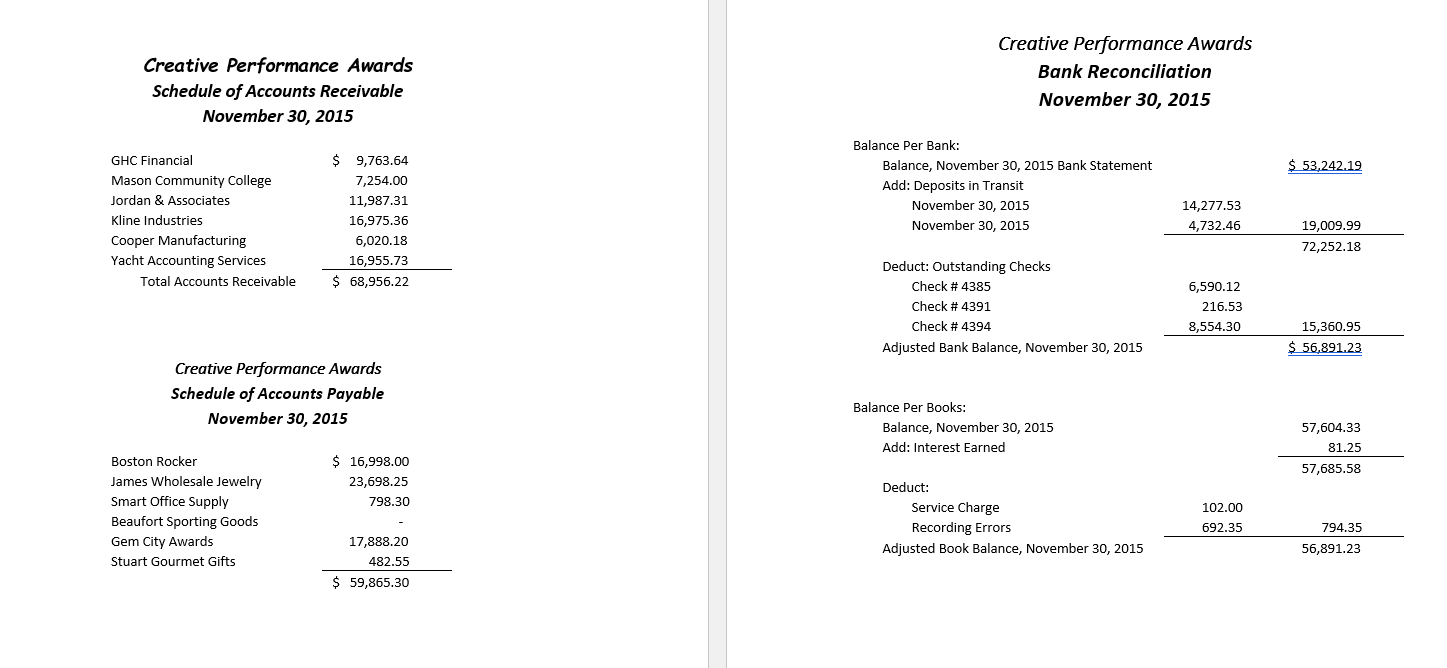

Step 5: Prepare the Worksheet Enter the balances from the General Ledger in Trial Balance columns of the worksheet. Enter the adjusting entries based on the information below and then complete the worksheet. 1. Accrued salaries on December 31 are $280 for Office employees and $500 for Sales employees. 2. Supplies on hand on Dec. 31 were $1,370. 3. Insurance policies which have not expired at the end of the year total $2,200. 4. The end of year physical inventory count showed that there is $94,927 of inventory on hand. 5. The annual depreciation that needs to be recorded of Office Equipment is $2,180. 6. The annual depreciation that needs to be recorded on the Building is $4,600. 7. The company estimates that $900 of the accounts receivable balance as of Dec. 31 will not be collected. 8. Unearned rent revenue that has been earned as of Dec. 31 is $4,300. 9. Interest accrued on the long-term note during December is $260. Creative Performance Awards Chart of Accounts Creative Performance Awards Trial Balance Creative Performance Awards Creative Performance Awards Schedule of Accounts Receivable Bank Reconciliation November 30, 2015 November 30, 2015 Creative Performance Awards Schedule of Accounts Payable November 30, 2015 Step 5: Prepare the Worksheet Enter the balances from the General Ledger in Trial Balance columns of the worksheet. Enter the adjusting entries based on the information below and then complete the worksheet. 1. Accrued salaries on December 31 are $280 for Office employees and $500 for Sales employees. 2. Supplies on hand on Dec. 31 were $1,370. 3. Insurance policies which have not expired at the end of the year total $2,200. 4. The end of year physical inventory count showed that there is $94,927 of inventory on hand. 5. The annual depreciation that needs to be recorded of Office Equipment is $2,180. 6. The annual depreciation that needs to be recorded on the Building is $4,600. 7. The company estimates that $900 of the accounts receivable balance as of Dec. 31 will not be collected. 8. Unearned rent revenue that has been earned as of Dec. 31 is $4,300. 9. Interest accrued on the long-term note during December is $260. Creative Performance Awards Chart of Accounts Creative Performance Awards Trial Balance Creative Performance Awards Creative Performance Awards Schedule of Accounts Receivable Bank Reconciliation November 30, 2015 November 30, 2015 Creative Performance Awards Schedule of Accounts Payable November 30, 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts