Question: Please create three scenarios: one where you have made adjustments to the operating ratios to improve liquidity, one where you have added adjustments to improve

Please create three scenarios: one where you have made adjustments to the operating ratios to improve liquidity, one where you have added adjustments to improve the asset management ratios, and then a sheet that also includes adjustments to the financing policy, specifically the assumed WACC.

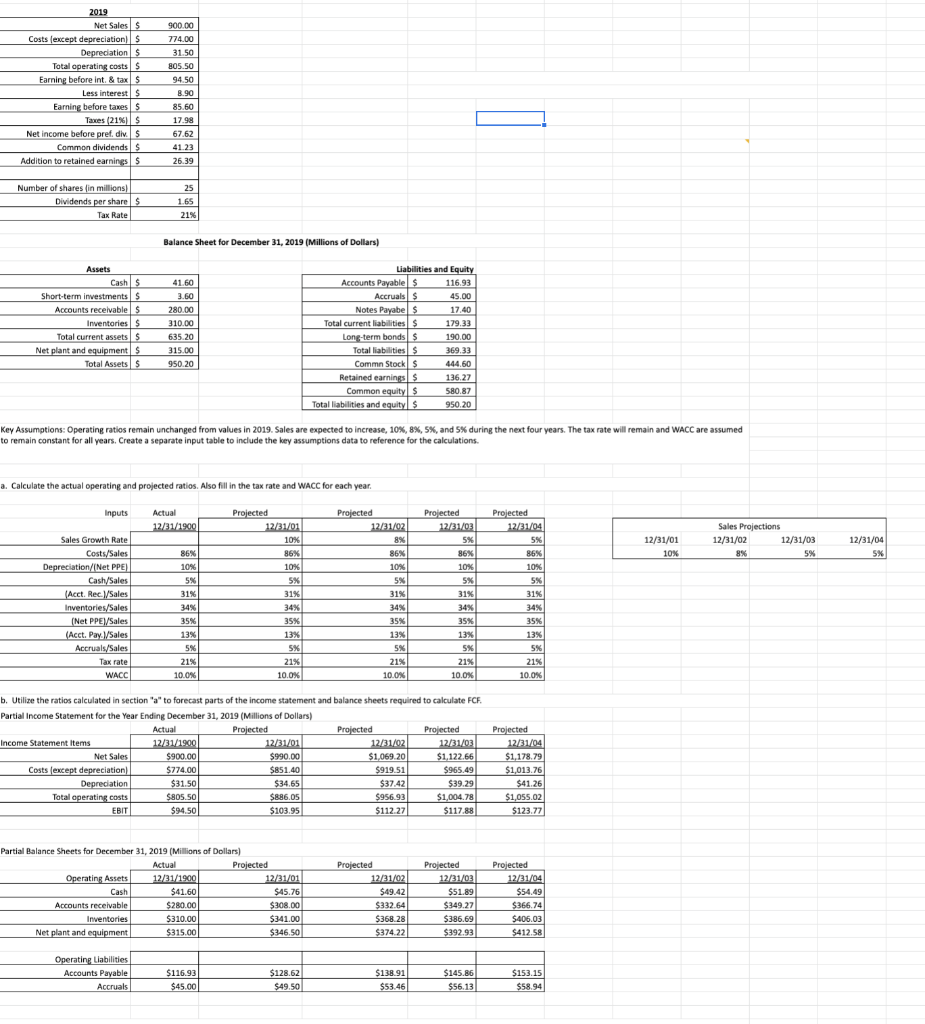

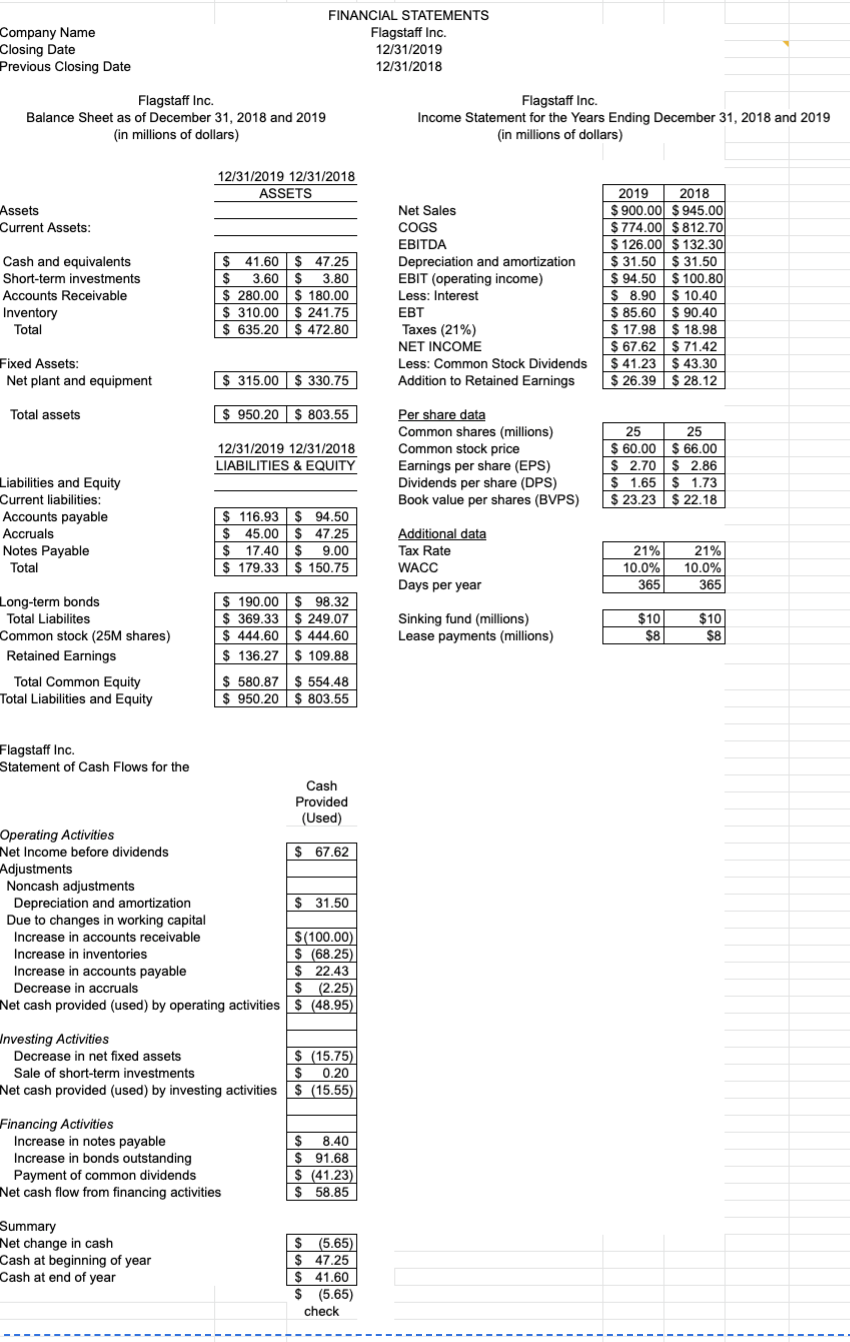

2019 Net Sales S Costs (except depreciations Depreciations Total operating costs $ Earning before int. & tax s Less interest Earning before taxes Taxes (21%) $ Net income before pref, div Common dividends $ Addition to retained earnings 900.00 774.00 31.50 805.50 94.50 8.90 D 85.60 17.98 67.62 41.23 26.39 Number of shares in millions) Dividends per shares Tax Rate 25 1.65 21% Balance Sheet for December 31, 2019 (Millions of Dollars) Assets Cash S Short-term investments $ Accounts receivables Inventories Total current assets $ Net plant and equipment $ Total Assets 41.60 3.60 280.00 310.00 635.20 315.00 950.20 Liabilities and Equity Accounts Payables 116.93 Accruals $ 45.00 Notes Payabels 17.40 Total current liabilities 179.33 Long-term bonds $ 190.00 Total liabilities 369.33 Commn Stocks 444.60 Retained earnings 136.27 Common equity 580.87 Total liabilities and equity 950.20 Key Assumptions: Operating ratios remain unchanged from values in 2019. Sales are expected to increase, 10%, 8%,5%, and 5% during the next four years. The tax rate will remain and WACC are assumed to remain constant for all years. Create a separate input table to include the key assumptions data to reference for the calculations. a. Calculate the actual operating and projected ratios. Also fill in the tax rate and WACC for each year. Inputs Actual 12/31/1900 12/31/01 10% Sales Projections 12/31/02 12/31/03 8% 5% 12/31/04 5% Sales Growth Rate Costs/Sales Depreciation/(Net PPE Cash/Sales (Acct. Rec.\/Sales Inventories/Sales (Net PPE]/Sales (Acct. Pay.\/Sales Accruals/Sales Tax rate WACC) 86% 10% 5% 5% 31% 34% Projected 12/31/01 10% 86% 10% 5% 31% 34% 35% 13% Projected 12/21/02 8% 86% 10% 5% 31% 34% Projected 12/31/03 5% 86% 10% 5% 31% 34% 35% 13% 5% % 21% 10.0% Projected 12/21/04 5% 86% 10% 5% 31% 34% 35% 13% 5% 21% 10.0% 35% 35% 13% 13% 5% 5% 5% 21% 10.0% 21% 10.0% 21% 10.0% b. Utilize the ratios calculated in section "a" to forecast parts of the income statement and balance sheets required to calculate FCF. Partial Income Statement for the Year Ending December 31, 2019 (Millions of Dollars) Actual Projected Projected Projected Income Statement items 12/31/1900 12/31/01 12/31/02 12/31/03 Net Sales $900.00 $990.00 $1,069.20 $1,122.66 Costs except depreciation $774.00 $851 40 $919.51 $965.49 Depreciation $31.50 $34.65 $37.42 $39.29 Total operating costs $805.50 $886.05 $956.93 $1,004.78 EBIT $94.50 $103.95 $112.27 $117.88 Projected 12/31/04 $1,178.79 $1,013.76 $41.26 $1,055.02 $123.77 Partial Balance Sheets for December 31, 2019 (Millions of Dollars) Actual Projected Operating Assets 12/31/1900 12/31/01 Cash $41.60 $45.76 Accounts receivable $280.00 $308.00 Inventories $310.00 $341.00 Net plant and equipment $315.00 $346.50 Projected 12/21/02 $49.42 $332.64 $368.28 $374.22 Projected 12/31/03 $51.89 $349.27 $386.69 $392.93 Projected 12/31/04 $54.49 $366.74 $406.03 $412.58 Operating Liabilities Accounts Payable Accruals $116.93 $45.00 $128.62 $49.50 $138.91 $53.46 $145.86 $56.13 $153.15 $58.94 Company Name Closing Date Previous Closing Date FINANCIAL STATEMENTS Flagstaff Inc. 12/31/2019 12/31/2018 Flagstaff Inc. Balance Sheet as of December 31, 2018 and 2019 (in millions of dollars) Flagstaff Inc. Income Statement for the Years Ending December 31, 2018 and 2019 (in millions of dollars) 12/31/2019 12/31/2018 ASSETS 2018 Assets Current Assets: Net Sales COGS EBITDA Depreciation and amortization EBIT (operating income) Less: Interest Cash and equivalents Short-term investments Accounts Receivable Inventory Total $ 41.60 $ 47.25 $ 3.60 $ 3.80 $ 280.00 $ 180.00 $ 310.00 $ 241.75 $ 635.20 $ 472.80 2019 $ 900.00 $ 945.00 $ 774.00 $ 812.70 $ 126.00 $ 132.30 $ 31.50 $ 31.50 $ 94.50 $ 100.80 $ 8.90 $ 10.40 $ 85.60 $ 90.40 $ 17.98 $ 18.98 $ 67.62 $71.42 $ 41.23 $ 43.30 $ 26.39 $ 28.12 EBT Fixed Assets: Net plant and equipment Taxes (21%) NET INCOME Less: Common Stock Dividends Addition to Retained Earnings $ 315.00$ 330.75 Total assets $ 950.20 $ 803.55 12/31/2019 12/31/2018 LIABILITIES & EQUITY Per share data Common shares (millions) Common stock price Earnings per share (EPS) Dividends per share (DPS) Book value per shares (BVPS) 25 25 $ 60.00 $ 66.00 $ 2.70 $ 2.86 $ 1.65 $ 1.73 $ 23.23 $ 22.18 Liabilities and Equity Current liabilities: Accounts payable Accruals Notes Payable Total $ 116.93 $ 94.50 $ 45.00 $ 47.25 $ 17.40 $ 9.00 $ 179.33 $ 150.75 Additional data Tax Rate WACC Days per year 21% 10.0% 365 21% 10.0% 365 $ 190.00 $ 98.32 $ 369.33 $ 249.07 $ 444.60 $ 444.60 $ 136.27 $ 109.88 Sinking fund (millions) Lease payments (millions) $10 $8 Long-term bonds Total Liabilites Common stock (25M shares) Retained Earnings Total Common Equity Total Liabilities and Equity $10 $8 $ 580.87 $ 554.48 $ 950.20 $ 803.55 Flagstaff Inc. Statement of Cash Flows for the Cash Provided (Used) Operating Activities Net Income before dividends $ 67.62 Adjustments Noncash adjustments Depreciation and amortization $ 31.50 Due to changes in working capital Increase in accounts receivable $(100.00) Increase in inventories $ (68.25) Increase in accounts payable $ 22.43 Decrease in accruals $ (2.25) Net cash provided (used) by operating activities $ (48.95) Jnvesting Activities Decrease in net fixed assets $ (15.75) Sale of short-term investments $ 0.20 Net cash provided (used) by investing activities $ (15.55) Financing Activities Increase in notes payable Increase in bonds outstanding Payment of common dividends Net cash flow from financing activities $ 8.40 $ 91.68 $ (41.23) $ 58.85 Summary Net change in cash Cash at beginning of year Cash at end of year $ (5.65) $ 47.25 $ 41.60 $ (5.65) check 2019 Net Sales S Costs (except depreciations Depreciations Total operating costs $ Earning before int. & tax s Less interest Earning before taxes Taxes (21%) $ Net income before pref, div Common dividends $ Addition to retained earnings 900.00 774.00 31.50 805.50 94.50 8.90 D 85.60 17.98 67.62 41.23 26.39 Number of shares in millions) Dividends per shares Tax Rate 25 1.65 21% Balance Sheet for December 31, 2019 (Millions of Dollars) Assets Cash S Short-term investments $ Accounts receivables Inventories Total current assets $ Net plant and equipment $ Total Assets 41.60 3.60 280.00 310.00 635.20 315.00 950.20 Liabilities and Equity Accounts Payables 116.93 Accruals $ 45.00 Notes Payabels 17.40 Total current liabilities 179.33 Long-term bonds $ 190.00 Total liabilities 369.33 Commn Stocks 444.60 Retained earnings 136.27 Common equity 580.87 Total liabilities and equity 950.20 Key Assumptions: Operating ratios remain unchanged from values in 2019. Sales are expected to increase, 10%, 8%,5%, and 5% during the next four years. The tax rate will remain and WACC are assumed to remain constant for all years. Create a separate input table to include the key assumptions data to reference for the calculations. a. Calculate the actual operating and projected ratios. Also fill in the tax rate and WACC for each year. Inputs Actual 12/31/1900 12/31/01 10% Sales Projections 12/31/02 12/31/03 8% 5% 12/31/04 5% Sales Growth Rate Costs/Sales Depreciation/(Net PPE Cash/Sales (Acct. Rec.\/Sales Inventories/Sales (Net PPE]/Sales (Acct. Pay.\/Sales Accruals/Sales Tax rate WACC) 86% 10% 5% 5% 31% 34% Projected 12/31/01 10% 86% 10% 5% 31% 34% 35% 13% Projected 12/21/02 8% 86% 10% 5% 31% 34% Projected 12/31/03 5% 86% 10% 5% 31% 34% 35% 13% 5% % 21% 10.0% Projected 12/21/04 5% 86% 10% 5% 31% 34% 35% 13% 5% 21% 10.0% 35% 35% 13% 13% 5% 5% 5% 21% 10.0% 21% 10.0% 21% 10.0% b. Utilize the ratios calculated in section "a" to forecast parts of the income statement and balance sheets required to calculate FCF. Partial Income Statement for the Year Ending December 31, 2019 (Millions of Dollars) Actual Projected Projected Projected Income Statement items 12/31/1900 12/31/01 12/31/02 12/31/03 Net Sales $900.00 $990.00 $1,069.20 $1,122.66 Costs except depreciation $774.00 $851 40 $919.51 $965.49 Depreciation $31.50 $34.65 $37.42 $39.29 Total operating costs $805.50 $886.05 $956.93 $1,004.78 EBIT $94.50 $103.95 $112.27 $117.88 Projected 12/31/04 $1,178.79 $1,013.76 $41.26 $1,055.02 $123.77 Partial Balance Sheets for December 31, 2019 (Millions of Dollars) Actual Projected Operating Assets 12/31/1900 12/31/01 Cash $41.60 $45.76 Accounts receivable $280.00 $308.00 Inventories $310.00 $341.00 Net plant and equipment $315.00 $346.50 Projected 12/21/02 $49.42 $332.64 $368.28 $374.22 Projected 12/31/03 $51.89 $349.27 $386.69 $392.93 Projected 12/31/04 $54.49 $366.74 $406.03 $412.58 Operating Liabilities Accounts Payable Accruals $116.93 $45.00 $128.62 $49.50 $138.91 $53.46 $145.86 $56.13 $153.15 $58.94 Company Name Closing Date Previous Closing Date FINANCIAL STATEMENTS Flagstaff Inc. 12/31/2019 12/31/2018 Flagstaff Inc. Balance Sheet as of December 31, 2018 and 2019 (in millions of dollars) Flagstaff Inc. Income Statement for the Years Ending December 31, 2018 and 2019 (in millions of dollars) 12/31/2019 12/31/2018 ASSETS 2018 Assets Current Assets: Net Sales COGS EBITDA Depreciation and amortization EBIT (operating income) Less: Interest Cash and equivalents Short-term investments Accounts Receivable Inventory Total $ 41.60 $ 47.25 $ 3.60 $ 3.80 $ 280.00 $ 180.00 $ 310.00 $ 241.75 $ 635.20 $ 472.80 2019 $ 900.00 $ 945.00 $ 774.00 $ 812.70 $ 126.00 $ 132.30 $ 31.50 $ 31.50 $ 94.50 $ 100.80 $ 8.90 $ 10.40 $ 85.60 $ 90.40 $ 17.98 $ 18.98 $ 67.62 $71.42 $ 41.23 $ 43.30 $ 26.39 $ 28.12 EBT Fixed Assets: Net plant and equipment Taxes (21%) NET INCOME Less: Common Stock Dividends Addition to Retained Earnings $ 315.00$ 330.75 Total assets $ 950.20 $ 803.55 12/31/2019 12/31/2018 LIABILITIES & EQUITY Per share data Common shares (millions) Common stock price Earnings per share (EPS) Dividends per share (DPS) Book value per shares (BVPS) 25 25 $ 60.00 $ 66.00 $ 2.70 $ 2.86 $ 1.65 $ 1.73 $ 23.23 $ 22.18 Liabilities and Equity Current liabilities: Accounts payable Accruals Notes Payable Total $ 116.93 $ 94.50 $ 45.00 $ 47.25 $ 17.40 $ 9.00 $ 179.33 $ 150.75 Additional data Tax Rate WACC Days per year 21% 10.0% 365 21% 10.0% 365 $ 190.00 $ 98.32 $ 369.33 $ 249.07 $ 444.60 $ 444.60 $ 136.27 $ 109.88 Sinking fund (millions) Lease payments (millions) $10 $8 Long-term bonds Total Liabilites Common stock (25M shares) Retained Earnings Total Common Equity Total Liabilities and Equity $10 $8 $ 580.87 $ 554.48 $ 950.20 $ 803.55 Flagstaff Inc. Statement of Cash Flows for the Cash Provided (Used) Operating Activities Net Income before dividends $ 67.62 Adjustments Noncash adjustments Depreciation and amortization $ 31.50 Due to changes in working capital Increase in accounts receivable $(100.00) Increase in inventories $ (68.25) Increase in accounts payable $ 22.43 Decrease in accruals $ (2.25) Net cash provided (used) by operating activities $ (48.95) Jnvesting Activities Decrease in net fixed assets $ (15.75) Sale of short-term investments $ 0.20 Net cash provided (used) by investing activities $ (15.55) Financing Activities Increase in notes payable Increase in bonds outstanding Payment of common dividends Net cash flow from financing activities $ 8.40 $ 91.68 $ (41.23) $ 58.85 Summary Net change in cash Cash at beginning of year Cash at end of year $ (5.65) $ 47.25 $ 41.60 $ (5.65) check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts